Average dwelling prices in Australia’s capital cities rose by 2.3% in May, their eighth monthly gain in a row, although having settled somewhat since the 2.8% recorded in March. Capital city prices are now 7.8% higher than previous records set in September 2017. Prices in Sydney alone, hardly at bargain basement levels before COVID-19 began, have increased by 14.3% in just four months, their fastest such increase in more than 30 years.

Gains are being driven by a low-rate environment, government incentive schemes, and the broader context of Australia’s soaring economic recovery (including very robust employment numbers). The other critical factor, of course, is fear of missing out (FOMO), a self-fulfilling cycle where those yet to buy in are motivated to do so by the prospect of having to pay more to do so at a future date. None of these factors look likely to change over the rest of 2021, and we expect that house prices will rise by another 10-15% out to the end of next year.

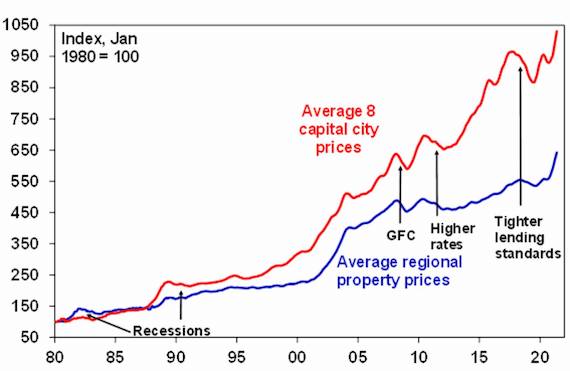

Average Australian property prices at a record high

Source: CoreLogic, AMP Capital

But house prices can’t increase at this rate indefinitely and history shows they sometimes go down – just ask anyone who bought into the Perth market at the top of the mining construction boom. Here are six reasons why the residential property market might start to cool in capital cities at some point over the next couple of years:

1. Affordability is becoming an issue.

While low interest rates make larger borrowings more affordable, first home buyers are being priced out of the market. After leading the initial recovery, housing finance data suggests that demand from new owner-occupiers has peaked and that investors are now taking over. In tandem, the top end of the market is now driving the strongest gains, whereas in the early stages of the pandemic it was the lower end that spiked first.

2. Regulation appears to be imminent.

Historically, surging house prices have tended to lead to a deterioration in lending standards and risks to financial stability, giving regulators impetus to tap on the brakes. The RBA have given fairly strong indications that they won’t use monetary policy to this end, at least not yet, so expectations are instead that they and APRA will look to macroprudential controls such as increased interest rate buffers, and limits on high loan-to-valuation and high debt-to-income ratio lending.

3. The cash rate remains low, but rising bond yields are pushing up fixed mortgage rates anyway.

Despite reassurances from the RBA, bond yields are up from their lows last year with the first signs of inflation and longer-fixed mortgage rates have followed suit. Fixed rates now account for around 40% of new housing finance, so these are significant developments. And while the RBA will keep rates low for now, eventually once inflation is sustained in their target band the interest rate cycle is likely to move up more decisively. Longer term, the RBA is more determined than ever to see inflation sustained in its target range which will ultimately put an end to the long-term downtrend in interest rates and mean higher variable rates. So, it’s likely that the 30-year tailwind for the property market of falling interest rates has now run its course.

4. Government stimulus measures will continue to be wound back.

HomeBuilder, a major driving force for the market through the pandemic, has now ended, and smaller state housing incentives may also be retired over coming months. More broadly, the indirect influence of fiscal latitude will gradually be reduced as governments seek to move their budgets back towards balance.

5. Low immigration will continue to be a drag.

Restrictions on migration have cut underlying demand for housing by around 100,000 dwellings (nearly 50%) this year, and this is one outage caused by the pandemic that won’t be switched back on overnight. Even with a vaccinated population, borders will probably be opened gradually with quarantine requirements remaining in place for some or most arrivals. Immigration will recover slowly, and if housing construction continues, -cwe could see an oversupply of property within the next few years.

6. New trends will continue to disrupt.

Along with lower immigration, the trend to remote working and an increased emphasis on lifestyle is likely to keep the pressure off in dense urban markets, and into the future should continue to act as a driver of demand into previously less-loved exurban and rural areas.

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital June 2021

While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.