Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

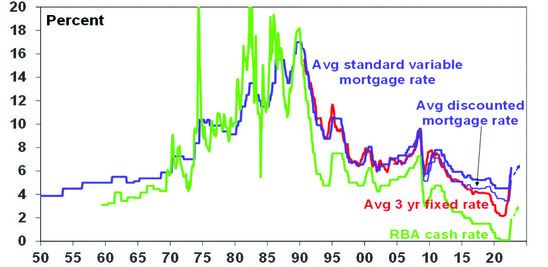

As widely expected, the RBA has increased the cash rate again by 0.5% taking it to 1.85%. This is more than double the 0.75% rate that applied before the pandemic started. The 175 basis points in rate hikes since April is the fastest back-to-back series of rate hikes since increases of 0.25%, 0.75% and 1% in October, November and December 1994 respectively.

In justifying another 0.5% hike the RBA noted that: inflation is the highest its been since the early 1990s and set to rise further with strong demand and a tight labour market playing a role; the labour market remains tight and businesses are pointing to a lift in wages growth; and it is important that medium term inflation expectations remain “well anchored”. While the RBA downgraded its growth forecasts to 3.25% for this year and to 1.75% for the subsequent two years it revised up its inflation forecast for this year from 6% to 7.75% and to 4% in 2023.

The RBA’s rapid rate hikes reflect a desire to bring demand back into line with constrained supply and to contain inflation expectations by reinforcing its commitment to its inflation target. Containing inflation expectations is critical as the 1960s and 1970s experience tells us the longer high inflation persists the more inflation expectations will rise and get built into price and wage setting making it even harder to get inflation back down.

Australian interest rates on the rise

Source: RBA, Bloomberg, AMP

The RBA’s commentary remained hawkish reiterating that it will do “what is necessary” to return inflation to target and it indicated that it expects to raise interest rates further. Banks are likely to pass the RBA’s rate hike on in full to their variable rate customers and deposit rates will rise further.

Five reasons why the cash rate will likely peak with a 2 in front of it rather than a 3 or more

Getting inflation back under control is critical as a rerun of the 1970s experience of high inflation will be disastrous for Australians, the economy and investment markets. So the RBA is right to sound tough and act aggressively now. However, we remain of the view that the cash rate won’t have to go as high for the RBA to cool demand enough to take pressure off inflation and keep inflation expectations down as the futures market and some economists are expecting. The futures market has lowered its expectations for the cash rate from above 4% two months ago but it and the consensus of economists is still factoring in a rise over 3% and some economists see it rising to 3.6% next year. There are five reasons why this is too hawkish:

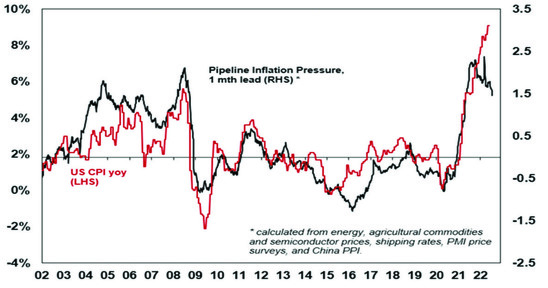

#1 Global supply bottlenecks are easing and this will take pressure off inflation. This is evident in various global business surveys showing reduced delivery times, falling work backlogs, lower freight costs, lower metal and grain prices, and falling input and output prices. As a result, our Pipeline Inflation Indicator for the US is trending down. Core inflation in the US is showing signs of having peaked and Australia appears to be following the US by about six months, pointing to a peak in inflation here later this year. A return to more normal weather after the floods should also help lower local food prices.

AMP Pipeline Inflation Indicator

Source: Bloomberg, AMP

Related to this, while global energy prices (for oil, coal and gas) are likely to remain high, they may be at or close to their peak so their contribution to ongoing inflation may go to zero later this year. In Australia, some pressure may also come off electricity prices next year as the number of generators offline due to maintenance and breakdowns decline.

#2 Don’t read too much into what the RBA is saying. Some have interpreted the RBA’s recent comments – describing households as a whole as being in a “fairly good position” to withstand higher interest rates based on scenarios involving a 3% rise in interest rates and rates being well below estimates of “neutral” – as consistent with the cash rate likely rising above 3%. While the RBA has to sound tough to keep inflation expectations down, there is a danger in reading too much into its commentary regarding the path for interest rates. RBA commentary late last year indicating that it did not expect the cash rate to start rising before 2024 based on their then forecasts was not so reliable as it changed tack quickly once it was clear that it was wrong on inflation. It could easily do the same again.

-

The neutral rate of interest concept – which is the rate at which monetary policy is neither expansionary nor contractionary – is fine in theory but has numerous problems. We won’t know where it really is until we have gone past it. Its impacted by things like the level of debt and it was of little use in the pre-pandemic period when rates were below estimates of neutral and yet growth slowed.

-

It’s hawkish rhetoric now is designed to reinforce its seriousness about getting inflation down, but will quickly change tack once its confident its getting what it wants. Just like it’s very dovish guidance from a year ago was designed to push up inflation expectations but then span on a dime.

-

Its sanguine comments on the financial health of the household sector sound just a bit too sanguine – see below.

The RBA is just another forecasting outfit – albeit with more resources, but this does not make it any more accurate than other commentators when it comes to interest rates. It also has a role in influencing expectations that other commentators don’t have. So reading too much into its guidance can be misplaced.

#3 Medium term Australian inflation expectations remain reasonably low. See “What are inflation expectations telling us?”. This makes the RBA’s task a bit easier – albeit it has to sound tough for a while to make sure it remains the case.

#4 Many households will see significant mortgage stress with a 3% or more rise in interest rates. On average, the household sector is in reasonable shape once the rise in wealth, a build up in excess saving and mortgage buffers (people being ahead on their repayments) is allowed for. But averages can be deceiving – a bit like having one arm in the freezer and one in the oven and saying on average you are okay. While RBA analysis shows that just over one third of households with a variable rate mortgage will see no increase in their payments with a 3% rise in interest rates, more than a third of all households with a mortgage – whether variable or fixed – will see a greater than 40% increase (and much more so for those on fixed rates). Roughly speaking, this is about 1.3 million households. This, at a time of falling real wages, will have a huge impact on spending in the economy and risk a significant rise in forced property sales. Coming at a time when home prices are already falling rapidly due the impact of rising rates on home buyer demand it will only add to home price falls, which will weigh further on consumer spending.

Looked at another way – a new borrower with an average $600,000 mortgage will have seen around a $600 a month increase in their monthly repayment since April once the latest rate hike is passed through. That is roughly an extra $7000 a year. Taking the cash rate to 3.1% would imply an extra $12,300 a year since April in mortgage payments. This is a huge hit to the household budget and spending power.

The surge in house prices and hence household debt levels over the last 30 years was made possible by falling interest rates. A rise in the cash rate to 3% or more would push total mortgage repayments (ie, interest and principal) to record highs relative to household income.

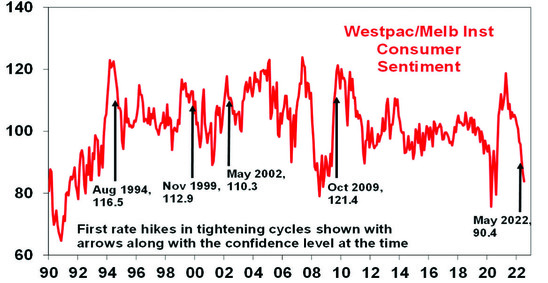

#5 It looks like the RBA is getting traction in slowing demand – far earlier than normal. While job indicators are still strong these are lagging indicators. By contrast consumer confidence is at recessionary levels & well below where it’s been at this point in past RBA rate hiking cycles.

Consumer confidence

Source: Westpac/MI, AMP

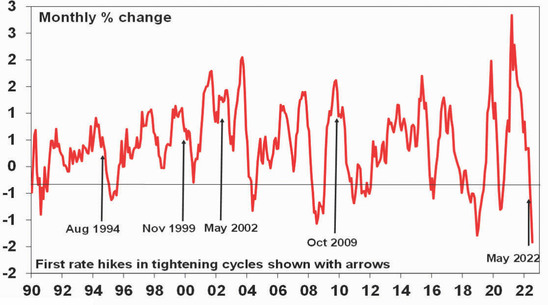

Likewise, national average home prices are falling with the pace of decline accelerating in July, with the 3-month rate of decline comparable to that seen in the GFC and the recessions of the early 1980s and 1990s. This will depress consumer spending via negative wealth effects.

Capital city home prices

Source: Core Logic, AMP

The earlier than normal hit to confidence and house prices reflects a combination of: higher household debt levels compared to what was the case in past rate hiking cycles; the fact that this tightening cycle started with the sharp rise in fixed mortgage rates that started last year; and cost of living pressures that have seen an unprecedented plunge in real wages. There is tentative evidence that this is starting to show up in slowing consumer spending with credit and debit card transactions looking like they are slowing, hotel and restaurant bookings looking like they are rolling over and July retail sales implying now falling retail sales in real terms. So, RBA monetary tightening appears to be getting traction earlier than would normally occur in an interest rate tightening cycle. All of which will start to take pressure off demand and hence inflation.

Concluding comment

For these reasons, our assessment remains that the RBA won’t need to raise the cash rate above 3% and that the peak will be around 2.6% either later this year or early next. By late next year rates are likely to be falling. This implies a slowing in the pace of rate hikes ahead which should help head off worst case scenarios for the property market and the economy.

Source: AMP Capital August 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.