In 2020, the race that stopped the nation was arguably not the Melbourne Cup, but the abandoned Australian Grand Prix, which had been scheduled for March 15 in Melbourne. For many, the shutting down of this race on the day really drove home the point that we were on the precipice of a world-changing moment. The turmoil that followed – spreading infections, border closures and nation-wide lockdowns – were a huge shock to our economic system, and across the corporate sector companies moved to withdraw or cancel dividends.

But only one year on, Australia is riding a triple boom across resources, housing and corporate profitability. The Aussie equity market is about 30% higher1. Tens of billions of dollars in deferred spending, propped up by government income support, is working its way through the retail2 and housing sectors3. In retail, the surge has moved on from homewares to a broader range of goods, including new and second-hand vehicles4.

Residential property had been a major concern for many at the start of the pandemic, given unattractive rental yields and the potential for widespread defaults. However, record low interest rates and stronger household balance sheets leveraged direct government support for the industry into perhaps the most surprising housing boom in our history. In response, approvals for renovations and new housing starts have also spiked, with tradespeople and materials suppliers are also reaping the rewards.

On the mining side, there are a significant number of new projects in train, and this expansion is a bigger story than the recent surge in the iron ore price (although that is certainly helping). Australia is also benefiting from demand for the new wave of minerals required for battery construction, with a number of new lithium projects starting to come on line over recent months. It’s also worth noting that we’re experiencing something of a soft commodity boom, on the back of a bumper 2020 grain harvest and with good sowing rain already soaking the eastern wheat belt.

All of these factors combined in the leadup to the February reporting period to produce strong cashflow and a rejuvenated dividend outlook across most sectors. The turnaround at this stage has been led by larger cap names, whereas smaller companies without the benefit of diversified cash flows have been somewhat later to benefit. That said, we should see strong growth across the board from this point on.

The outlook for dividends through to 2023

In general, we believe Australian companies are very well-positioned from a cash perspective. For those with avenues to do so, this may lead to an increase in mergers and acquisition, as well as investment in new plant and projects. It won’t necessarily be a zero-sum game for expansion and dividends; with rates so low many may choose to finance those investments with debt and push cash back to investors in the form of dividends or buybacks.

Regardless of some early jitters around inflation, in our opinion the outlook remains strong. Broadly, the cycle is on the upswing and momentum is strong. Policymakers erred on the side of overstimulation, and we believe the outcome is a much more desirable situation to deal with than the prospect of having to stoke a stalling economy while the pandemic continues.

The market underwent a monumental rerate through the end of 2020 and valuations appeared extremely generous; now the market is growing into its PE multiples as the earnings start to flow. After such a strong surge the coming period might resemble a holding pattern as far as prices are concerned, but dividends should continue to deliver, particularly as the rest of the banks – a mainstay of Australian income portfolios – report in August. As deferred loans come back on line, provisions (the liabilities banks are obliged to keep on their balance sheets in case of bad debt) are expected to be written back, which is positive news for payout ratios in that sector.

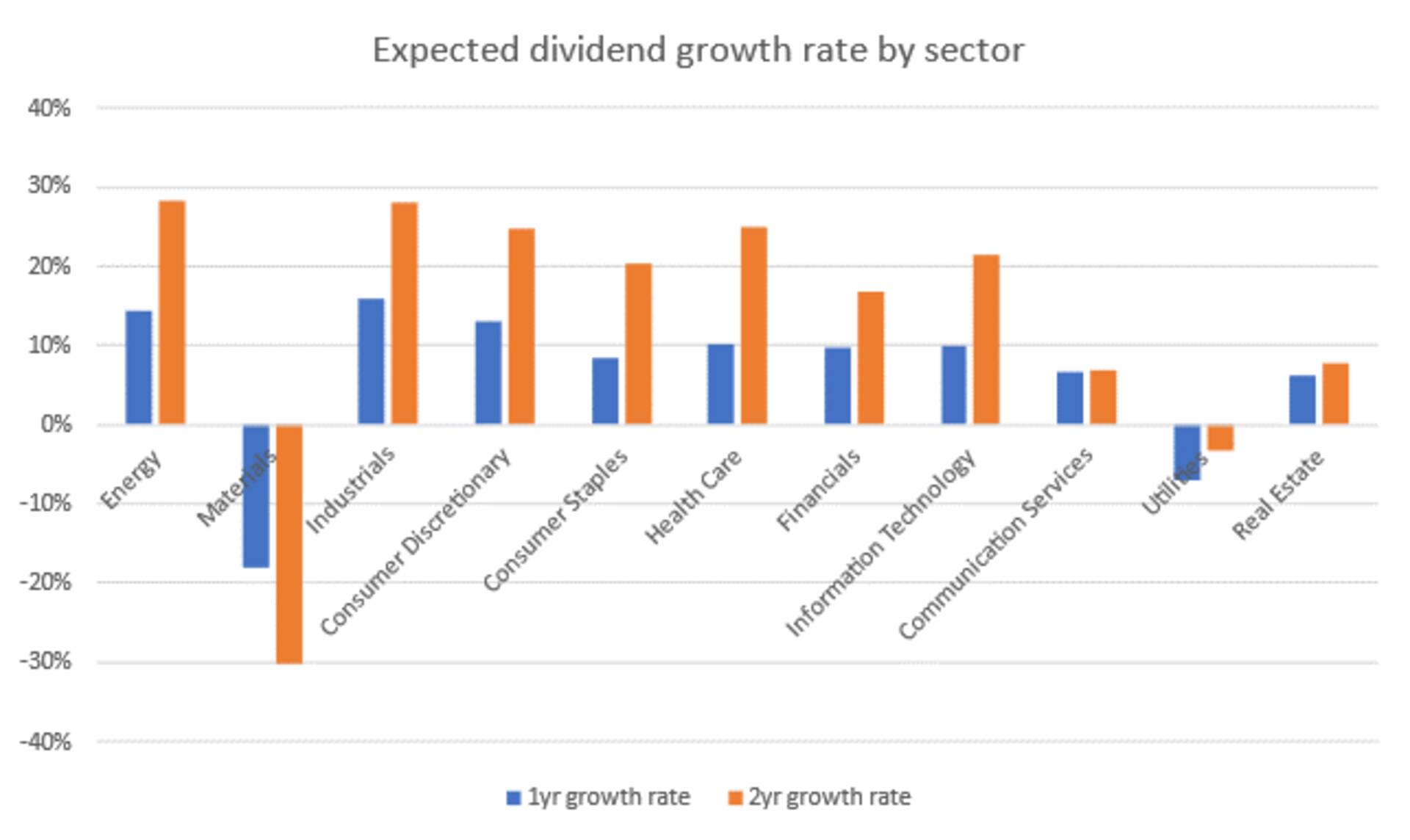

In fact, as the chart below suggests, dividends in almost every sector are forecast to grow strongly on a one- and two-year basis, with the exception of materials, which are coming off records driven by those soaring iron ore prices and volumes and utilities who are suffering from poor pricing, particularly in wholesale electricity. Tourism and education are expected to also continue to languish, along with the insurance sector which now has widespread flooding to add to its list of woes at a time when low interest rates are strangling the carry on insurers’ cash reserves.

Source: AMP Capital, FactSet sector estimates. As at 30 March 2021.

The main risk to this two-year dividend outlook is linked to vaccinations and the associated threat of lockdowns, which will remain high until a critical proportion of the population are inoculated. That will also allow sectors such as tourism and travel to come back from the brink, and may even unleash a reopening boom in foreign spending that could buoy our exports. The world and particularly Australia (considering that the effects of COVID-19 on economic activity at this point in time are comparatively minimal) appears overstimulated and we believe that when the world is vaccinated, inflation might follow.

We have seen a little in the way of that kind of inflation recently in parts of the mining sector in Western Australia, a state that has been largely COVID-free since the first wave of the pandemic. But for now, we believe a little inflation is normal this early in the cycle, although a factor to keep an eye on in the event that asymmetrical inflation in sales or cost lines starts to cut into company profit margins.

If the vaccine rollout can continue without any major disruptions, we expect that the market will continue its strong push higher through the ASX’s record high of 7,2005, driven by the strong profit and dividend growth in local equity markets.

1 All Ordinaries Index and S&P/ASX 200 Index. As at 31 March 2021.

2 https://www.9news.com.au/national/australia-coronavirus-households-businesses-amass-200-billion-savings-during-pandemic/1a7acc26-19e7-4cb5-a97d-312216430726

3 https://www.theguardian.com/australia-news/2021/mar/01/australian-house-prices-core-logic-record-largest-monthly-rise-in-almost-two-decades

4 Federal Chamber of Automotive Industries, https://www.fcai.com.au/news/index/view/news/705

5 S&P/ASX200 Index. As at 21 February 2020.

Source: AMP April 2021

Important: This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling 02 9299 1500, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person. Any links have been provided for information purposes only and will take you to external websites. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.