– but remains “patient” on rates. We expect the first rate hike in August

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Key points

-

The RBA will end quantitative easing this month.

-

While it now sees unemployment falling below 4% and higher inflation it is prepared to be “patient” for now.

-

We expect rate hikes to commence in August.

-

Ultimately, we see the cash rate rising to around 1.5 to 2% in the years ahead but it’s a bit of guess and the RBA will only raise rates as far as necessary to cool inflation.

-

Rate hikes from later this year are unlikely to be enough to threaten the economic recovery but they will add to the slowdown in the property market where we see dwelling prices peaking later this year.

Introduction

Over the last six months several central banks have raised interest rates. This started in emerging markets but developed country central banks have also hiked rates – notably those in the UK, NZ, Norway and South Korea. Both the Fed and Bank of Canada are likely to hike in March.

And now the RBA is (slowly) getting closer to rate hikes too. Last year it ended cheap funding for banks in June, slowed its bond buying and in November ended its 0.1% yield target for the April 2024 Government bond. It has now decided to end bond buying this month and while the RBA’s commentary was less hawkish than expected – being prepared to be “patient” in waiting for more confidence that the pick up in inflation will be sustained and still wanting to see faster wages growth – its forecasts have now shifted in a more hawkish direction: it now expects unemployment to fall below 4% this year; it expects a further pick up in wages growth; and now sees underlying inflation rising to around 3.25% in coming quarters before falling back to 2.75% next year (where it was forecast to be 2.25%).

So, while the RBA was not as hawkish as expected in its post meeting statement, its revised more upbeat forecasts have moved it in a more hawkish direction to at least allow the possibility of a start to rate hikes later this year, whereas previously its forward guidance was that a rate hike was unlikely until 2024, possible in 2023 but not in 2022.

For some time we have been more hawkish than the RBA and coming into this year were expecting the first hike would occur in November, but brought that forward to August two weeks ago. And that remains our view.

What’s driving expectations of earlier rate hikes?

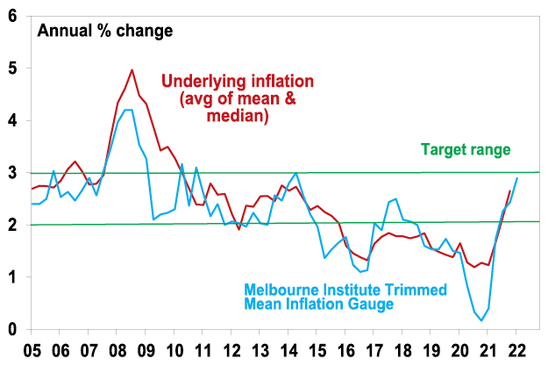

Pretty much as has been seen in other countries, key data for jobs and inflation in Australia have been far stronger than expected with unemployment falling to 4.2% in December (against the RBA’s own forecast for 4.75%) and underlying inflation has now surprised on the upside for two quarters in a row reaching 2.6% in the December quarter. Moreover, the Melbourne Institute’s monthly Inflation Gauge, which is based on price surveys, has done a good job of pre-empting the official inflation data over time (albeit with a bit more volatility) points to a further rise in underlying inflation (the Trimmed Mean) into this quarter.

MI Inflation Gauge points to a further rise in underlying inflation

Source: Melbourne Institute, AMP

And, at its February meeting while the RBA was not as hawkish as expected it indicated that its forecasts for unemployment have been revised down and its inflation revised up. Wages growth is not yet at the “3 point something” that the RBA would like to see, but with unemployment on track to fall below 4% wages growth is now likely to pick up to the desired pace in the second half, while underlying inflation is now comfortably in the target range and likely to run above it through the second half of this year.

So while I can understand the RBA’s near term “patience” – although it does remind a bit of the Fed six months or so ago – the conditions for rate hikes look like being met in the second half of the year. With inflation pushing into the top half of the target range, the danger in waiting too long to start monetary tightening is that it will allow inflation to become entrenched and it will then be harder to get back under control again. This is the risk that central banks like the Fed may now be facing.

When will the RBA start raising rates?

Our base case remains for the first hike to come in August followed by another in September taking the cash rate to 0.5%. But if December quarter wages data due in three weeks shows an acceleration in wages growth, then the first rate hike could come in June.

Does this mean that the RBA got it wrong?

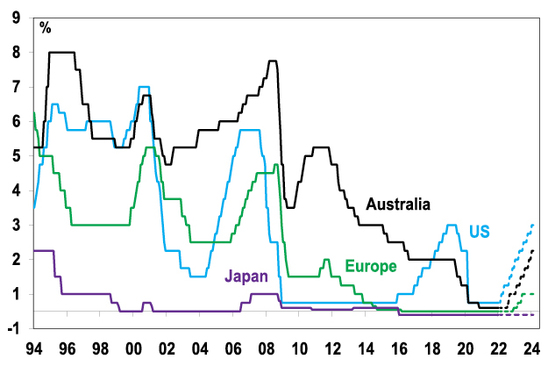

Some may complain that its forecasts were too cautious and so its forward guidance that a rate hike was unlikely until 2024, possible in 2023, but not in 2022 has been too dovish. But that guidance was based on data and forecasts and both change. Forecasting is always hard. Particularly in a pandemic which has blown forecasts all over the place and caused massive dislocation to supply and demand. And don’t forget that the RBA’s shift to focussing on actual inflation, as opposed to forecast inflation and adoption of very dovish guidance were designed to break Australia out of the very low inflation and low wages growth trap it has been in for the last six or seven years and for which many criticised it for being too hawkish. In this sense it may be argued that the RBA is now finally getting what it wanted, and it’s been right to be dovish! And it’s not as if inflation is now out of control in Australia. Underlying inflation is in the middle of the target range and headline inflation is half what it is in the US. And at 3.5%yoy, inflation in Australia is well below that in many comparable countries, viz 7% in the US, 5% in Europe, 5.4% in the UK, 4.8% in Canada and 5.9% in NZ.

How far will interest rates rise in Australia?

This is a guessing game as there are lots of cross currents.

-

On the one hand, very high household debt to income ratios compared to when rates last went up (in 2009-10) and particularly when inflation was last a big problem mean much smaller rate hikes will be necessary than in the past as they will now be more potent in slowing spending. For example, the threefold increase in the household debt to income ratio since the late 1980s means a 0.25% rate hike today is equivalent to a 0.75% rate hike back then. What’s more a big part of the rise in inflation has been caused by a pandemic driven surge in demand for goods and disruptions to supply, both of which should correct in time, which the RBA is rightfully mindful off so as not to overtighten.

-

On the other hand, many households have used the pandemic and lockdown period to pay down their debt faster (or build up saving buffers) and there has been increased use of fixed rate mortgages (which accounted for 50% of new lending). Both of which will help protect borrowers against initial rate hikes to some degree.

As best we can tell though fixed rate mortgages are still only around 30% of total mortgage debt outstanding and fixed rates have already started to rise cooling the property market which is one of the avenues through which monetary policy acts to cool things. And, of course, monetary policy operates with a lag of around 12 months and many who took out fixed rate deals in 2020 will see them start to mature later this year and next resulting in borrowers rolling over to much higher rates anyway. On balance while buffers and fixed rates may complicate things, the high level of household debt is likely to ultimately dominate in constraining how much the RBA will need to raise rates.

We are assuming a rise in the cash rate over the next few years to around 1.5 to 2%, which all things being equal will translate to an increase in variable mortgage rates of up to 2%. While this will cut into household spending power it should still be manageable for borrowers as banks were imposing a serviceability buffer of 2.5% up until October (ie, borrowers had to still be able to service the loan with up to a 2.5% higher interest rate) which has since been raised to 3%. This would take the cash rate back to or just above where it was in the years just before the pandemic but assumes much lower unemployment and faster wages growth and inflation.

Of course, this is all a bit of a guess at present and the RBA will not be on autopilot mindlessly raising rates to some level based on where rates were in the past and crashing the economy and property market in the process. The RBA will move in small increments – probably two steps at a time and pause to see what happens before doing more, but rates will not rise to nosebleed levels.

Official interest rates

Source: Bloomberg, AMP

What about the impact on the economy and shares?

At a high level, that the RBA is removing stimulus and getting closer to rate hikes is good news because it means economic conditions are improving. While rate hikes will cause bouts of uncertainty, we don’t see RBA rate hikes this year as being enough to end the economic recovery & bull market in shares:

-

Monetary policy will still be relatively easy for much of this year at least. It’s usually only tight monetary conditions that result in economic downturns & we are a long way from that.

-

This means that profits will continue to rise.

-

Despite the recent falls in share markets on rate hike fears, credit spreads have remained low, metal prices have held up and value stocks have been outperforming growth stocks all of which are positive signs for economic growth.

-

Even with two RBA rate hikes this year term, deposit rates would only rise to around 0.7% so they will still be very low relative to the grossed-up dividend yield on the Australian shares of around 5%.

However, the move towards RBA interest rate hikes does mean that we are now in a more constrained and volatile period for shares compared to the environment of the last year.

What about residential property prices?

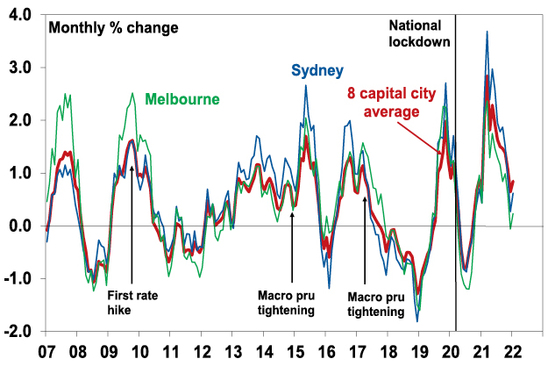

The Australian property market is highly sensitive to the monetary cycle as a result of very high price and debt to income ratios. Rate hikes in 2009-10 were quickly followed by a period of weaker prices and macro prudential tightening achieved the same in 2015-16 and then more so in 2017-19. Dwelling price growth has already started to slow and we expect the combination of worsening affordability along with rising fixed rates and then rising variable rates later this year to see home prices peak in the September quarter and fall 5 to 10% in 2023.

Average capital city home prices

Source: CoreLogic; AMP

Source: AMP Capital February 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.