What’s driving the demand for Australian housing?

While it’s generally agreed Australian property prices are high in a global context, the reasons for it are subject to many factors. In our view, the shift to low interest rates since the early 1990s, deregulation of the banking system and the rise in two income households has clearly played a role. Consistent with this, the rise in price levels from below to above trend has gone hand-in-hand with increased household debt. More recent increases in demand may be due to:

-

Higher population growth;

-

Construction activity lagging the rise in demand for housing;

-

State governments supporting densification, which is increasing land values in established areas close to infrastructure;

-

Re-investment in the housing stock (the number of home renovation shows testament to this); and

-

Record-low interest rates and risk aversion to other asset classes such as shares since the financial crisis.

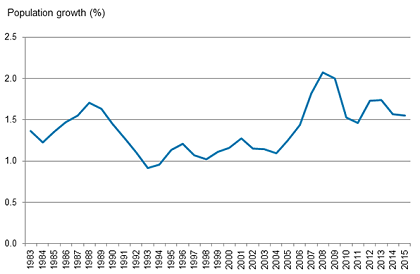

Population growth has been a big factor, increasing since the mid-1990s in response to an ageing population, skills shortages, and more recently the resources boom.

Australian population growth (1983-2015)

Source: Australian Bureau of Statistics, as at June 2015

While interest rates get all the headlines, prices have risen because construction has not matched the rise in demand. Vacancy rates remain low and there has been a cumulative supply shortfall since 2001 of more than 200,000 dwellings. The main reason behind the slow supply response appears to be tough land use regulations in Australia.

It is a fact that house prices are high compared to rents and incomes which, combined with relatively high household debt to income ratios, suggests Australia is vulnerable on this front should something threaten the ability of households to service their mortgages. The trigger for this in our view could be higher unemployment.

How has the Reserve Bank of Australia responded?

The Reserve Bank of Australia (RBA) left rates on hold at 2.0% in its June meeting and has indicated that monetary policy needs to be accommodative for some time to come to stimulate the economy. Low interest rates are acting to support borrowing and spending.

Credit is recording moderate growth overall, with stronger lending to businesses and growth in lending to the housing market broadly steady over recent months. Dwelling prices continue to rise strongly in Sydney, though trends have been more varied in a number of other cities.

Will the housing market soften?

APRA is adamant that it wants to see growth in property investment lending slow into the second half of the year and if lenders don’t toe the line then tougher action is likely. As such, we should expect to see a slowing in the availability of credit for property investors and, as a result, some slowing in price growth in Sydney and to a lesser degree Melbourne over the next year.

Over the next 12 months weakness is most likely in the cities/towns exposed to a slowing mining boom. However, given the undersupply of dwellings, a downturn in property prices will likely have to await the peak of the next interest rate cycle or if the economy fails to respond to record low interest rates and unemployment rates rise.

Commercial property currently represents better value than residential housing

Historically residential property has been a great performer because of the consistency of capital growth over the long term rather than the income yield from rental income. The gross rental yield on housing is around 2.9% (after costs this is around 1%), compared to yields of 6% on commercial property and 5.7% for Australian shares (with franking credits).

With the prospect of weaker capital growth in residential, the commercial markets are likely to outperform in the next couple of years supported by higher income yields and increasing demand for higher yielding investments.

Final thoughts

Housing price vulnerability has been around since the house price boom that ran into 2003. As such, APRA and the RBA are right to be concerned about further inflating the property market. The renewed strength in auction clearance rates this year to record levels, particularly in Sydney and Melbourne, is a concern.

We expect commercial property to benefit from this environment. Our research suggests that the greatest opportunities lie in population growth areas/cities, dominant assets and core locations with ‘destination’ and experiential assets to attract customers and staff.

About the Author

Michael Kingcott is the Head of Property Investment Strategy and Research at AMP Capital leading commercial property research and investment strategy.