Planning is the key to successful investing. Creating a plan will help you find investments that fit your investing time frame and risk tolerance, to help you reach your financial goals sooner.

1. Review your finances

Before you invest, review your financial situation.

Write down what you owe (your debts) and what you own (your assets). For your assets include your:

-

super

-

home

-

savings

-

other investments

This net worth calculator can help you record this. Writing down what you own and what you owe will help you see what savings you can invest. It will also help you see how you can diversify.

Then write down your income and expenses. This budget planner can help you track what money is coming in and going out. This will help you see how much you can put toward investing regularly.

2. Set your financial goals

Write down your financial goals. For each goal include how much you’ll need and how long you have to reach it. For example, taking a $10,000 holiday in one year, or reaching $500,000 in superannuation before you retire.

Then divide your goals into:

-

short term (0 to 2 years)

-

medium term (3 to 5 years)

-

long term (5 years or more)

Setting and defining your financial goals will help you pick the right investment to reach each goal.

3. Understand investment risks

Investment risk is the likelihood that you’ll lose some or all the money you’ve invested. This can be due to your investment falling in value or not performing how you expected. All assets carry investment risks — some are riskier than others.

Risks that can affect the value of your investment include:

|

Interest rate risk |

Interest rate changes reduce your returns or cause you to lose money. This is a key risk for fixed interest investments. |

|

Market risk |

An investment falls in value because of economic changes or other events that affect the entire market. |

|

Sector risk |

An investment falls in value because of events that affect a specific industry sector. |

|

Currency risk |

Currency movements impact your investment and returns. This is a key risk for overseas investments, Australian companies with overseas operations and investments that have foreign currency in them. |

|

Liquidity risk |

You can’t sell your investment and get your money when you need to without impacting the price in the market. |

|

Credit risk |

A company or government you lend to will default on the debt and be unable to make the repayments. |

|

Concentration risk |

If your investments aren’t diversified, poor performance in one investment or asset class can significantly affect your portfolio. |

|

Inflation risk |

The value of your investments doesn’t keep pace with inflation. |

|

Timing risk |

The timing of your investment decisions expose you to lower returns or loss of capital. |

|

Gearing risk |

Using borrowed money to invest can magnify your losses. Your investments may fall in value but you still have to pay the remaining loan balance and interest. |

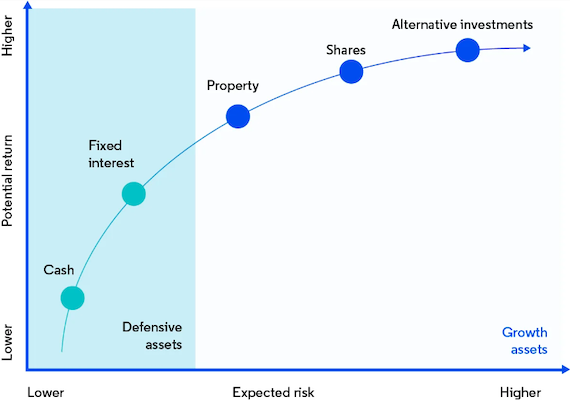

Risk and return

As a general rule, the higher the expected return on an investment, the higher the risk of the investment. The lower the expected return, the lower the risk. Lower risk means the returns are more stable and there is a lower chance you could lose money.

For example, a government bond is a low risk investment. It pays interest, and the value of the investment doesn’t change too much in the short term. Shares are a higher risk investment. The price of a share can move up and down a lot over a short amount of time.

The graph below shows the risk and return relationship for different asset classes.

Important: There are no shortcuts to investing success. The combination of high returns and low risk doesn’t exist.

Know your risk tolerance

Your risk tolerence depends on your ability to cope with falls in the value of your investment. Your age, capacity to recover from financial loss, financial goals and your health are some of the factors that may influence your risk tolerance.

Ask yourself: how would I feel if I woke up tomorrow and found the value of my investments had dropped 20%?

If this drop would cause you to worry and withdraw your money, high-risk investments are not for you.

Each investor’s risk tolerance is different and for different financial goals that have different investment time frames, you may be willing to accept different levels of risk.

It’s important to understand your risk tolerance and find investments that are aligned to it.

4. Research your investment options

To find the right investments, you need to think about:

-

Return — what is the expected return on the investment? Does it come from income or capital growth?

-

Time frame — how long do you need to invest to get the expected return?

-

Risk — what types of risk does the investment involve? Are you comfortable to take on these risks?

-

Access to cash (liquidity) — how long will it take to sell the investment and get your cash out?

-

Cost to buy and sell — how much will it cost to buy and sell the investment?

-

Tax — how much tax will you pay on earnings (income and capital gains) from the investment?

See choose your investments for an overview of different types of investments.

Important: Make sure the expected returns are realistic. If the returns look too good to be true, it could be an investment scam.

5. Build your portfolio

The way you structure your portfolio will depend on your financial goals, investing time frame and risk tolerance.

For short-term goals, lower-risk investment options are better. Consider investments like a savings account, term deposit or government bonds. These investments are lower risk as they’re less likely to fall in value and you can access your money.

For longer-term goals, investments with higher returns such as shares and property, can be better. These investments are higher risk but you’re investing long term, so you can ride out any short-term falls in value.

It’s important to make sure you diversify your portfolio across different asset classes and within each asset class. This protects you against losing too much if the value of one investment falls. See diversification for how this strategy can help you.

If you need help with investing

We can help you work out your risk tolerance, set goals and choose the right investments. Call us today on 02 9299 1500.

6. Monitor your investments

It’s important to review your investments regularly to make sure they’re performing as expected. And check whether you’re on track to reach your financial goals. See keep track of your investments.

Source:

Reproduced with the permission of ASIC’s MoneySmart Team. This article was originally published at https://moneysmart.gov.au/how-to-invest/develop-an-investing-plan

Important note: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person. Past performance is not a reliable guide to future returns.

Important

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.