Introduction

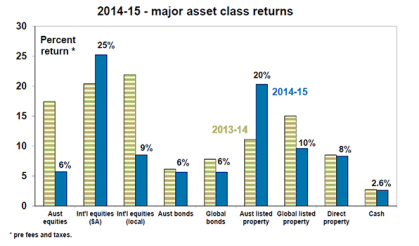

Despite the usual turmoil along the way and ending on a weak note with Greek and Chinese-related turmoil, 2014-15 provided another year of solid returns for investors who were prepared to move beyond cash. Most asset classes had reasonable returns resulting in average superannuation funds returning 9.9%, their third financial year in a row of returns around 10% or more.

Source: Thomson Reuters, AMP Capital

There’s been plenty to worry about as usual, but..

As always, the worry list over the last 12 months was long with:

-

Concerns about the end of the US Fed’s quantitative easing and approaching Fed rate hikes, which has seen bond yields drift higher since their lows earlier this year.

-

Geopolitical scares regarding Ukraine, the so-called IS and related terror threat and the West Africa Ebola outbreak.

-

Deflation fears associated with the collapse in oil prices.

-

Another soft start to the year for US/global growth.

-

Recurring worries about China & recently its share market.

-

A renewed soft patch in European economic growth late last year and the return of Greek-related contagion risk this year.

-

Ongoing concerns about Australia post the mining boom.

But these concerns have been partly offset by a combination of:

-

A delay in rate hikes in the US and further monetary easing globally – notably in Europe, Japan and China.

-

Assurances that rate hikes in the US will be dependent on further improvement in economic growth and gradual.

-

Further rate cuts and an ongoing slide in the $A helping drive a pick-up in non-mining economic activity in Australia.

-

Progress towards another bailout package for Greece and Chinese Government support for its share market.

The end result has been an environment of continued but uneven and constrained economic growth with periodic deflationary shocks (low oil prices, Greece fears, the cautious consumer, etc) serving to keep monetary conditions easy (interest rates low) and investors cautious. Despite periodic corrections (eg Australian shares had top to bottom corrections of 9% last September and through April/June), such an environment of continuing growth and easy monetary conditions against a backdrop of reasonable valuations has been good for investment returns.

Key lessons for investors

The past year provides several lessons for investors, notably:

-

Turn down the noise – the advent of social media has seen the noise around investing, in particular the constant talk of one problem after another, ramped up. But it’s essential to turn it down if you want to be a successful investor.

-

Inflation remains missing in action – thanks to a combination of constrained global growth, excess capacity and commodity prices in a secular downtrend thanks to rising supply, the world is deflation prone. This means a continuation of low interest rates and the “search for yield”.

-

Diversification and active asset allocation are critical – another year of underperformance by Australian shares provides a reminder of the importance of diversifying globally and the uneven/choppy return environment provides a reminder of the importance of asset allocation.

What about the macro investment outlook?

It is hard to see the outlook for investment markets differing radically from what we have seen over the last few years:

-

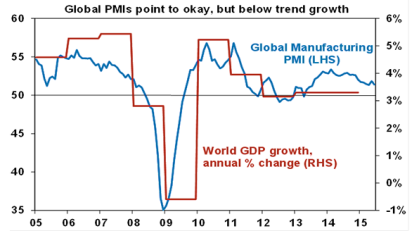

Global growth is likely to remain uneven and constrained at around 3-3.5%. While the messy global growth outlook is often seen as a negative, it’s really a good thing. Sure, we don’t want to see a collapse back into recession but the best way to guarantee that would be to see a synchronised surge in economic growth bringing on inflation and interest rate concerns. So let’s hope global growth remains constrained!

Source: Bloomberg, AMP Capital

-

Inflation is likely to remain low, thanks to the constrained global recovery leaving spare capacity in place and the secular downtrend in commodity prices.

-

Commodity prices are likely to remain in a downtrend in response to rising supply.

-

Growth in Australia is likely to remain sub-par at around 2.5% as the mining boom continues to unwind, offset by improving non-mining activity. Bad for mining and WA but good for home building, retailing, tourism, higher education, manufacturing, farmers and Australia’s eastern states. Some improvement in growth in prospect for 2016.

-

Global monetary conditions are likely to remain easy. While the Fed is likely to raise interest rates starting later this year, it will likely be gradual but monetary conditions are likely to continue easing elsewhere. Quantitative easing in Europe and Japan is likely to continue well into next year and maybe beyond while Chinese benchmark interest rates are likely to fall below 4%. Another RBA rate cut is 50/50 and rate hikes are unlikely before 2017.

-

Expect a further rise in the value of the $US, albeit at a more constrained pace, with the $A falling into the $US0.60s over the next 12 months.

The return outlook

The bottom line is that the world remains in a sort of messy sweet spot for investors. Growth is not flash but okay, inflation is low and monetary conditions overall are set to remain easy. For the main asset classes, this has the following implications:

-

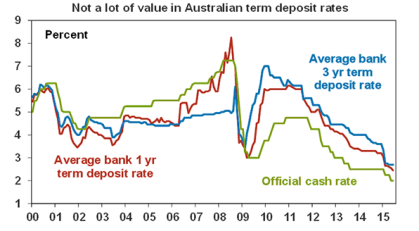

Cash and term deposit returns to remain poor. In Australia it’s likely to be 2% or less over the year ahead and bank term deposit rates are pushing down to around 2%. Investors need to decide what they really want: if capital stability is more important than a decent stable income flow, then stick with cash. If not, then consider the alternatives.

Source: RBA; AMP Capital

-

Low sovereign bond yields of around 3% or less indicate that the return potential from bonds is low. A move to higher bond yields will mean even lower bond returns. However, unless global growth/inflation rises significantly then any rise in bond yields is likely to be very gradual.

-

Corporate debt should continue to provide okay returns. A drift higher in bond yields is a mild drag but with continued modest global growth the risk of default should remain low.

-

Hybrid growth assets like real estate investment trusts and listed infrastructure should benefit from the ongoing “search for yield” and modest economic growth driving higher rents. But think 8-9% pa returns rather than double digit.

-

Unlisted commercial property is also likely to benefit from the “search for yield” and modest growth in rents, with returns around 8-9%. But it’s perhaps less vulnerable to short-term swings in bond yields.

-

Residential property returns are likely to be mixed with many cities seeing zero capital growth and Sydney slowing to around 8% per annum. Very low rental yields are not good.

-

The bull market in shares likely has further to go as: shares are not unambiguously overvalued and are mostly cheap if allowance is made for low bond yields; they are not overloved by investors with various surveys suggesting an ongoing degree of caution; uneven and below-trend growth is extending the economic cycle; and monetary conditions are likely to remain easy for some time. However, volatility is likely to remain with history telling us that the first Fed rate hike can cause corrections (8-9% in both 1994 and 2004).

Source: Bloomberg, AMP Capital

-

Within shares, we favour global over Australian shares (unless it’s income you are after) and European and Chinese/Asian shares over US shares.

-

Finally, the continuing downtrend in the $A enhances the case for global shares (unhedged) over Australian shares.

Things to keep an eye on

The key things to keep an eye on over the year ahead are:

-

Global business conditions PMIs – these point to constrained growth but a sharp rise or fall could cause problems.

-

When/if the Fed starts to raise rates later this year – with US wages growth being a guide to timing and aggressiveness.

-

The spread of Italian and Spanish bond yields to German yields – a good guide to whether the Eurozone crisis is continuing to fade.

-

Chinese economic growth readings.

-

Whether Australian non-mining activity keeps improving.

Concluding comments

Investment returns are likely to slow from the double-digit average of the last few years. And the September quarter is historically a rough one for shares with a likely Fed hike still ahead. But looking beyond near-term uncertainties, the mix of reasonable share valuations, continued albeit constrained global growth, easy monetary conditions and a lack of investor euphoria suggest returns are likely to remain reasonable.

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.