Many investors have been rattled by falls in share markets and are fretting about what the new year may hold.

But there are a number of reasons to suggest that after a weak 2018, 2019 will be better, and that a well-diversified portfolio should deliver reasonable returns.

1. This is a “mid-cycle” correction

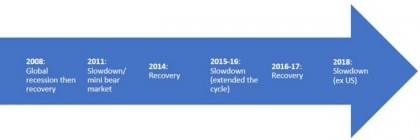

Firstly, while some investors fear a recession and full-blown bear market, when you look at the global economy, what you see is not a major recession, but yet another “mid-cycle” correction. As the timeline below illustrates, the recovery since the global financial crisis has been anything but straightforward with several mid-cycle slowdowns along the way including around 2011 and 2015-16.

2. No full-blown recession

But while we are in a growth slowdown globally, I don’t see the conditions being in place to drive that into a full-blown recession. I don’t see excess investment; I don’t see lots of interest rate hikes around the world; I don’t see tight monetary policy; and I don’t see a major inflation problem.

My feeling is that growth might be a little bit subdued in the first part of 2019, but as we go through the year, we will see another pick-up in growth and that will keep the global economic growth going.

3. Oil prices falling

Another reason I have for optimism is that oil prices have fallen 30-odd per cent. That takes pressure off inflation and also puts money in the hands of consumers – a bit like a tax cut.

It’s a classic example of the benefits of these mini-downturns. It’s not so good for share markets, but ultimately lower oil prices help extend the cycle and therefore are likely to drive a recovery in share markets as we go in 2019.

4. Modest rate hikes or even cuts

The fourth reason is that interest rate rises should be constrained in 2019. The US Federal Reserve will probably raise interest rates a bit more through 2019, but I think it’s going to be at a slower pace, and it wouldn’t surprise me at all if they have a pause through the first part of 2019.

That’s reflecting the slower pace of growth that we have seen and signs that US inflation in the very short term may be constrained around the Federal Reserve’s 2% target. Other major countries are very unlikely to raise rates and some (such as China) are likely to cut them.

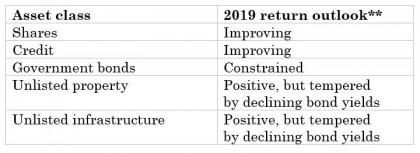

The impact on investment returns

Despite the concerns of investors, the four reasons above mean I don’t believe we are headed for a deep bear market or major recession and therefore I anticipate better returns in 2019, albeit things could still get worse before they get better.

** Warning: These forecasts are prospective financial information based on various assumptions. The forecasts are predictive in nature, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties, and may differ materially from results ultimately achieved. Source: AMP Capital

Australia’s outlook

The local outlook is ok, but returns will be constrained.

On the one hand, there’s strength in infrastructure spending, business investment looks healthier, and export values should hold up; on the other hand, there’s the housing slowdown, which will constrain things, all of which should keep Australian interest rates on hold, or if, as we expect, ultimately drive a rate cut. So the return outlook for bank deposits will remain very low as we go through 2019.

What to watch

There are, as always, some areas to keep an eye on through 2019.

- Australian housing I expect Australian housing is going to remain weak. With credit tightening and rising supply, expectations are a lot weaker which is attracting fewer buyers into the property market. There’s also reduced foreign demand and a potential change of government on the horizon – all of those things are going to lead to more downside in Australian property prices, though that will be concentrated in Sydney and Melbourne.

- The US Federal Reserve Globally, watch to see what the US Federal Reserve are doing – but as mentioned I don’t expect dramatic US rate rises in 2019.

- The Trump trade war The trade issue between the US and China will bubble along periodically as we go through 2019, particularly in the first part of the year. To see whether the war flares up again, investors need to monitor what happens with the trade truce struck on the sidelines of the recent G20 summit that saw China and the US put tariff increases on hold for 90 days.

To learn more about our predictions for 2019, watch our recent webinar.

https://vimeo.com/304496565

Author: Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist, AMP Capital

Source: AMP Capital 15 Jan 2019

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.