Introduction

I have discovered after nearly 10 years that Taylor Swift is actually pretty good. Songs like Style and Shake it Off are right up there when it comes to great head candy. Not quite as good as say The Beach Boys of course but still up there. In my Holden, the next CD I had loaded after Taylor’s 1989 was a compilation of The Carpenters’ greatest hits (which got there after an obsession with the Johnny Depp film “Dark Shadows”) and I must admit that Taylor cannot generate the emotion inherent in The Carpenters’ songs where Karen’s voice and the production overlay of her brother can send me over the top.

So what’s this got to do with it? Not much really except that share markets are full of emotion and right now there seems to be a lot of nervousness around. In fact this has arguably been the case since April during which we have seen several major share markets have decent corrections, eg Chinese shares -32%, Asian shares (ex Japan) -17%, Emerging market shares -16%, Eurozone shares -13% and Australian shares. Of course the US share market has been relatively stable with at most a 4% pull back, although being virtually flat year to date it might be described as being in a “stealth correction”.

This note takes a look at the drivers of these declines and whether it’s just a correction or something more serious.

The short term worry list

In our view the correction could have further to run over the next few months with a reasonable worry list remaining in place.

-

Uncertainty remains in relation to China following recent softer economic data, continuing volatility in Chinese shares and China’s move to devalue the Renminbi by 3% and allow market forces to play a greater role in its determination.

-

Commodity prices are in a secular bear market reflecting a surge in supply in response to the super cycle price upswing last decade, slowing growth in China and the rising trend in the value of the $US (as most commodities are priced in US dollars). At present it seems the negative impact of falling commodity prices on producers (eg, US energy companies) is dominating the positive effect on commodity users (eg, US consumers). And China’s currency devaluation is seen as reducing demand for them particularly to the extent it makes Chinese producers more economic.

-

The malaise in emerging markets is worsening. Their period of strength ended with the commodity boom and many of them have fallen victim to hubris that set in through the boom years last decade and so they are now suffering from populist policies. Slower growth in China is not helping and the devaluation of the Renminbi has helped accelerate the collapse in emerging market currencies (which are down 36% from their 2011 high). The problems in the emerging world are weighing on global growth (as they are now more than 50% of world GDP) and leading to fears of a re-run of the 1997-98 emerging market crisis.

-

Greek related Eurozone risks could re-emerge, albeit briefly. While Greece and the Eurozone have agreed a third bailout program, Greece could be headed to new elections and the IMF is likely to insist that Greece’s debt burden is reduced before participating in the bailout with a decision due in October. Neither of these are likely to be major threats though. First, there is enough broad based support for the program in the Greek parliament and still popular Greek PM Tsipras looks like he will emerge as a more centrist leader. Second, Greece’s debt burden is likely to be relieved by lowering its debt servicing costs via interest rate grace periods, longer maturities, etc. However, uncertainty around either or both of these could cause short term nervousness.

-

The combination of slower growth in China, falling commodity prices, weakness in the emerging world and the fragility of growth in developed countries indicate the risk of deflation globally remains high. In some ways this is good as a slower global recovery means less inflation and a longer global recovery. But it also poses risks for profits.

-

The Fed appears to be heading towards a rate hike and this against the backdrop of deflationary forces globally is creating intense uncertainty. The start of a rising cycle in US interest rates is often associated with market volatility. How far will it go? Is the Fed going to crunch growth? The start of the last two major interest rate tightening cycles by the Fed in 1994 and 2004 were associated with falls in US shares of 9% and 8% respectively. Investors have now grown used to near zero interest rates for more than 6 years in the US and there is naturally fear that raising them will threaten the still fragile US and global economies.

-

Some technical indicators for the US share market are looking a bit tired, particularly with declining breadth in terms of stocks keeping the market up.

-

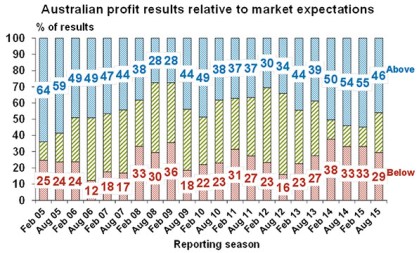

Australian shares are not being helped by a somewhat disappointing start to the local earnings reporting season. So far 46% of companies have beaten expectations and 61% have seen profits rise from a year ago which is okay, but it’s down on what was seen in the February reports, and given the tendency for good results to come early there is a risk of slippage as the reporting season continues.

Source: AMP Capital

Seasonal pain

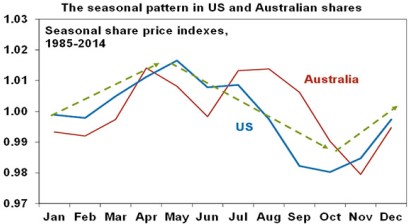

Apart from these considerations it should also be recognised that the seasonal pattern for shares typically sees rougher returns over the period May to November. This is consistent with the old saying “sell in May and go away, buy again on St Leger’s Day (a UK horse race in September).”

Source: Bloomberg, AMP Capital

Is it a correction or something worse?

The important issue though is whether current weakness is just a correction or the start of a new bear market? Periodic sharp falls in the range of 5% to even 20% are quite normal and healthy in that they help the market let off steam and the rising trend resume. Of course it becomes more concerning if the rising trend in share prices gives way to a declining trend and a new bear market sets in. On this front our view remains that the cyclical bull market in shares likely has further to go. Put simply shares are not seeing the sort of conditions that normally precede a new cyclical bear market: shares are not unambiguously overvalued; they are not over loved by investors; uneven & below trend growth is extending the economic expansion cycle; and monetary conditions are likely to remain easy for a while yet. Looking at each of these in turn.

-

Share market valuations are mostly okay. Sure, measured in isolation against their own history some share markets are not cheap anymore. However, once the gap between share market earnings yields and bond yields is allowed for, shares still look cheap (see the next chart).

-

While global economic growth is constrained, a slower recovery should mean a longer recovery as it means spare capacity remains significant and we are a long way from the sort of inflation and debt excesses that precede cyclical downturns/recessions. In terms of current specific concerns: China is unlikely to allow growth to slip much lower for the simple reason that it will lead to social unrest, lower commodity prices will ultimately be positive for growth in developed and Asian economies which are mostly commodity users and while parts of the emerging world will remain weak a re-run of the 1997-98 crisis looks unlikely as the conditions today are very different.

Source: Bloomberg, AMP Capital

-

Global monetary conditions look set to remain easy. Continued spare capacity and the lack of inflationary pressure has seen global monetary conditions ease not tighten this year. And while the Fed may raise interest rates by year end, they will still remain very low (in a range of 0.25% to 0.5%) and the Fed is likely to signal that any further moves are likely to be gradual, unlike in past tightening cycles. So monetary conditions in the US and globally are likely to remain easy for a long while.

-

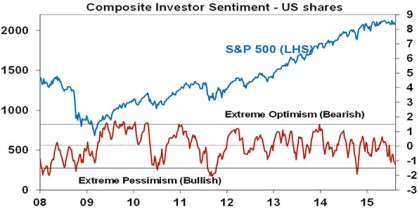

Finally, shares are a long way from being over loved. Sir John Templeton once observed that “bull markets are born on pessimism, grow on scepticism, mature on optimism and die of euphoria”. There still looks to be a lot of scepticism out there and in my travels in recent times I am yet to find a cabbie piling into shares (one of the best guides to when we have hit euphoria). In fact various measures of investor sentiment that we track are showing high levels of pessimism which is a bullish sign from a contrarian perspective. (See the next chart.) This is particularly the case in relation to Asian and emerging market shares.

Source: Bloomberg, AMP Capital

Concluding comments

First, while there is a high risk of a further correction in share markets in the next month or so, from a broad brush perspective we are not seeing the signs normally seen at major cyclical peaks in shares and so the cyclical bull market in shares looks like it has further to go.

Second, China and the Fed are probably the key risks worth keeping an eye on.

Third, while there will be cyclical bounces in commodity prices and emerging market shares the time to “blindly overweight them” was last decade and until supply imbalances in the case of commodities and structural problems in parts of the emerging world are resolved it makes sense to be selective and cautious when investing in them.

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.