Commercial real estate is a unique asset class that acts and performs differently from other investment classes. It is generally characterised by relatively low total-return volatility and high-income stability. As part of a multi-asset portfolio, commercial real estate can provide several benefits, such as an attractive risk-return profile and low correlation with other asset classes (diversification) whilst also providing long-term inflation protection.

While once regarded as an expensive investment option only available to large companies and high net worth individuals, this sector can be accessed by retail investors through listed property funds. Commercial real estate is an established asset class in capital markets and an important consideration for investors wanting to diversify beyond asset classes such as term deposits and bonds.

Is it the right time to buy real estate?

Real estate is still fairly priced. A leading indicator of fair value is current real estate yield spreads versus the long-term average. Presently, 10 Year Government Bond yields are at 2.8%, which represents the risk-free rate. The east coast prime office markets of Australia are exhibiting yields over 280 basis points (bps) above the risk-free rate, compared to the 20-year average spread of 180 bps. Even super-prime real estate transactions in the range of 4.50% to 5.00% are still comfortably above long-term average spreads. Our view is that pricing remains fair in the current low yield environment. Yield compression is anticipated to continue in 2018, compressing by an average of 12.5 to 25 bps across all sectors, however economic volatility and monetary policy changes may change this trajectory.

Why this cycle is different to 2007

Under ‘normal’ market conditions there is a positive spread between bonds and real estate yields, ie you get a lower return from bonds than the return that you get from investing in real estate – the higher return from real estate reflects the higher risk relative to investing in bonds. In 2007, the market became overheated and the relationship inverted, which meant that the prices being paid for assets didn’t reflect the risk (relative to the risk-free investment in bonds). As a result, investors were left with high levels of debt exposed as interest rates lifted.

In 2007, the average gearing level for AREITs was ~55%.

Today leverage remains under 30%. Investment managers have been more conservative in their capital management strategies in this cycle, however the redevelopment of core assets may see this gearing level rise, as investors deploy their available capital to enhance returns. Having said this, the clear strategic objectives of investment managers is to keep gearing lower so that a fall in asset values will not result in involuntary sales.

Finding value a challenge, not impossible

This current cycle has been led by strong capital growth, with rental growth and tenant demand appearing more fragmented. In this environment, outperformance on the demand side has come down to active asset management by fund managers. Investors will need to focus on boosting income returns through active management as the current cycle matures and inevitably results in a slowdown. Redevelopment and targeting exposure to growth sectors such as technology and e-commerce will be critical to achieving outperformance in rental growth.

Where to find value in the current cycle?

Australia’s roaring population growth, high infrastructure spending and positive business confidence will stabilise returns over the medium term for investors. On a sector by sector basis, there will be mixed performance, however active management and a disciplined long-term strategy for attracting tenants will be critical to success.

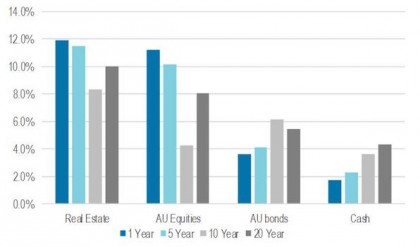

Figure 1: Average annual returns (CARG) by asset class

Past performance is not a reliable indicator of future performance.

Source: MSCI, AMP Capital Real Estate Research. As at December 2017.

Relative to other asset classes, commercial real estate in Australia has historically delivered attractive risk-adjusted returns. As illustrated in figure 1 commercial real estate has outperformed most other asset classes over the last 5,10 and 20 years on average (on a compound annual growth rate basis). Notably, commercial real estate has also demonstrated relatively low total return volatility in comparison to other asset classes as illustrated in figure 2 and can therefore be considered lower risk.

Figure 2: Risk vs Returns by asset class (past 20 years)

Past performance is not a reliable indicator of future performance.

Source: MSCI AMP Capital Real Estate Research. As at December 2017.

The low volatility in commercial real estate returns can be explained by the fact that in comparison to other asset classes, a high proportion of returns are being generated by income rather than capital appreciation. Notably, in comparison to residential property, commercial real estate lease term agreements are long-term in nature and are usually contracted over a 5 to 10-year time-frame. Even 15 or 20+ year leases are not uncommon. These long-term lease agreements help provide a relatively stable income stream to investors. This helps to generate a stable return pattern and reduce total return volatility.

Different ways to invest in real estate

Direct real estate

When investing in direct real estate, investors purchase the assets themselves and gain access to the ‘pure’ risk of real estate. This means they can try to achieve predictable, secure, long-term rental cash-flows through exposure to the real estate market cycle, rather than the equity market. The downside of owning a physical asset is that money has to be spent on maintaining the asset over time and liquidity can also be a risk. Historically, direct real estate has produced relatively strong returns for investors (as illustrated in figure 2).

Unlisted property funds provide an efficient way for smaller investors to get exposure to high-quality real estate assets.

Listed real estate (REITs)

Investors in listed real estate investment trusts (REITs) do not hold the title to the property, but instead own units in a fund or trust that is listed on the stock exchange. With REITs being closely linked to the performance of the general share market, REIT performance is generally more volatile (as illustrated in figure 2) than that of unlisted funds. However, investing in REITs, particularly by taking a global approach, provides investors with a number of advantages:

-

In comparison to unlisted property funds, REITs offer greater liquidity and the ability to quickly adapt to changing market fundamentals

-

If the REIT invests in listed global property companies it allows investors to gain exposure to some of the best real estate assets and managers in the world.

By taking a global approach, investors can gain access to different property cycles, economic trends and interest-rate environments. It also allows investors to broadly diversify their real estate allocation by investing into real estate asset classes that are not available domestically such as multi-family (built to rent), self-storage and student housing.

As with all listed investments though there are risks to consider such as the value of the Fund’s investment potentially decreasing as a result of adverse share market movements.

Source: AMP Capital 13 July 2018

Author: Claire Talbot, Portfolio Manager, AMP Capital Core Property Fund

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.p