Introduction

The turmoil in global investment markets has continued into this week, although the last few days have seen a bit of stabilisation and improvement in several markets. From their highs to their recent lows major share markets have now had the following falls: Chinese shares -43%, Asian shares (ex Japan) -23%, emerging markets -22%, Eurozone shares -18%, Australian shares -16%, Japanese shares -15% and US shares -12%. Such falls are painful for investors. This note looks at some of the main issues.

What has driven the falls?

In a way we have seen a range of issues combine to create a perfect storm for share markets over the last few weeks with:

-

China’s currency devaluation and weaker economic data raising concerns about the Chinese economy.

-

This came at time when concerns about the emerging world have been building for several years as falling commodity prices have weighed on commodity producers particularly in South America and the Middle East, this has been made worse by a shift to populist/anti-reform economic policies and Russia has shot itself in the foot over Ukraine.

-

China’s recent currency devaluation has triggered further falls in Asian and emerging market currencies, which have already been falling for four years now (and are down 37% from their 2011 high – just like the $A!).

-

Tensions between North and South Korea.

-

The bombing in Thailand.

-

Worries about the Fed raising interest rates at some point after investors have got used to near zero interest rates for more than six years.

-

The concerns in the emerging world have seen US shares break down through the technical chart ranges that have provided support of late.

-

Even Greece got a look in with a new election on the way (although it’s unlikely to be a major threat as either the still popular Syriza will be returned in a coalition government (most likely) or the main opposition group New Democracy wins – but both sides support the three year bailout deal just agreed to with the rest of Europe).

All these issues have combined and we have seen something of a negative feedback loop with falls in Asian share markets leading to falls in European and then US shares and this then feeding back into Asian shares. At least until the last few days.

Are the share market falls just a correction or the start of a major bear market?

This remains the big question. (Note, I define a bear market as a 20% fall that is not recovered within 12 months, as we have seen examples of 20% of so falls in the past which are virtually forgotten about in a few months as shares quickly recover, eg in 1998.) Of course we can never know the answer in advance with certainty but there are good reasons to believe this is just a correction in major share markets as prior to recent falls shares lacked the conditions that normally precede bear markets: they were not unambiguously overvalued, they were not over-loved by investors, monetary conditions have not been tightened aggressively – in fact there had been no tightening at all – and cyclical growth indicators were pointing sideways.

Beyond these signs and put simply, if you believe the Chinese economy will collapse causing a severe global growth downturn/recession then shares are probably headed into a bear market. If alternatively you think this is unlikely then it’s likely to remain a correction. Our view is that the latter is more likely as the Chinese Government has a very low tolerance for social unrest that would flow from a hard landing as it knows that could pose a threat to the Government. To avoid this it needs to keep growth at a strong pace. Its monetary easing this week with a cut in interest rates and bank reserve requirements is a positive sign. China is the only major country that has the fire power for lots more easing and it’s really the only major country that needs to do it.

If it’s just a (severe) correction are we at/near the bottom?

Again this is impossible to know with certainty in advance. Our view remains that further falls and volatility in next few months could occur as worries regarding China and emerging markets linger, concerns about whether the Fed will raise interest rates soon will remain and seasonal weakness continues into September/October. However, there are some positive signs:

First, after sharp falls in share markets and falls in bond yields share valuations have become quite attractive. Our valuation measures for global and Australian shares have fallen back into very cheap territory.

Source: Bloomberg, AMP Capital

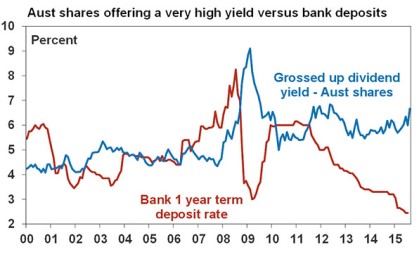

The gap between the grossed up dividend yield on Australian shares (which is now around 6.5%) and term deposit rates (around 2.5%) is now at its highest level since the GFC.

Source: Bloomberg, AMP Capital

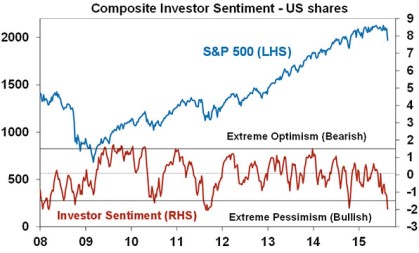

Second, investor confidence has rapidly collapsed as evident by all the talk of global calamity. In fact a measure of investor sentiment based on various surveys and indicators of fear that we track has fallen to levels often associated with market bottoms. This is positive from a contrarian perspective.

Source: Bloomberg, AMP Capital

Third, China has provided additional monetary stimulus which may help provide a circuit breaker to the negative feedback loop that has been developing. Significantly more easing is still required with real interest rates still too high and the banks’ required reserve ratio also too high. But at least they are going in the right direction.

Finally, the US Federal Reserve has indicated it is aware of global growth risks and ongoing low inflation and looks like it will delay raising interest rates in September.

What is the risk of a re-run of the 1997-98 Asian/emerging market crisis?

This saw a 60% fall in Asian and emerging market shares and contributed to sharp 10% to 23% falls in the midst of both 1997 and 1998 in both global and Australian shares, but the latter markets quickly recovered after each setback and actually had good years in 1997 and 1998. A re-run is certainly a risk and there are some parallels. And the world is arguably more vulnerable that it was in the strong 1990s. However, while the risks are there, a re-run will likely be avoided as key emerging countries are now less dependent on foreign capital (with better current account balances and stronger foreign exchange reserves) and most Asian and emerging market currencies are now floating and so don’t have to be defended from speculative attacks which contributed to the Asian contagion of 1997 as investors speculated against one fixed currency after another (starting with Thailand).

What are the key things to watch?

To keep it simple there are four key things to watch:

-

Further policy stimulus in China – this will likely be needed and come in the form of monetary stimulus and increased government spending.

-

A stabilisation/improvement in Chinese economic data.

-

The Fed not making a mistake with a premature rate hike – it now looks likely that it will delay raising rates in September.

-

Global growth indicators, like business conditions PMIs, need to continue to track sideways like they have over the last few years rather than start to trend down.

What should investors consider?

In this uncertain environment investors need to allow for several things:

-

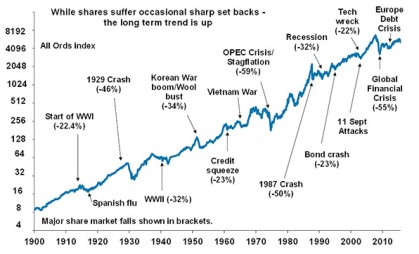

First, shares invariably go through volatile patches in the short term with corrections and bear markets, but also provide solid returns over the long term. Shares literally climb a wall of worry over many years with numerous events dragging them down periodically, but the trend ultimately rising. This can be seen in the next chart.

Source: ASX. AMP Capital

-

Second, selling after a major fall just locks in a loss (and is just as bad as piling in only after a period of strong gains).

-

Third, when shares and growth assets fall they are cheaper and offer higher long term return prospects. This is just like a sale at a supermarket, but we always seem to see it the wrong way around so after falls many investors actually to sell and fail to take advantage of the value that emerges.

-

Finally, while shares have fallen in value over the last few months, the dividends from the market as a whole have continued to increase. In fact, dividend payments remain more attractive and more stable than interest payments on bank term deposits.

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.