New ways to access various investments, tax changes and new regulations, all with social media adding to the noise. But it’s really quite simple and this can be demonstrated in charts. This note continues our series that began with “Five great charts on investing”, which can be found here and looks at another five great charts – well, one is actually a table – on investing.

Chart #1 Time in versus timing

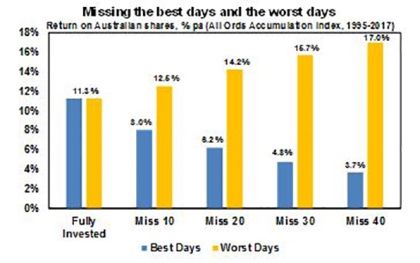

Without a tried and tested asset allocation process, trying to time the market, ie selling in anticipation of falls and buying in anticipation of gains, is very difficult. A good way to demonstrate this is with a comparison of returns if an investor is fully invested in shares versus missing out on the best (or worst) days. The next chart shows that if you were fully invested in Australian shares from January 1995, you would have returned 11.3% per annum (including dividends but not allowing for franking credits, tax and fees).

Source: Bloomberg, AMP Capital

If by trying to time the market you avoided the 10 worst days (yellow bars), you would have boosted your return to 12.5% pa. If you avoided the 40 worst days, it would have been boosted to 17% pa. But this is very hard to do and many investors only get out after the bad returns have occurred, just in time to miss some of the best days and so end up damaging their returns. For example, if by trying to time the market you miss the 10 best days (blue bars), the return falls to 8% pa. If you miss the 40 best days, it drops to just 3.7% pa. Hence the old cliché that “it’s time in that matters, not timing”.

Key message: market timing is great if you can get it right, but without a process the risk of getting it wrong is very high and if so it can destroy your returns.

Chart #2 Look less

If you look at the daily movements in the share market, they are down almost as much as they are up, with only just over 50% of days seeing positive gains. See the next chart for Australian and US shares. So day by day, it’s pretty much a coin toss as to whether you will get good news or bad news. But if you only look monthly and allow for dividends, the historical experience tells us you will only get bad news around a third of the time. Looking out further on a calendar year basis, data back to 1900 indicates the probability of bad news in the form of a loss slides to just 20% in Australian shares and 26% for US shares. And if you go all the way out to once a decade, since 1900 positive returns have been seen 100% of the time for Australian shares and 82% for US shares.

Daily and monthly data from 1995, data for years and decades from 1900. Source: Global Financial Data, AMP Capital

Key message: the less you look at your investments, the less you will be disappointed. This matters because the more you are disappointed, the greater the chance of selling at the wrong time.

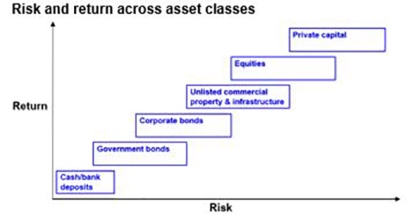

Chart #3 Risk and return

This chart is basic to investing. Each asset class has its own risk (in terms of volatility and risk of loss) and return characteristics. Put simply: the higher the risk of an asset, the higher the return you will likely achieve over the long term and vice versa. The next chart shows a stylised version of this. Starting with cash (and bank deposits), it’s well known that they are very low risk but so is their return potential. Government bonds usually offer higher returns but their value can move around a bit in the short term (although major developed countries have not defaulted on their bonds). Corporate debt has a higher return potential again but a higher risk of default – particularly for junk bonds. Corporate debt is basically a hybrid between equities & government bonds. Unlisted or directly held commercial property and infrastructure offer a higher return again but they come with higher risk and are less liquid and can be less able to be diversified (although this can be remedied by investing via a managed fund). Equities can offer another step up in return but this is because they come with higher risk as they are subject to share market volatility and individual companies can go bankrupt wiping out share holder capital. Beyond this, private equity entails more risk again and so tends to command an even higher return premium. Each step up involves more risk and this is compensated for with more return.

Source: AMP Capital Key message: Investors need to allow for the risk (and liquidity) and return characteristics of each asset. Those who don’t mind short-term risk (and illiquidity in the case of unlisted assets) can take advantage of the higher returns growth assets offer over long periods. The key is that there is no free lunch.

Chart #4 Diversification

But this not the end of the story. The next table shows the best and worst performing asset class in each year over the last 15.

Best and worst performing major asset class

| Year | Best Asset Class | Worst Asset Class |

|

2001 |

Aust listed property |

Global equities unhedged |

|

2002 |

Unlisted infrastructure |

Global equities unhedged |

|

2003 |

Global listed property |

Global equities unhedged |

|

2004 |

Global listed property |

Cash |

|

2005 |

Aust equities Cash |

Cash |

|

2006 |

Global listed property |

Aust bonds |

|

2007 |

Aust equities |

Global listed property |

|

2008 |

Aust bonds |

Aust listed property |

|

2009 |

Aust equities |

Unlisted property |

|

2010 |

Global listed property |

Global equities unhedged |

|

2011 |

Unlisted infrastructure |

Aust equities |

|

2012 |

Aust listed property |

Cash |

|

2013 |

Global equities unhedged |

Australian bonds |

|

2014 |

Global listed property |

Cash |

|

2015 |

Unlisted infrastructure |

Cash |

|

2016 |

Unlisted infrastructure |

Cash |

Note: refers to the major asset classes. Source: Thomson Reuters, AMP Capital

It can be seen that the best performing asset each year can vary dramatically and that last year’s top performer is no guide to the year ahead. For example, those who loaded up on listed property after their strong pre-Global Financial Crisis (GFC) performances were badly hurt as they were amongst the worst performing assets through the GFC. So it makes sense to have a combination of asset classes in your portfolio. This particularly applies to assets that are lowly correlated ie that don’t just move in lock step with each other. For example, global and Australian shares tend to move together during extreme events. But bonds and shares tend to diverge when crises hit – as we saw in the GFC when shares fell sharply but bonds rallied. And so there is a case to have bonds in a portfolio to help stabilise returns.

Key message: diversification is also a bit like the magic of compound interest. Having a well-diversified exposure means your portfolio won’t be as volatile. And this can help you stick to your strategy when the going gets rough.

Chart #5 Residential property has a role

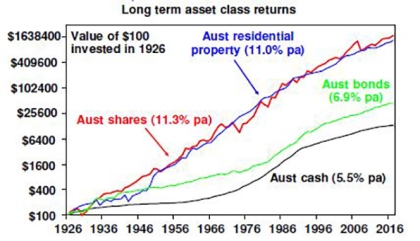

Chart #1 in the first edition in this Five Charts series highlighted the power of compound interest, with a comparison showing the value of $1 invested in various Australian asset classes back in 1900 and what it would be worth today. Unfortunately, I do not have monthly data for Australian residential property returns back that far but I do have them on an annual basis back to 1926 and this is shown in the next chart starting with a $100 investment. (Commercial property return series only really go back a few decades.)

Source: ABS, REIA, Global Financial Data, AMP Capital

Again it can be seen that over very long periods the power of compounding works wonders for shares compared to bonds and cash. But it can also be seen to work well for Australian residential property with an average total return (capital growth plus net rental income) of 11% pa, which is similar to that for shares. All of which highlights, along with the diversification benefits of a real asset like property, the case to have it in a well-diversified portfolio along with listed assets like shares, bonds and cash. The key is to allow for the different “risks” experienced by property versus shares. Property prices are less volatile than share prices as they are not traded on share markets and so are not as subject to the whims of investors and movements in their values tend to relate more to movements in the real economy. But residential property takes longer to buy and sell and it’s harder to diversify as you can’t easily have exposure to hundreds or thousands of properties exposed to different sectors and countries like you can with shares. So there are trade-offs between residential property and shares.

Key message: given their long-term returns and diversification benefits, there is a key role for residential property in your investment portfolio (putting aside issues of current valuations).

Source: AMP Capital 11 September 2017

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note:

While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.