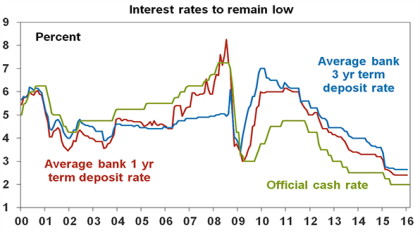

An investment environment of constrained economic growth and high volatility means that interest rates are likely to remain lower for longer – with central banks globally cutting interest rates or leaving them on hold at low levels. Low interest rates bring to the spotlight the potential to gain yield from investments, rather than just focussing on the potential for capital growth, as even when the capital value of an investment is low it can provide stable cash flow – this is comforting to investors during periods of market declines.

Low interest rate environment is set to continue

With interest rates set to remain low or fall further, bank deposit rates – already at their lowest in Australia since the 1950s – are likely to also remain low or go lower. Our view is that further falls are likely as the RBA is set to cut official interest rates to 1.75% in the next few months on the back of global uncertainties, sub-par growth and benign inflation. This in turn means an ongoing need to understand and consider alternative sources of yield on offer.

Source: Reserve Bank of Australia, AMP Capital

Past performance is not a reliable indicator of future performance

How does yield prove its worth in a low interest rate environment?

A high and sustainable starting point yield for an investment provides some security during volatile times like the present:

-

Since 1900 dividends have provided more than half of the 11.6% total return from Australian shares and their contribution has been stable in contrast to the short swings in the capital value of shares.

-

Dividends are relatively smooth over time. Companies hate having to cut them as they know it annoys shareholders so they prefer to keep them sustainable.

-

As baby boomers retire, investor demand for income will likely be high as the focus shifts to income generation.

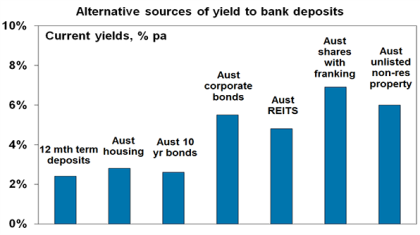

The chart below shows the yield on a range of Australian investments. Yields on global investments tend to be lower.

Source: Bloomberg, AMP Capital

Past performance is not a reliable indicator of future performance

All of these yields have fallen over the last few years as interest rates have fallen however, several of the alternatives still offer much higher yields than term deposits.

Other asset classes that offer attractive yields

-

Corporate debt offers higher yields than term deposits– these yields are offered without the volatility of shares. Investment grade yields for Australian corporates are around 6.5% or less and lower quality corporate yields are higher.

-

Australian real estate investment trusts (A-REITs) are reasonable at 4.8%– following the turmoil of the global financial crisis (GFC) A-REITs have refocussed on their core business of managing buildings, collecting rents and passing it on to their investors, with lower gearing.

-

Unlisted infrastructure offers yields of around 5%– this is underpinned by investments such as toll roads and utilities, where demand is relatively stable.

What are the risks for investors?

While there is a strong case for investors to focus on investments that offer decent yield, as with any investment there are risks associated with the volatility in the value of the underlying investment. The alternative investments listed above are considered to be more risky than term deposits.

In the case of shares, the key for an investor is to work out whether they prefer stable value for their investment –in which case bank deposits are a sensible option – or a higher, more stable income flow, whereby Australian shares are more appropriate.

In any case, in the search for higher yield investors need to remain alert to opportunities while being aware of how particular shares or assets have performed in the past in relation to dividends. Focusing on opportunities that have a track record of delivering reliable earnings and distribution growth is they key here.

About the Author

Shane Oliver

Dr Shane Oliver has extensive experience analysing economic and investment cycles and how current positioning affects the return potential for asset classes such as shares, bonds, property and infrastructure. Shane is a regular media commentator, providing economic forecasts and analysis of key variables and issues that affect all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.