Federal Treasurer Scott Morrison put forward a number of proposed changes, mainly around contributions to superannuation and taxation, in his budget speech last night.

Here’s a brief roundup of what the proposals could mean for you—whether you’re starting out in your career, taking care of family, on the cusp of retirement or enjoying life after work.

Here’s a brief roundup of what the proposals could mean for you—whether you’re starting out in your career, taking care of family, on the cusp of retirement or enjoying life after work.

Remember, proposals are not set in stone and could change as legislation passes through parliament.

Superannuation

1. Lifetime cap for non-concessional superannuation contributions

Proposed effective date: 7.30pm (AEST) 3 May 2016

Currently, the non-concessional contributions cap is $180,000 per person, per financial year. If you are under age 65 at any time in the financial year, you can make a non-concessional contribution of up to $540,000 under the bring-forward provisions.

The government proposes to replace the current contributions cap with a $500,000 lifetime non-concessional contributions cap. This lifetime cap is proposed to commence at 7.30pm (AEST) on 3 May 2016. The cap will be indexed to average weekly ordinary time earnings (AWOTE).

The lifetime cap will take into account all non-concessional contributions made on or after 1 July 2007.

Contributions made between 1 July 2007 and 3 May 2016 will be counted towards this lifetime cap. However, contributions made before commencement of this measure, that is 7.30pm (AEST) on 3 May 2016, will not result in an excess.

Excess contributions made after commencement will need to be removed or be subject to penalty tax.

2. Reduction of the concessional contributions cap

Proposed effective date: 1 July 2017

Currently, the standard concessional contribution (CC) cap is

$30,000 per financial year. A higher temporary concessional contributions cap of $35,000 (unindexed) applies if you are aged 49 years or over on 30 June of the previous financial year.

The government is proposing to reduce the annual cap on concessional superannuation contributions to $25,000 for everyone, irrespective of their age.

3. Reduction to Division 293 tax threshold

Proposed effective date: 1 July 2017

From 1 July 2017, the government has proposed to lower the Division 293 threshold (the point at which high income earners pay an additional 15 per cent tax on contributions) from $300,000 to $250,000.

4. Allowing catch up concessional contributions

Proposed effective date: 1 July 2017

Currently, the concessional contributions cap is applied on a ‘use it or lose it’ basis. That is, the unused amount of the concessional cap cannot be carried forward.

From 1 July 2017, the government will allow eligible individuals to make additional concessional contributions where they have not reached their concessional contributions cap in previous years. This option will only be available to those individuals with a superannuation balance less than $500,000.

It is proposed that the unused amounts will be carried forward on a rolling basis for a period of five consecutive years with only unused amounts that accrue after 1 July 2017 being eligible.

The proposed measure will also apply to members of defined benefit schemes.

5. Removal of the work test to contribute to superannuation

Proposed effective date: 1 July 2017

Currently, individuals aged 65 to 75 who want to make voluntary superannuation contributions need to meet the work test. People aged 70 or over are also currently unable to receive contributions from their spouses.

The government will remove these restrictions for all individuals aged less than 75, from 1 July 2017.

6. Making it easier to claim tax deductions for personal super contributions

Proposed effective date: 1 July 2017

Currently, if you are engaged in employment activities during a financial year, a deduction for personal superannuation contributions can only be claimed where the ‘less than 10% rule’ is satisfied. This rule broadly requires that the income attributable to employment activities does not exceed 10% of income from all sources.

The government is proposing to abolish this test, allowing all individuals up to age 75 to claim an income tax deduction for personal superannuation contributions. If legislated,

this will effectively allow all individuals, regardless of their employment circumstances, to make concessional superannuation contributions up to the concessional cap.

Observations:

- This measure assists those whose employer may not provide the ability to make salary sacrifice contributions to super. It will also assist those who are partially self- employed and partially wage and salary earners.

7. Introducing the Low Income Super Tax Offset (LISTO)

Proposed effective date: 1 July 2017

From 1 July 2012, individuals with an income of up to $37,000 automatically received a government contribution of up to

$500 paid directly into their super. However, this Low Income Superannuation Contribution (LISC) will not be available in respect of concessional contributions made after 1 July 2017.

From 1 July 2017, the government is proposing to introduce a replacement – the Low Income Superannuation Tax Offset (LISTO). The LISTO will provide a non-refundable tax offset to

superannuation funds, based on the tax paid on concessional contributions made on behalf of low income earners, up to an annual cap of $500.

The LISTO will apply to members with adjusted taxable income up to $37,000 who have had a concessional contribution made on their behalf.

8. Making spouse contributions more attractive

Proposed effective date: 1 July 2017

Currently, if you make contributions into your spouse’s account you are entitled to a tax offset of up to $540 if certain requirements are met. One of the requirements to qualify for the maximum offset is that the receiving spouse’s assessable income, reportable employer superannuation contributions and reportable fringe benefits in the financial year must be less than $10,800.

To be eligible to receive the contribution, the receiving spouse must currently be:

-

under age 65, or

-

aged between 65 and 70 and has met the work test for the financial year in which the contribution is made.

The government proposes to:

-

remove the work test restrictions for all individuals aged up to 75, and

-

increase access to the spouse superannuation tax offset by raising the lower income threshold for the receiving spouse to $37,000 (cutting out at $40,000).

9. Changes to the taxation of Transition to Retirement (TTR) income streams

Proposed effective date: 1 July 2017

The internal earnings within a superannuation account on the amount used to purchase a pension are currently tax-free. This will no longer apply to transition to retirement income streams from 1 July 2017 should the proposal go ahead.

This means that earnings on fund assets supporting a transition to retirement income stream after this date would be subject to the same maximum 15 per cent tax rate applicable to an accumulation fund.

10. Introduction of a $1.6 million superannuation transfer balance cap

Proposed effective date: 1 July 2017

From 1 July 2017, the government is proposing to introduce a

$1.6 million transfer balance cap. This cap will limit the total amount of accumulated superannuation benefits that an individual will be able to transfer into the retirement income phase. Subsequent earnings on pension balances will not form part of this cap.

If you have superannuation amounts in excess of $1.6 million, you will be able to maintain this excess amount in a superannuation accumulation account (where earnings will be taxed at the concessional rate of 15 per cent).

A tax on amounts that are transferred in excess of the $1.6 million cap (including earnings on these excess transferred amounts) will be applied, similar to the tax treatment that currently applies to excess non-concessional contributions.

Fund members who are already in the retirement income phase with balances above $1.6 million will be required to reduce their retirement balance to $1.6 million by 1 July 2017 should the proposal go ahead. These excess balance amounts may be converted to a superannuation accumulation account.

Taxation – general

11. Changes to marginal tax rates

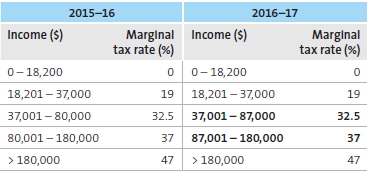

As speculated, a tax cut has been proposed at the current $80,000 taxable income threshold. As a result, marginal tax rates for resident taxpayers are proposed to change as follows:

Notes: Medicare levy may also apply, 47% tax rate includes Temporary Budget Repair Levy (TBRL, additional 2%). The TBRL is due to expire from 30 June 2017 and has not been extended in this budget.

Observations:

-

The Low Income Tax Offset (LITO) remains unchanged which gives resident taxpayers an effective tax-free threshold of $20,542 in 2016–17.

-

Indicative tax cuts: If you earn $87,000 or more per year, you would get a maximum tax cut of $315 under this measure. If you earned less than $80,000 there will be no change to your tax calculation.

Taxation – small business

12. Increase in small business entity turnover thresholds

Proposed effective date: 1 July 2016

Starting from 1 July 2016, the government proposes to increase the small business annual aggregated turnover threshold from $2 million to $10 million for certain small business concessions.

From 1 July 2016 these small business concessions include:

-

the lowering of the small business corporate tax rate (see below)

-

for all businesses with annual aggregated turnover of less than $10 million simplified asset depreciation rules, including immediate tax deductibility for asset purchases costing less than $20,000 until 30 June 2017, and

-

other tax concessions such as the extension of the FBT exemption for work-related portable electronic devices and the immediate deduction of professional expenses.

Observation:

-

The current $2 million turnover threshold, or alternative $6 million net asset value test, will be retained for access to the small business Capital Gains Tax concessions.

13. Lowering the company tax rate to 25 per cent

Proposed effective date: 1 July 2016

The government proposes to reduce the company tax rate to 25 per cent by 2026–27.

Initially, the tax rate for companies with an annual aggregated turnover of less than $10 million will be reduced to 27.5 per cent from 1 July 2016.

14. Unincorporated small business tax discount

Proposed effective date: 1 July 2016

For small businesses, that are not companies, the government proposes to extend the unincorporated small business tax discount.

From 2016–17, the discount will be available to business with aggregated annual turnover of less than $5 million, up from the current threshold of $2 million. The discount on tax payable on business income will be increased to 8 per cent, up from the current 5 per cent, but the maximum discount available will remain at $1,000 per annum.

Over the next decade it is proposed to further expand the discount in phases to a final discount of 16 per cent, with the existing $1,000 maximum discount per individual for each income year to remain.

Families and social security

15. Deferral of reforms to child care payments

Proposed effective date: 1 July 2018

As part of the May 2015 Federal Budget it was proposed that a new single Child Care Subsidy (CCS) would replace the Child Care Benefit, the Child Care Rebate and the Jobs, Education and Training Child Care Fee Assistance from 1 July 2017.

This measure has not yet been legislated and the proposed start date will now be deferred until 1 July 2018.

What you need to know

Any advice contained in this document is general in nature and does not consider your particular situation. Please do not act on this advice until its appropriateness has been determined by a qualified financial adviser. Whilst the tax implications have been considered we are not, nor do we purport to be a registered tax agent. We strongly recommend you seek detailed tax advice from an appropriately qualified tax agent before proceeding.

AMP Financial Planning Pty Limited ABN 89 051 208 327, AFSL No. 232706.