What is the equity risk premium?

What is the equity risk premium?

To compensate for their greater short-term volatility and risk of loss, shares should provide a return differential over a ‘risk free’ asset like government bonds over the long term. This return differential is referred to as the equity risk premium (ERP) and used to be thought of as being around 5% pa or more as this is what it had been for much of the post World War Two war period. But thanks largely to the 2007-09 global financial crisis (GFC), global shares have underperformed global bonds by around 1% pa over the last decade and Australian shares have underperformed Australian bonds by around 2.1% pa. Does this mean the equity risk premium concept is meaningless and that shares are a dud? The answer is no.

As the ERP concept relates to the very long term, the last decade or so proves nothing about its merits. Unfortunately, much confusion and disagreement surrounds the ERP. This is largely because it can refer to three different things: the historically realised return gap between equities and bonds; the gap required by investors to attract them to invest in equities; and the prospective (or likely) long-term gap based on current valuations. A key issue is not what equities have done relative to bonds in the past but what their potential is going forward. These concepts can move in opposite directions.

The historical (or ex post) equity risk premium

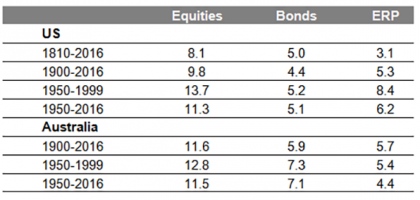

Many analysts tend to focus on historical data as a guide to what sort of return premium investors require for shares over bonds and to what it will be in future. However, while a useful starting point, this approach has limitations. Firstly, the historically realised return differential between equities and bonds varies significantly over time. As can be seen in the next table, between 1950 and 1999 the ERP was 8.4% pa in the US. But if the period is extended to 2016, the ERP falls to 6.2% pa. Similarly the realised ERP for Australian shares was 5.4% pa over the 50 years from 1950, but if the period is extended to 2016 it drops to 4.4% pa.

Nominal returns, % pa

Source: Global Financial Database, Thomson Financial, AMP Capital

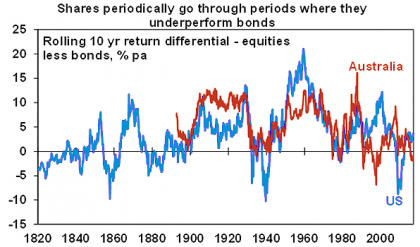

The instability of the realised ERP is highlighted below. Over rolling 10-year periods, the excess return from shares over bonds has varied from around -10% to +20% pa in the US and from around -7% to +17% pa in Australia. So the negative or low equity risk premium experienced in recent times is not unusual in an historic context. There is also a degree of mean reversion in the chart, with periods of low excess returns from shares being followed by periods of high excess returns, and vice versa. So the poor performance of shares versus bonds over the last decade globally and in Australia suggests there is a good chance of shares outperforming bonds over the decade ahead (just as the US share market has already shown).

Source: Global Financial Data, Thomson Reuters, AMP Capital

Obviously, the starting and end point valuation for markets for any period can heavily affect the size of the realised risk premium, even over long periods. For example, over the 50 years from 1950, equity returns were boosted by the fact that shares were depressed relative to earnings in 1950 (in the aftermath of the Great Depression and WWII) and so generated strong capital gains over the next 50 years as share prices rose relative to earnings. As a result, over the 1950 to 1999 period shares outperformed bonds by a very wide margin. However, by changing the end point to the end of 2016, the return from shares has been reduced thanks to the tech wreck and GFC. The point is that even when measuring over long periods the starting point and end point have a big impact on the measured equity risk premium.

Secondly, to the extent valuation changes (rising price to earnings multiples) boosted the realised ERP over the post-war period, this would have not been expected by investors and hence the measured ERP over that period is not a good guide to what they would have required to invest in shares.

Thirdly, in any case it is difficult to justify why investors would have demanded such a large premium (ie, 8.4% pa in the US and 5.4% pa in Australia over the 50 years from 1950). This would imply an implausibly high degree of risk aversion. It’s interesting to note that if we go way back to 1810, the US equity risk premium is just 3.1% pa.

Finally, historical equity data for countries like the US and Australia suffers from a survival bias. An investor who bought into German and Japanese shares in 1900 would have been wiped out along the way.

For these reasons, while an analysis of the past is a good starting point it does not provide a definitive guide as to what the equity risk premium should be or will be.

The required equity risk premium

We have already noted the historically realised ERP is not a good guide as to what investors actually require to invest in shares. The 5% plus ERP achieved in much of the post-war period was in large part due to a windfall gain to equity investors they were not expecting or requiring. Several considerations suggest that the required ERP has fallen and is now well below this, including:

-

improved regulatory and legal protection for investors, which means less risk from investing in shares;

-

lower trading costs in equities, greater scope to spread risk via diversification and improved market liquidity making it much easier to get out when desired;

-

increased demand for shares from pension funds helped by tax concessions on retirement savings;

-

the fall in inflation from the 1970s and 1980s, which has likely resulted in a higher quality of earnings;

-

this and less regular recessions should have reduced economic uncertainty – although this may have been partly reversed following the GFC and the constrained and fragile growth profile seen since then;

-

a greater feeling of global political security with no major wars since the end of WW2 and the end of the Cold War – although again this may have been partly reversed following the rise of terrorism and populist/nationalist politics.

While the GFC, the rise of terrorism and populism and a more risk-averse older population may have partly offset some of these favourable factors, the broad trend is still positive and suggests investors should demand a lower risk premium than, say, 50 or 100 years ago. Our assessment is that the appropriate equity risk premium going forward for US and global equities is somewhere around 3%. For Australian shares, fewer opportunities for diversification justify a slightly higher premium of around 3.5%, and for Asian shares greater economic and market volatility suggest a required ERP of around 4%. However, what will actually be delivered going forward is a different matter.

The prospective (or ex ante) equity risk premium

A simple way to think of the prospective (or likely) ERP for the next five to 10 years at any point in time is as follows:

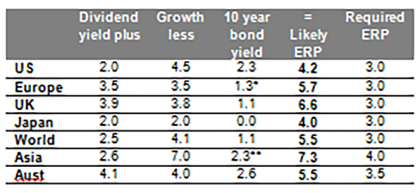

Likely ERP = Dividend Yld plus Growth Rate less Bond Yld

The Growth Rate is the growth rate in share prices and this is assumed to equal the long run growth rate in listed company earnings. This in turn is assumed to equal long-term nominal growth in the economy (with some adjustments). This approach makes sense as the return on shares equals dividend income plus capital growth. The table below provides current figures for each of these, the prospective ERP in the second last column and our estimate of the required ERP in the final column.

* Average of Germany, France, Italy & Spain. ** US bond yield. Source: Bloomberg, AMP Capital

This suggests that likely ERPs for shares are above what we think is required. This is particularly so for Europe, Asia and Australia but less so for the US (which has outperformed in recent years) and Japan (thanks to poor growth prospects). Of course, this calculation of the prospective risk premium assumes that bond yields are unchanged. The risk over the next few years is that bond yields rise towards more normal levels as central banks raise interest rates and inflation picks up. This will result in capital losses on government bond investments and hence a potentially higher excess return from shares over bonds. Of course if bond yields rise rapidly this could negatively impact share markets but this is unlikely given still low underlying inflation pressures globally and only a gradual removal of still easy monetary conditions. And the positive gap between the prospective and required equity risk premiums indicates shares have a bit of a buffer on this front.

Concluding comments

-

The historical record does not provide a definitive guide as to the risk premium that shares should or will offer over bonds. Just as the recent negative excess return from global and Australian shares over the last decade understates the return from shares over bonds, longer-term perceptions of a 5% plus return excess based on history exaggerate it;

-

A range of factors suggests the required ERP is somewhere around 3-4% pa;

-

Current estimates suggest the prospective ERP is above this, particularly for European, Asian and Australian shares.

While stocks are vulnerable to a correction after their sharp gains since February last year, their attractive risk premium compared to bonds along with the favourable outlook for growth and profits suggests that any short-term pullback in shares will simply be a correction in a still rising trend.

If you would like to discuss anything in this report, please call us on 02 9299 1500 or email admin@fifteenhundred.com.au.

Source: AMP Capital 3 May 2017

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.