Around the globe, prices are spiking. In the United States, the most recent official inflation reading puts price rises at a 31 year high1. In Germany it’s at 29-year highs2. Canada recently printed an 18-year record for inflation3 and in the United Kingdom, price rises are at a ten year high4.

In Australia inflation is much more muted with the headline rate up three per cent over the 12 months to the September quarter5. Underlying inflation – the Reserve Bank’s preferred measure – is lower at just over two per cent6. But overall, prices are higher than they’ve been for several years and economists are undecided on how long higher prices will remain.

With the global economy rapidly launching back into recovery mode, real asset investors need to be thinking about implications of the recent spike in inflation.

Historically, real assets have performed better than other asset classes during spikes in inflation, and they’re uniquely equipped to provide investors with a means to ride out the current inflationary surge. There are several key reasons for that.

-

Income from real assets is generally linked to inflation. As prices rise, so too does income.

-

During economic upswings, real assets such as real estate and infrastructure tend to do well as demand increases, rents rise, and utilisation improves.

-

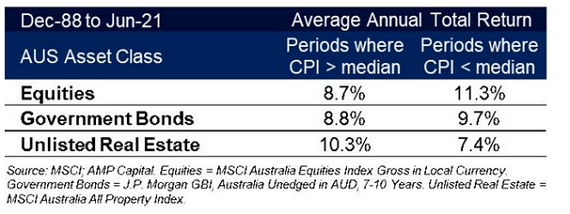

Over the long term, real asset returns historically beat other sectors during inflationary spikes.

What’s driving inflation?

The recent escalation in headline inflation rates is driven by the convergence of a multitude of factors at both the macro and micro levels.

1. Household costs have risen quickly. This has been driven by rising demand for consumer goods and higher gas, coal and oil prices, which are cascading into higher consumer costs. They are also contributing to bottlenecks in production and shipping.

2. Labour shortages are driving wage costs higher. This is particularly the case for services such as hospitality, construction and manufacturing, which typically rely on migrant labour. The shortages that have emerged in the labour force have driven wages growth in most developed economies.

3. Economies have rebounded faster than expected. Despite not feeling quick, or painless, by comparison to other pandemics and global catastrophes, COVID 19 was comparatively short and benign. The immediate and substantial response from governments and central banks, pushing interest rates to all-time lows and holding them there, will provide a significant tail wind to consumer and business spending well beyond the pandemic crisis.

Inflation isn’t always a bad thing

Inflation in an economy, when contained and limited, can be classified as a ‘good thing’. It’s less because of its actual effects on the economy, and more for what accompanies its emergence. Inflation is primarily the consequence of labour and resource scarcity, driving up the cost of goods and services for consumers and businesses.

Inflation is often accompanied by strong growth in economic output. With labour scarcity comes lower unemployment and higher wages. Thicker household wallets empower consumers to spend more which flows on to improved company profits and so on. In short, economic booms go hand in hand with some form of escalated inflation.

The inflation we are seeing today is also aligning with an improvement in economic prospects for the global economy, as it recovers from the lockdowns of COVID. The chief beneficiaries, based on early wages and employment data, appear to be households and consumers, who are experiencing the highest wages growth since 2006-07 when unemployment last reached a historic low of 4.3 per cent7.

This will prove very beneficial to the real assets sectors including shopping centres, tourism and airports as consumers take their newfound wealth, and accumulated lockdown war chests and go on a spending bonanza.

How do real assets respond to and manage inflationary risks?

The good news for investors is that returns from most real assets are resilient and well correlated to inflationary risks, primarily due to their inherent ability to absorb inflation through rental income.

There are four key factors that set real assets apart in their ability to combat inflation.

1. Higher demand. A sharp rise in inflation rates has historically been associated with an increase in economic output and GDP growth. This is broadly positive for all asset classes, but particularly real assets which benefit greatly from the higher demand that comes from an uplift in economic growth.

2. Fixed income increases. Commercial leases and contracts associated with sectors such as the office and logistics markets typically have inflation linked annual increases in rents written into the contract.

3. Productivity arbitrage. Environmental, society and governance factors and technology has enabled sectors to deliver higher returns despite a rising cost base.

4. Low-income volatility. Renters lock into leases for set terms. In many real assets, what’s known as long weighted average lease expiry (WALE) can shield investors from fluctuations.

Strategies for success – active asset management is key

Inflation and interest rates have a significant impact on investment performance, however they are determined by central banks and governments, removing control from investors reach.

What is within the reach of investors, is sector, market and manager selections which are critical to achieving an optimal return through an inflationary cycle. Active asset management is key.

Investors have a number of tools and strategies at their disposal to achieve a desirable investment performance including income profile and sector selection.

Income profile

What is the lease structure? How is income derived? What sectors underpin that lease and what is their risk profile during an inflationary event? Long WALE, contract income assets are typically inflation adjusted during their term, allowing investors to hedge their returns against fluctuations in market costs.

On the infrastructure side, when we see cost increases in assets from rising inflation during economic upswings, those assets can also benefit from utilisation rates on the revenue side, such as patronage through airports.

Sector selection

While all real assets are highly correlated to inflationary pressures, not all sectors are equal in their delivery of return performance. Some sectors are more prone to market level risks that can undermine their inflation fighting abilities. Sectors such as office and logistics which are more prone to supply risk, are examples.

Targeting markets with low supply outlooks, linked to stable underlying income streams is crucial to success. In the post COVID world of high household savings, and post lockdown social activity, we expect airports, large entertainment driven shopping centres, and e-commerce driven logistics facilities to be standout performers for returns.

We also expect renewable energy assets, and other ESG-driven asset classes to benefit from long term government support tailwinds. These should be considered as a wrap to any asset selection to enhance returns. For example, a logistics facility with a solar roof can increase income returns by 100-200 basis points based on anecdotal evidence of roof rents versus market rents.

Why this inflationary cycle is containable?

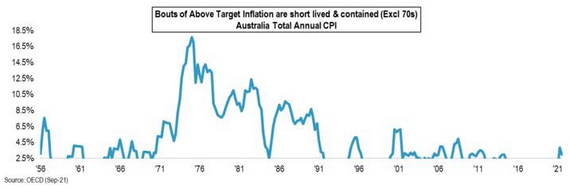

Our view on inflation is to be alert, but not alarmed at the current cycle. Despite the headline inflation rate likely to remain elevated in the short term, the risk of a sustained breakout remains unlikely and containable.

Inflation can still be brought under control through higher interest rates, with central banks holding significant leverage to reduce the money supply, without impacting growth recovery.

Additionally, reduced government spending over the medium term through fiscal constraint and wound back stimulus while the global economy normalises, as well as supply chains reopening will also help.

On the consumer side, pricing is holding at modest growth rates and despite record unemployment lows, wage growth is elevated but not excessive.

With household savings rates at 9.7 per cent in Australia and 9.4 per cent in the US8, there are good buffers built into household budgets.

Conclusion

Inflation is on the rise in developed economies, though not as severely in Australia. It means investors need to align their investment strategies to hedge against the impact of higher prices. What is important is the long-term impacts, not just the short term.

In our view, real assets provide an attractive option in an inflationary environment. We believe active asset management is also critical to achieving strong performance outcomes.

1. U.S. inflation rate hits 31-year high. How to invest in times of high inflation – MarketWatch

2. Germany: Inflation hits 29-year high of 5.2% | News | DW | 29.11.2021

3. Inflation rate jumps again to new 18-year high of 4.7% | CBC News

4. UK inflation at 10-year high sets stage for interest rate rise within weeks – CNN

5. https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/latest-release

6. RBA

7. ABS

8. Bloomerg

Author: Luke Dixon, Head of Real Estate Research – Real Estate Sydney, Australia

Source: AMP Capital 9 December 2021

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

AMP Capital Asia Limited (CE Number: AUN326) is regulated by the Hong Kong Securities and Futures Commission (“SFC”) to conduct Type 1 (Dealing in Securities), Type 4 (Advising on Securities) and Type 9 (Asset Management) regulated activities in Hong Kong. This material has not been reviewed by the SFC and is provided to you on the basis that you are a Professional Investor as defined in the Securities and Futures Ordinance (Cap. 571) (“SFO”) and subsidiary legislation. This material is provided for your use only and you will not distribute or make this material available to a person who is not a Professional Investor as defined in the SFO. This material is for general information purposes only and does not constitute advice or recommendation to buy or sell investments.

The information in this document contains statements that are the author’s beliefs and/or opinions. Any beliefs and/or opinions shared are as at the date shown and are subject to change without notice.

This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives.