After a period of relative calm share markets have seen a return to volatility lately. This has gone hand in hand with a back-up in bond yields. This note looks at the main drivers and how long this period of weakness may last.

Why the falls?

The weakness in share markets reflects a range of factors.

-

After 15-20% gains since February lows (and a brief interruption around the Brexit vote) shares had become vulnerable to a pull back. Adding to this vulnerability was very low volatility in the US share market which can be seen as a sign of short term complacency on the part of investors.

-

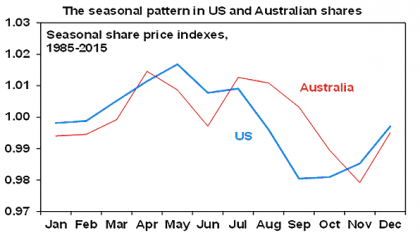

This is particularly so as we are now in a seasonally weak part of the year – the period from August to October is notorious for share market weakness. This can be seen in the next chart, which shows the seasonal pattern in share markets since 1985 (after removing the underlying rising trend). Shares tend to rise from November to around May and then have weakness around the September quarter.

Source: Bloomberg, AMP Capital

-

There has been a back-up in bond yields globally, which puts pressure on both the comparative attractiveness of shares and, directly, on parts of the share market (like utility companies) that pay high dividends and are seen as an alternative to bonds. The rise in bond yields has occurred due to a range of factors. These include: perceptions that central banks (notably the Bank of Japan and the European Central Bank) may be reaching the limits of what they can do; talk of a refocus from monetary stimulus to fiscal stimulus; receding deflationary pressure as commodity prices stabilise; perhaps the realisation that bonds are poor value; and fears of renewed Fed rate hikes at a time when US economic data has been a bit mixed.

-

Nervousness about the Fed ahead of its meeting next week has been a particular factor with contradictory comments by dovish and hawkish Fed officials adding to the volatility. (In fact one might argue that transparency at the Fed has gone way too far and turned into a cacophony.)

-

There are a range of events looming over the next few months that may be causing investor nervousness: uncertainty about the Fed as already mentioned; the potential for new worries about a Eurozone break up with a presidential election re-run in Austria in early October (involving a far right Eurosceptic candidate) and a November referendum to reform the Italian Senate; the US election in November; and South China Sea tensions and North Korean bomb tests are likely not helping either.

-

In Australia, a perception that we are at or close to the end of the RBA’s easing cycle has added to upwards pressure on local bond yields, which has affected local shares.

Just another correction or a renewed bear market?

Given the nature of share markets the weakness could have a way to go – once falls get underway they add to fear which creates more selling and the seasonal and risk factors mentioned above arguably have further to run. Australian shares may be down 7% from their August high, but US and global shares generally are only down 3%.

However, there are several reasons why this is likely a 5-10% correction as opposed to a resumption of the bear market that began in the June quarter last year and took many share markets – including Australian shares – down 20% or more to their lows in February this year.

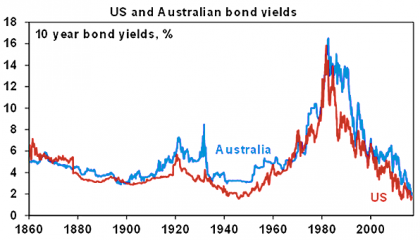

Firstly, bond yields are unlikely to rise too far. The giant long term bond rally that got underway in the early 1980s is likely in the process of bottoming out – as central banks get close to the end of monetary easing, fiscal austerity gives way to fiscal stimulus and a stabilisation in commodity prices leads to lessening deflation risk. But so far the back up in bond yields while it might feel big is just a flick off the bottom looking like just another correction in the long term bond bull market. It’s hard to see a sharp back up in bond yields as global growth remains subdued and fragile, core inflation remains well below inflation targets, Fed rate hikes are likely to remain gradual, the ECB and Bank of Japan are a long way from ending stimulus or starting rate hikes, and any shift to fiscal stimulus is likely to be gradual and modest. While the Fed is likely edging towards another rate hike, recent mixed data makes a December move more likely than a September hike. Bond yields are more likely to trace out a bottoming process like we saw in the 1940s and 1950s as opposed to a sudden and sustained lurch higher.

Source: Global Financial Data, Bloomberg, AMP Capital

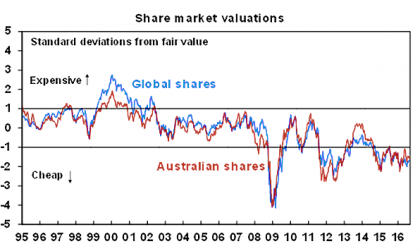

Secondly, share market valuations are not onerous for a low rate world – assuming we are right and it remains that way. While price to earnings multiples for some markets are a bit above long term averages, valuation measures that allow for low interest rates and bond yields show shares to be cheap.

Source: Thomson Reuters, AMP Capital

Thirdly, the global economy is continuing to muddle along and Australian growth is solid. US economic growth appears to have picked up after another soft spot early this year, Chinese economic growth appears to have stabilised just above 6.5%, global business conditions surveys (or PMIs as they are called these days) are at levels consistent with continued global growth around 3%, and are nowhere near signalling anything approaching recession (see the next chart). Australia is continuing to grow with consumer spending, housing construction, a resurgence in services like tourism and higher education exports and booming resource export volumes (the third phase of the mining boom) keeping the economy going at a time when the drags on growth from the end of the commodity price and mining investment booms are close to fading.

Source: Bloomberg, AMP Capital

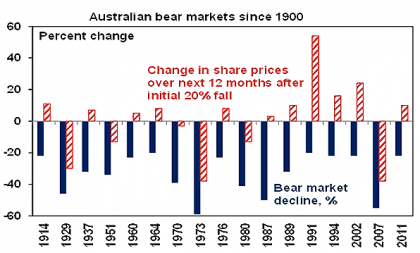

The low likelihood of a recession is very important. Ignoring the 20% fall between April 2015 and February this year, since 1900 there have been 17 bear markets in Australian shares (defined as 20% plus falls). Eleven saw shares higher a year after the initial 20% decline. The remaining 6 pushed further into bear territory with average falls over the next 12 months, after having declined by 20%, of an additional 22.5%. Credit Suisse, focussing on the period from the 1970s, called these Gummy bears and Grizzly bears respectively.

Source: ASX, Global Financial Data, Bloomberg, AMP Capital

The big difference between them is whether there is recession in Australia or the US or not. Grizzly bears tend to be associated with recessions but Gummy bears tend not to be. So if recession is avoided as I think it will be then the bear market that ran from April 2015 to February this year in Australian shares is unlikely to resume and markets are more likely to remain in a rising trend.

Finally, if recession is avoided the profit outlook should continue to improve. There are some pointers to this: US earnings rose 9% in the June quarter and is likely to have bottomed as the negative impact of the fall in oil prices and the rise in the $US has abated; and Australian profits should return to growth this financial year as the impact of last year’s plunge in commodity prices – which drove resource profits down 47% – falls out.

Five things investors should consider doing

After a strong rebound in share markets from the February lows we look to have entered a rougher patch. However, with most share markets offering reasonable value, global monetary conditions remaining easy and no sign of recession, the trend in shares is likely to remain up. But times like the present can be stressful as no one likes to see the value of their investments decline. The key for investors is to:

-

Firstly, recognise that we have seen it all before as periodic sharp falls are regular occurrences in share markets. Shares literally climb a wall of worry with numerous events dragging them down periodically, but with the trend ultimately rising and providing higher returns than more stable assets.

-

Secondly, avoid selling after falls as it just locks in a loss.

-

Thirdly, allow that when shares and all assets fall in value they are cheaper and offer higher long term return prospects. So the key is to look for investment opportunities that pullbacks provide. It’s impossible to time the bottom but one way to do it is to average in over time.

-

Fourthly, recognise that while shares may fall in value the dividends – or income flow – from a well-diversified portfolio of shares tends to remain relatively stable and continues to remain attractive, particularly against bank deposits. Australian shares are offering an average grossed up for franking credits dividend yield of around 6% compared to term deposit yields of around two to three per cent.

-

Finally, turn down the noise. At times like the present the flow of negative news reaches fever pitch, making it harder to stick to an appropriate long term strategy let alone see the opportunities that are thrown up

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.