Active ETFs are proactively managed and aim to outperform their benchmark or objective.

But they share many attributes with ETFs which are passively managed and aim to track a particular benchmark:

-

Buying and selling via a live market price on the ASX using a full service or online broker

-

Can be managed and reported in one place – alongside all other broker portfolio holdings

-

Open-ended: the issuer can issue and redeem units based on supply and demand

-

Generally trade at tight spreads around net asset value (NAV)

However, there are some differences between how active ETFs and ETFs work, particularly around portfolio disclosure and the role of third-party market makers.

Daily versus quarterly disclosure

ETFs disclose their portfolio and NAV on a daily basis.

But active ETFs only disclose their portfolio every three months, generally lagged by two months (i.e. portfolio at end of January disclosed at end of March). The composition of a portfolio is an active manager’s key intellectual property (IP). If their portfolio was continuously revealed to the market, like ETFs, their competitors could simply replicate their portfolio.

To protect IP the Financial regulator ASIC has agreed to allow Active ETFs to disclose their portfolio holdings on a delayed basis.

This difference in disclosure flows through to differences in how ETFs and Active ETFs are traded on the exchange.

ETF market makers

ETFs rely on third party ‘market makers’ to provide liquidity during the trading day. If there are no unit holders selling, the market maker ensures there are still orders in the market.

If an ETF’s indicative net asset value (iNAV) at a point in time during an ASX trading day is $2.50, for example, the third-party market maker might offer to sell ETF units at $2.51 and buy at $2.49.

Market makers know the holdings of index the ETF is tracking. They can therefore accurately calculate the true value of the ETF, or net asset value (NAV), and can set bids and offers accordingly.

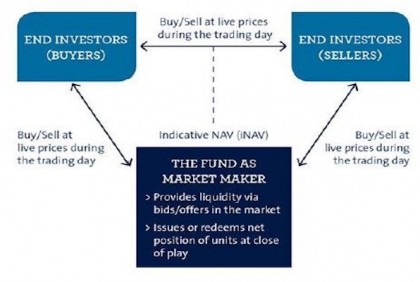

The Active ETF as market maker

In addition to investors buying and selling with each other, the Active ETF acts as market maker providing live bids / offers and creating new units. Active ETFs benefit from the publication of a regularly updated indicative net asset value (iNAV), providing investors with a “fair value” for the Active ETF throughout the trading day. The indicative net asset value (iNAV) is updated every 15 seconds.

-

Investors can buy and sell between each other at live prices during the trading day.

-

They can buy and sell from the fund as market maker. If an Active ETF’s indicative net asset value (iNAV) at a point in time during an ASX trading day is $2.50, for example, the Active ETF may offer to buy units at $2.49 and sell units at $2.51.

Source: AMP Capital 13 July 2018

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.