The backstory

To say that it’s been a challenging period for bond investors for the best part of a decade, is not an exaggeration. If we cast our minds back to 2008, the world was in a precarious situation as the Global Financial Crisis took effect. Central bankers were busy thinking of ways to avoid a deep global recession or worse, a depression.

Troubled times called for decisive action which took the form of quantitative easing (QE). As part of QE, the US Federal Reserve bought up vast amounts of debt, essentially pumping liquidity into financial markets and interest rates were cut close to zero. While other central banks dragged their heels, many eventually adopted similar measures to help stimulate their respective economies.

QE measures were predominately successful, and a deep prologued global recession was avoided. However pumping liquidity into the financial ecosystem had flow on effects which impacted all assets classes. Risk assets such as equities benefitted from this environment as markets generally like liquidity. For investors the decision to invest in equities ahead of bonds and cash was an easy one when the latter was paying investors close to zero.

For asset allocators there was little incentive to invest in government bonds on valuation or risk/return grounds as the payoff for taking on duration risk was negligible. Over this period, general consensus was to be overweight risk assets and underweight traditional defensive assets such as bonds.

While this positioning was great for investors as risk assets rallied, asset allocators were increasingly asking themselves what assets will play the ‘defensive’ role in a portfolio if bond yields are close to zero? This saw a greater focus on alternative investments by many institutional investors such as the superannuation funds, who increased allocations to more illiquid investments such as private assets and other alternative strategies to help fill the void.

The reset

While central bankers were patting themselves on the back for avoiding the world plunging into recession, many market analysts were questioning what the pathway out of QE would look like. The answer was not clear until a culmination of unforeseen events rapidly changed market dynamics, notably the Covid pandemic and Russia’s invasion of Ukraine.

Both events significantly contributed to rising inflation and the subsequent reset in monetary policy brought a rapid rise of interest rates and bond yields. The Covid period saw the breakdown of global supply chains with many key ports effectively shut down, putting upward price pressure on everything from cars to computers. Inflationary pressures were further compounded by Russia’s invasion of Ukraine which saw commodity prices soar.

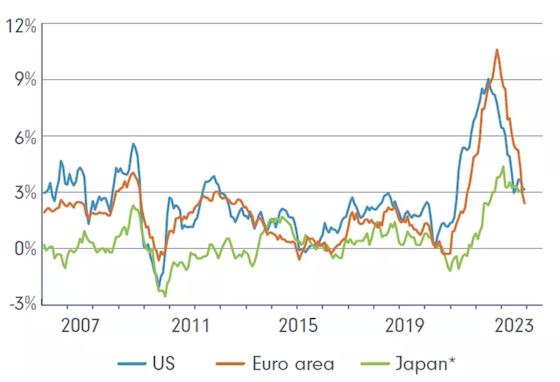

This rapid rise in inflation caused central banks around the world to hike rates aggressively and at speed.

Chart 1. Inflation – advanced economies

*Excludes the effects of consumption tax increase in 2014.

Source: RBA; Refinitive.

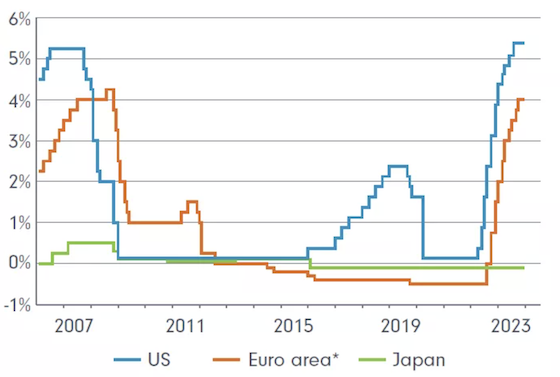

Chart 2. Policy interest rates

*Main refinancing rate until the introduction of 3-year LTROs in December 2011; deposit facility rate thereafter.

Source: Central banks.

Rapid interest rate hikes had an adverse impact on asset prices as assets are generally priced against a risk-free rate such as US 10 Year Treasuries, generally considered to be risk free. Assets sensitive to changes in interest rates including infrastructure, property and notably bonds were all adversely impacted as inflation, interest rates and bond yields rose.

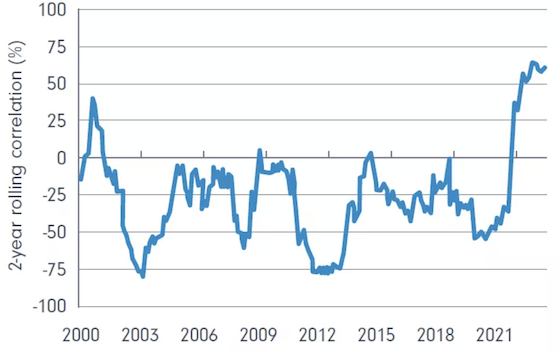

Bond investors couldn’t catch a break with several years of negligible returns, followed by a period of double-digit negative returns as inflation took hold and rates rose. Furthermore, bonds offered no protection from market volatility as the correlation between bonds and equities became positive, meaning both equities and bonds went down in value during periods of equity market sell offs.

Chart 3. 2 year Rolling Correlation of US 10 Year Treasuries & the S&P 500

Source: US Federal Reserve

So why invest in bonds now?

1. Inflation

Globally, inflation levels have been easing from their peaks. In Australia inflation peaked in December 2022 at 7.8% and as at the end of September 2023 was 5.4%. Likewise, in the US inflation peaked at 9.06% in June 2022 and by the end of November last year was back to 3.14%.

While it’s too early to declare that the inflation genie has been put back firmly into the bottle, we’re arguably edging closer to the end of the interest rate tightening cycle, with key central banks pausing rate hikes as they monitor the efficacy of rate rises on curbing inflation.

Should central banks begin easing interest rates once inflation is deemed to be under control, this would be positive for bond strategies exposed to duration risk such as government bonds or strategies benchmarked against the Bloomberg Global Aggregate Bond Index.

The extent of any potential rate cuts will depend on numerous factors. Our base case is that we are likely to experience a global cyclical recession in 2024 following a period where the market is pricing in a ‘soft landing’ scenario. Should this occur and we end up in a recession, central banks are likely to cut rates aggressively to avoid a deep recession. Such a scenario should be positive for bonds.

2. Bond Yields

Higher bond yields offer a more compelling investment case for holding bonds on a forward-looking basis, meaning you’re paid a higher yield for holding bonds. However, rising bond yields have impacted the capital return from bonds.

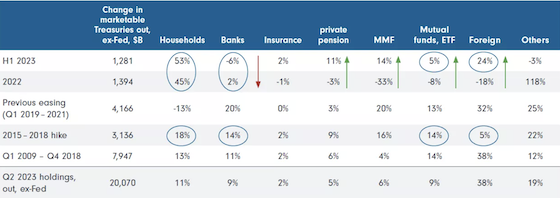

Bond yields have remained elevated partly due to the demand/supply dynamics impacting government bonds, notably US Treasuries as issuance has increased to fund the US deficit and demand has fallen as the government’s demand for bonds has deceased following the roll back of central bank QE programs.

Fidelity believe that this demand/supply imbalance will regulate itself with other segments of the market such as households, taking up some of the excess demand and putting downward pressure on bond yields. In the interim, bond yields may remain elevated despite inflation moderating, as this demand/supply imbalance persists.

Household Demand for US Treasuries Rising

Source: US Federal Reserve, Macrobond

As inflation and demand/supply pressures ease our expectation is for bond yields to fall from current levels. While this will impact the yield offered to clients a fall in bond yields would have a positive impact on capital returns from bonds.

3. Diversification

Bonds have traditionally been a source of diversification within a portfolio. However as noted above, due to rising inflation and interest rates, bonds have not provided the portfolio diversification that investors would expect. The phenomenon where bonds and equities are highly correlated is typical in environments where there is a rapid regime shift in the inflation and interest rate environment – a move from low inflation and interest rates to high inflation and higher interest rates.

As markets digests the change in market environment and we enter a more ‘normal’ rate cycle, we’d expect bonds to play an important diversification role in a portfolio as they’ve done traditionally.

There’s no doubt it’s been a bumpy journey for bond investors of late. The imbalances caused by aggressive QE, a global pandemic and geopolitical tensions have all contributed to turbulence in bond markets. However, as with all investment decisions, it’s important to look forward and understand how changing market conditions may impact asset class returns.

While there may still be a few bumps in the road, moderating inflation and a potential loosening in monetary policy should be positive for investors, reasserting bonds as an important pillar within a diversified portfolio.

Source:

Reproduced with permission of Fidelity Australia. This article was originally published at https://www.fidelity.com.au/insights/investment-articles/is-it-time-for-bonds-to-shine/

This document has been prepared without taking into account your objectives, financial situation or needs. You should consider these matters before acting on the information. You should also consider the relevant Product Disclosure Statements (“PDS”) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 119 270 or by downloading it from our website at www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated herein about specific securities is subject to change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. While the information contained in this document has been prepared with reasonable care, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. This document is intended as general information only. The document may not be reproduced or transmitted without prior written permission of Fidelity Australia. The issuer of Fidelity Australia’s managed investment schemes is FIL Responsible Entity (Australia) Limited ABN 33 148 059 009. Reference to ($) are in Australian dollars unless stated otherwise.

© 2024. FIL Responsible Entity (Australia) Limited.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.