While interest rates in the US are rising, Australia’s interest rates remain stubbornly low. That flows through to subdued returns from term deposits and government bonds, and many investors continue to be faced with the question of where to invest for income in a low yield environment.

Corporate bonds – debt securities issued by companies – can diversify portfolios and generate a higher income return than term deposits and government bonds. Those are just two of four reasons investors looking for stable income might want to consider them as part of a diversified portfolio.

1. A strong buffer against share market volatility

Corporate bonds can be a lower-risk way to gain exposure to corporates than equities because they pay investors relatively stable cash flows. Corporate bonds and Australian equities are also often negatively correlated: when share values increase corporate bonds fall, and vice versa. So, when investors allocate a part of their portfolio to corporate bonds, it can make their portfolio more ‘defensive’ – returns will be smoother and less volatile, particularly during times of equity market turmoil.

2. Higher income than term deposits and government bonds

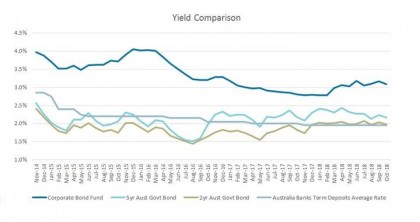

Corporate bonds are expected to provide investors with a relatively high excess yield over term deposits and government bonds in the medium term, as illustrated by the chart below, which shows the historical excess yield of the AMP Capital Corporate Bond Fund over term deposits and government debt. However, it should be noted that the AMP Corporate Bond Fund is a managed investment scheme, which has a different risk profile to a bank term deposit. In addition, given sound company fundamentals, corporate bonds are well positioned to benefit from continued recovery in the global economy.

Past performance is not a reliable indicator of future performance.

Source: AMP Capital, Bloomberg. As at October 2018.

3. Risk of capital loss is reduced

Active bond managers use multiple levers to manage downside risk, particularly in a rising interest rate environment. Primary amongst these is the ability of a manager to adjust the bond portfolio’s ‘duration’. Duration measures the sensitivity of a bond’s capital value to a change in interest rates in years.

For example, if a bond has a duration of five years, its price will rise about 5% if interest rates drop by 1%, and its price will fall by about 5% if interest rates rise by 1%. Given this multiplicative outcome, corporate bonds with higher durations carry more risk and have higher price volatility than bonds with lower durations.

Subsequently, when interest rates rise, portfolios with higher duration suffer bigger losses. By managing the fund’s duration – or shortening the fund’s duration – an investment manager can aim to limit the risk of capital loss in a rising interest rate environment.

4. Access to the benefits of diversification

Investors in an actively managed corporate bond fund can spread their portfolio risk by being exposed to a range of issuers, industries and geographies. Typically, when investors have exposure to a large number (upwards of 100) of securities it minimises the impact of a default or systemic event on the portfolio.

Other considerations

Corporate bonds are traditionally considered lower down the risk spectrum than shares. Nevertheless, when investors explore investing in corporate bonds it is prudent to have a focus on investment-grade credit.

It is important to invest in companies with strong or improving corporate fundamentals, a solid management team with a bondholder focus, and where a normalisation of global growth could translate into revenue and earnings growth.

Important note: AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMPCFM) is the responsible entity of the AMP Capital Corporate Bond Fund (Fund) and the issuer of the units in the Fund. To invest in the Fund, investors will need to obtain the current Product Disclosure Statement (PDS) from AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232 497) (AMP Capital). The PDS contains important information about investing in the Fund and it is important that investors read the PDS before making a decision about whether to acquire, or continue to hold or dispose of units in the Fund. Neither AMP Capital, AMPCFM nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to their objectives, financial situation and needs.

Author: Steven Hur

Source: AMP Capital 3 December 2018

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.