Communication infrastructure has rapidly advanced over recent decades. While many countries have upgraded their infrastructure to keep up with these changes, the rapid pace in which technology is advancing means countries will continually need to invest to remain globally competitive. For example, multinational consulting firm McKinsey, forecasts a telecom infrastructure investment of US$9.5 trillion between 2013 and 2030.1

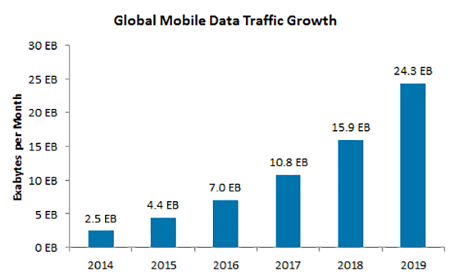

A large portion of this investment will be used for communication towers, as they facilitate the global transition of mobile communications, from voice and basic data to high-speed broadband. The chart below demonstrates the huge rise in global mobile data traffic – expected to increase nearly 10-fold between 2014 and 2019.

Source: CISCO, 2015

Emerging trend for private investors

One impact from this growth has been the emergence of independent tower operators, as governments and telecommunication companies have been selling tower assets that no longer meet their strategic goals.

Historically, owning an extensive tower network presented a competitive advantage in terms of coverage and service. However with increased capital expenditure requirements from new technologies and increased data needs, telecommunication companies are finding it more efficient to sell-off assets and take 10-15 year leases on the towers. This is a very attractive business model for independent tower companies, as not only do they secure stable, inflation protected cash flow streams, but they are also able to add other carrier’s equipment to towers that have historically only had one tenant. This could potentially result in doubling revenue for very limited additional capital expenditure.

What does this mean for infrastructure investing?

We are beginning to see an increase in interest for infrastructure investing and in the number of investors making discrete allocations to this asset class. As allocations rise, we expect to see a significant amount of new capital enter the space. Investors need to ask themselves whether they want to invest now and benefit from the expected growth in this asset class – or whether they want to wait for the investment trend to become increasingly recognised.

Through an active approach to portfolio management, investors can seek to take advantage of the emerging communication theme, with fund managers increasing exposure to sectors that are most likely to benefit and reducing exposure to sectors that are expected to underperform.

To find out more about investing in global listed infrastructure securities, please click here.

1 McKinsey Global Institute, 2013. Infrastructure Productivity: How to save $1 trillion a year. www.mckinsey.com/insights/engineering_construction/infrastructure_productivity

|

Joseph Titmus, BEc, SA Fin Joseph Titmus is based in AMP Capital’s London office and is responsible for the analysis of infrastructure companies in Europe and Latin America. He has nine years’ experience in the financial industry and was involved in the development of AMP Capital Brookfield’s listed infrastructure capability. Joseph joined AMP Capital’s Sydney office in February 2006 as an investment adviser within the Global Real Estate Securities Team. He moved over to the Global Listed Infrastructure Team in October 2008 and relocated to London in April 2010. |