Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Key points

- 2021 saw strong investment returns with low volatility.

- 2022 is likely to see more constrained returns with increased volatility.

- Watch: coronavirus and vaccines; inflation; the US mid-term elections; China issues; Russian tensions with Ukraine and the west; & the Australian election.

Introduction

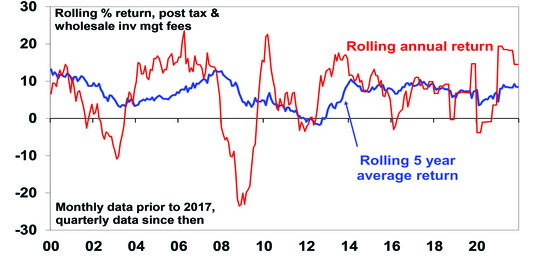

Despite a wall of worry with coronavirus and inflation, 2021 was a great year for diversified investors, with average balanced growth super funds looking like they have returned around 14%, after just 3.6% in 2020. Balanced growth super fund returns have averaged around 8.5%pa over the last five years, well above inflation and bank deposit rates.

Balanced growth superannuation fund returns

Source: Mercer Investment Consulting, Morningstar, AMP

But can strong returns continue? Here is a simple point form summary of key insights and views on the investment outlook.

Six things that went wrong in 2021

-

Several coronavirus waves disrupted economic activity.

-

Inflation took off as coronavirus boosted spending on goods and disrupted production and supply chains.

-

Some key central banks started to remove monetary stimulus earlier than expected with some raising rates.

-

Bond yields surged.

-

Chinese growth slowed sharply.

-

Geopolitical tensions with China, Russia & Iran stayed high.

But there were three big positives

-

Science and medicine appeared to offer hope of getting on top of coronavirus. This saw less severe illness through the mid-year Delta wave compared to the 2020 waves.

-

As a result, the broad trend was towards global reopening.

-

Monetary and fiscal policy remained ultra-easy.

As a result, global growth is estimated to have been nearly 6% and this drove strong profit growth and along with low rates saw strong returns from shares and other growth assets offsetting losses in bonds.

Four lessons from 2021

-

Inflation is not dead – a surge in money supply under the right circumstances, in this case massive fiscal stimulus and supply shortages, can still boost inflation.

-

Shares climb a wall of worry – particularly if earnings are rising and interest rates are low/monetary policy is easy.

-

Timing market moves is hard and the key is to have a well-diversified portfolio – despite lots of worries share markets overall surprised with their strength but some share markets (eg in Asia missed out) and bonds performed poorly.

-

Turn down the noise – investors are getting bombarded with irrelevant, low quality and conflicting information which confuses and adds to uncertainty. So, the best approach is to turn down the noise and stick to a long-term strategy.

Seven reasons for optimism on economic growth

-

Coronavirus could finally be moving from a pandemic to being endemic – more on this below.

-

Excess savings of around $US2.3trn in the US and $250bn in Australia will provide an ongoing boost to spending.

-

While Fed and likely RBA monetary policy will tighten this year it will still be easy. It’s usually only when policy becomes tight that it ends the economic cycle & the bull market and that’s a fair way off.

-

Inventories are low and will need to be rebuilt which will provide a boost to production.

-

Positive wealth effects from the rise in share and home prices will help boost consumer spending.

-

China is likely to ease policy to boost growth.

-

While business surveys are down from their highs, they remain strong and consistent with good growth.

Global growth is likely to slow this year but to a still strong 5% with Australian growth of around 4%, despite the Omicron wave resulting in a brief set back in the March quarter. We have revised down our March quarter Australian GDP forecast by 1% to 0.6%, but revised up subsequent quarters by the same.

Four reasons for optimism regarding coronavirus

The current situation is quite worrying. Global and Australian coronavirus cases have surged over the last month. Australia managed the first 22 months of the pandemic highly effectively with a suppression strategy that minimised deaths and supported the economy. Following the further relaxation of restrictions since November, significant pressure has been placed on the health system. Overseas experience showed a reopening rebound in Delta cases in even highly vaccinated countries (eg, Singapore). And the Omicron variant arrived in late November with clear evidence it was far more transmissible than Delta. All at a time when much of the population has yet to have a booster shot. The end result looks like being another hit to the economic recovery in the current quarter as people self-regulate to avoid covid or have to isolate. However, each covid wave seems to be having a smaller negative economic impact. More fundamentally, despite the short-term uncertainty there are four reasons for optimism regarding coronavirus:

-

Vaccines are still providing protection against serious illness – particularly once booster shots are administered.

-

New coronavirus treatments are on the way which will aid in the treatment of the more vulnerable.

-

Omicron is more transmissible but less harmful (evident in far lower levels of hospitalisations and deaths relative to the surge in new cases compared to past waves) and so could come to dominate other variants.

-

Past covid exposure is providing a degree of herd immunity.

Combined, this could set coronavirus on the path to being endemic where we learn to “live” with it. South Africa, London and New York are possibly already seeing signs of a peak in Omicron. Of course, the risk of new variants that are more transmissible & more deadly remains – which is why it’s in the interest of developed countries to speed up global vaccination.

Key views on markets for 2022

Still solid economic growth, rising profits and still easy monetary conditions should result in good overall investment returns.

-

Global shares are expected to return around 8% but expect to see a rotation away from growth and tech heavy US shares to more cyclical markets.

-

Australian shares are likely to outperform, helped by leverage to the global cyclical recovery and as investors continue to search for yield in the face of near zero deposit rates but a grossed-up dividend yield of around 5%.

-

Still very low yields & a capital loss from a rise in yields are likely to again result in negative returns from bonds.

-

Unlisted commercial property may see some weakness in retail and office returns, but industrial is likely to be strong. Unlisted infrastructure is expected to see solid returns.

-

Australian home price gains are likely to slow with prices falling later in the year as poor affordability, rising fixed rates, higher interest rate serviceability buffers, reduced home buyer incentives and higher listings impact.

-

Cash and bank deposits are likely to provide very poor returns, given the ultra-low cash rate of just 0.1%.

-

Although the $A could fall further in response to coronavirus and Fed tightening, a rising trend is likely over the next 12 months, helped by still strong commodity prices and a decline in the $US, probably taking it to around $US0.80.

Five reasons to expect more volatility

-

Inflation – while its likely to moderate this year as production rises & goods demand subsides it is likely to be associated with ongoing scares and the risk that its higher for longer.

-

The start of Fed and RBA rate hikes and quantitative tightening – monetary policy is unlikely to get tight enough to threaten the economic recovery and cyclical bull market, but monetary tightening could still cause volatility.

-

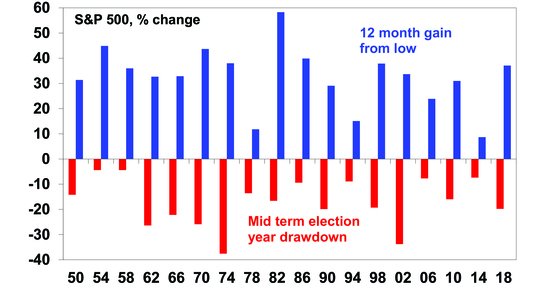

The US mid-term elections – mid-term election years normally see below average returns in US shares, and since 1950 have seen an average drawdown of 17%, albeit with an average 33% gain over the subsequent 12 months.

Us mid-term election year share market drawdowns

Source: Strategas, AMP

-

China/Russia/Iran tensions – a partial Russian invasion of Ukraine could lead to even higher European gas prices.

-

Mean reversion – shares are no longer cheap, the easy gains are behind us and calm years like 2021 tend to be followed by volatile years.

Six things to watch

-

Coronavirus – new variants could set back the recovery.

-

Inflation – if it continues to rise and long-term inflation expectations rise, central banks will have to tighten aggressively putting pressure on asset valuations.

-

US politics – political polarisation is likely to return to the fore in the US, posing the risk of a deeper than normal mid-term election year correction in shares.

-

China issues are likely to continue – with the main risks around its property sector and Taiwan.

-

Russia – a Ukraine invasion could add to EU energy issues.

-

The Australian election – but if the policy differences remain minor, a change in government would have little impact.

Nine things investors should remember

Yeah – I put these in most years!

-

Make the most of the power of compound interest. Saving regularly in growth assets can grow wealth substantially over long periods. Using the “rule of 72”, it will take 144 years to double an asset’s value if it returns 0.5%pa (ie, 72/0.5) but only 14 years if the asset returns 5%pa.

-

Don’t get thrown off by the cycle. Falls in asset markets can throw investors out of a well thought out strategy.

-

Invest for the long-term. Given the difficulty in timing market moves, for most it’s best to get a long-term plan that suits your wealth, age & risk tolerance & stick to it.

-

Diversify. Don’t put all your eggs in one basket.

-

Turn down the noise.

-

Buy low, sell high. The cheaper you buy an asset, the higher its prospective return will likely be and vice versa.

-

Avoid the crowd at extremes. Don’t get sucked into euphoria or doom and gloom around an asset.

-

Focus on investments you understand offering sustainable cash flow. If it looks dodgy, hard to understand or has to be justified by odd valuations or lots of debt, then stay away.

-

Seek advice. Investing can get complicated and its often hard to stick to a long-term investment strategy on your own.

Source: AMP Capital 12 January 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.