A self-managed super fund (SMSF) is a private super fund that you manage yourself. SMSFs are different to industry and retail super funds.

When you manage your own super, you put the money you would normally put in a retail or industry super fund into your own SMSF. You choose the investments and the insurance.

Your SMSF can have up to four members, who are friends or family. Most SMSFs have two or more. As a member, you are a trustee of the fund — or you can get a corporate trustee. In either case, you are responsible for the fund.

While having control over your own super can be appealing, it’s a lot of work and comes with risk.

Only set up your own super fund if you’re 100% committed and understand what’s involved.

The risks and responsibilities of SMSFs

All members of an SMSF are responsible for the fund’s decisions and for complying with the law.

These responsibilities come with risks:

-

You are personally liable for all the fund’s decisions — even if you get help from a professional, or if another member made the decision.

-

Your investments may not bring the returns you expect.

-

You are responsible for managing the fund even if your circumstances change — for example, if you lose your job.

-

There may be a negative impact on your SMSF if there is a relationship breakdown between members, or if a member dies or becomes ill.

-

If you lose money through theft or fraud, you won’t have access to any special compensation schemes or to the Superannuation Complaints Tribunal.

-

You could lose insurance if you’re moving from an industry or retail super fund to an SMSF. See consolidating super funds.

SMSFs take time and money

Managing an SMSF is a lot of work. Even if you get professional help, it’s time-consuming.

You need enough time to set up the fund, and time to manage ongoing activities, such as:

-

researching investments

-

setting and following an investment strategy

-

accounting, keeping records, and arranging an audit each year by an approved SMSF auditor

SMSF trustees spend on average eight hours a month to manage an SMSF. That’s more than 100 hours a year. (Source: SMSF Investor Report, April 2019, Investment Trends)

The set-up and running costs can be high. Ongoing costs include:

-

investing

-

accounting

-

auditing

-

tax advice

-

legal advice

-

financial advice

In 2018, the average operating cost of running an SMSF was $6,152. The median cost was $3,923. (Source: Self-managed super funds: a statistical overview 2017–18, Australian Taxation Office, Table 25: Expenses. This includes deductible and non-deductible expenses reported at the following SMSF annual return labels: approved auditor fee, management and administration expenses, other amounts and SMSF supervisory levy. It does not include costs such investment expenses and insurance premiums.)

You need financial and legal knowledge

You need the financial and legal knowledge and skills to:

-

understand different investment markets, and build and manage a diversified portfolio

-

set and manage an investment strategy that meets your risk-tolerance and retirement needs

-

comply with tax, super and investment regulations and laws

-

organise insurance for fund members

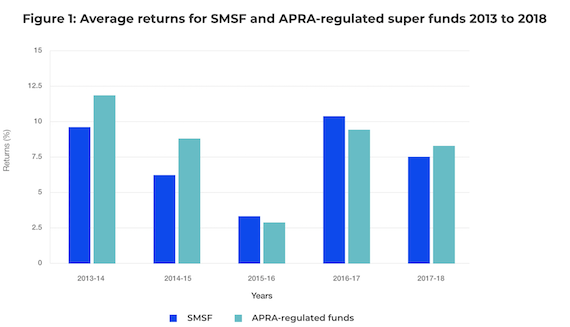

On average, SMSFs haven’t beaten APRA-regulated funds

Historically SMSFs have not performed as well as retail or industry super funds, also known as ‘APRA-regulated funds’ (APRA is the Australian Prudential Regulation Authority).

APRA-regulated funds use highly skilled professionals to manage their investments. You need to be confident that the investments you choose will perform better.

The table below compares the average returns for SMSFs with APRA-regulated super funds over a five-year period. On average, APRA-regulated super funds achieved higher returns than SMSFs.

Source: Self-managed super funds: a statistical overview 2017–18, Australian Taxation Office

The returns you can expect from your SMSF are determined by your balance. If your balance is more than $500,000 it’s possible you may get returns that are competitive with APRA-regulated funds.

If you want to set up an SMSF

If you are 100% sure about managing your own super fund, start researching investment options, and consider getting professional advice.

Research your investment options

Part of the appeal of an SMSF is controlling and having access to a broader range of investments.

However, there are some very strict rules about what you can invest your super in. Check restrictions on investments on the ATO website.

Set up your SMSF

The self-managed super funds section of the ATO website is a great resource. It explains what you need to do to set up your fund and to comply with regulations. All SMSFs are regulated by the ATO.

Because everyone’s situation is different, it’s always best to speak to us on 02 9299 1500 before you make a decision or any investments.

Source: Moneysmart .gov.au

Reproduced with the permission of ASIC’s MoneySmart Team. This article was originally published at https://moneysmart.gov.au/how-super-works/self-managed-super-funds-smsf

Important note: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person. Past performance is not a reliable guide to future returns.

Important

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.