In the recent sell-off of global equity markets, A-REITs have also been sold down (though much less than the broader Australian equity market). However, the property fundamentals of A-REITs remain strong as property valuations continue to improve – this is illustrated by 4% Net Tangible Assets growth in the recent reporting season results.

The defensive nature of this asset class is demonstrated by the quality and characteristics of the A-REIT income streams, being contractual rent with lease terms from five to 20 years. These are often linked to annual Consumer Price Index increases and with the highest quality tenants – Federal and State Governments, Woolworths, Wesfarmers and numerous other high credit-rated listed companies on the Australian Stock Exchange. Thus, A-REITs are the landlords to a majority of Australia’s largest listed companies.

The A-REIT sector continues to evolve and become increasingly more specialised – witness the spinout of Westfield’s ownership share of its Australian regional mall properties into the Scentre Group. Additionally, the Goodman Group as a global logistics provider has expanded its international footprint in Europe, China, Japan, Brazil and the USA. Compared to pre-2008, the market is noticeably only backing those A-REITs who have a specialist, proven, overseas business model.

The yield nature of A-REITs and sustainable distribution payout ratios – with up to 4% growth – will continue to provide investors with access to Australia’ highest quality commercial assets, with the strongest of tenants.

1. Strong risk-adjusted returns

The A-REIT sector has been a major beneficiary of investor appetite for yield and defensive investment, particularly after the Global Financial Crisis. The attraction as a defensive asset class remains and we believe the market will be more discriminating in seeking those REITs with the highest quality property portfolios, that are managed with conservative capital policies.

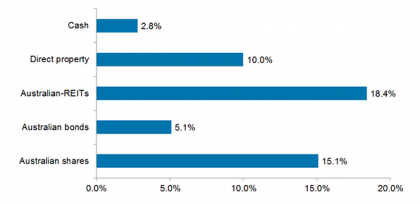

A-REITs have outperformed Australian equities

Past performance is not indicative of future performance. Source: AMP Capital. Asset class returns over three years to 31 July 2015, Cash: UBS 90 Day Bank Bill Index AUD, Direct Property: IPD Unlisted Wholesale Property Fund Index; A-REITs: S&P ASX 200 A-REIT Accumulation Index AUD, Australian bonds: UBS Composite All Maturities Index AUD, Australian Shares: S&P/ASX 200 Accumulation Index.

Over the past three years (July 2011 – July 2014) Australian REITs such as Charter Hall Group, Goodman Group and Federation Centres have been major contributors to the performance of the A-REIT asset class. All three are major owners of prime institutional property assets as well as they have benefited by redevelopment of their property portfolios.

We believe investors should expect A-REIT total returns to moderate in the medium-term as the high teen returns over the past one to six years are certainly not sustainable for this asset class. However, higher quality A-REITs present good opportunities to provide investors with fundamental property-like returns over the medium to long-term.

2. Strong balance sheets

The A-REIT sector is very well capitalised. This is partly due to equity raisings in the aftermath of the GFC. However, REITs have also adopted more conservative capital management policies – prudent gearing levels, sustainable distribution payout ratios, diversifying debt providers and showing a good sell discipline by disposing of properties. We believe all these factors have contributed to the strength of balance sheets. Going forward, the current Boards of REITs also have the learnings from less effective capital management policies that were in place prior to the GFC to help determine the success of future policies.

3. Greater liquidity than investing in direct real estate alone

A-REITs not only offer investors liquidity if it is needed but also allow access to high quality, diversified property portfolios. Thus, investors can achieve a high quality commercial property portfolio with minimal initial capital requirements. As property is a long-term asset class, an investment into A-REITs should also be considered over at least five years. Liquidity is dual edged, it allows entry and exit into A-REIT investments but the downside is potential volatility (though usually less than the equity market). However, volatility on the downside provides us with opportunities to buy high quality A-REITs, sometimes at good discounts to their intrinsic value.

4. Higher yields than many other asset classes

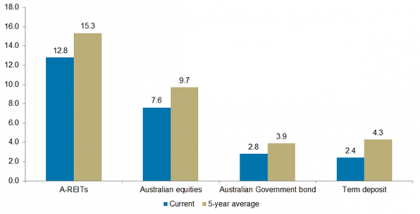

A-REITs are well positioned to deliver growing distribution yields to investors. This is due to income security (being contractual rental income), their well-capitalised nature, the current low interest rate environment and the direct commercial property market increasing further in value.

The A-REIT sector is currently showing an attractive distribution yield of 5.4%. The capital position of A-REITs is robust with sector gearing (debt to asset values) at 31% and a distribution payout ratio of 80%. We would expect the sector yield to oscillate in the 5.0% to 6.0% range and over the next three years A-REITs could deliver compound EPS growth of approximately 4.5%.

A-REITs are currently offering yields in excess of 5%

Source: Bloomberg, IRESS, Reserve Bank of Australia, as at 31 July 2015. A-REITs: S&P ASX 200 A-REIT Accumulation Index AUD, Australian Equities: S&P/ASX 200 Index, Australian Government bond: Australian 10 year Government Bond, Term deposit: Australian 1-year term deposit rate. Past performance is not indicative of future performance.

Final thoughts

A major benefit of investing into Australian REITs is it allows retail investors to access the highest quality commercial property in Australia without significant transaction costs and this diversified property exposure is also very liquid.

Traditionally the A-REIT market could be divided into retail, office, diversified (some residential) and industrial. Over the past few years the investment choice has expanded to include healthcare assets, retirement properties, storage facilities and childcare centres. Our market is merely playing catch up compared to the US REIT market where most of these property asset classes have traded in REIT form for many years. Indeed the outlook is promising as further property asset classes are securitised at the high quality institutional level, such as, large format retail centres (a current IPO – Aventus), student accommodation, education facilities, hospitals and petrol service stations.