A popular portfolio management theory is that people should de-risk their portfolios around the date of retirement and make the switch from growth assets to income-producing assets. But this may not necessarily always be the correct approach.

Although there are many circumstances where this strategy makes sense, it’s important to not apply a blanket approach as it’s not always the case. Each investor’s individual circumstances must be considered when determining an investment strategy and risk profile in retirement. For example, it’s important to consider the level of savings they have, how they intend to spend it and their risk tolerance and preferences.

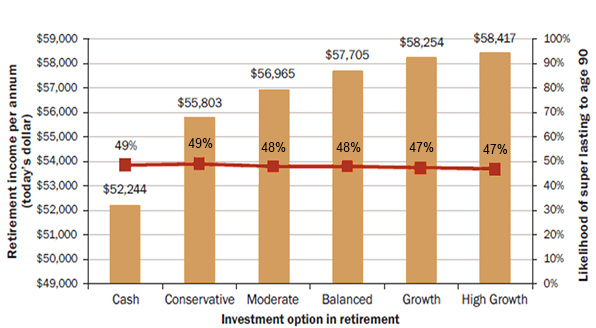

Let’s look at some examples. The chart shows how much annual income a retired couple aged 65 could receive after retiring with combined superannuation assets valued at $500,000, depending on the risk profile applied to how their capital is invested (ranging from zero-risk ‘cash’ to 100% growth assets ‘high growth’). This couple has a life expectancy of 25 years, in line with Australian life table expectations. With this in mind, the red line shows the likelihood of the superannuation assets lasting until 90 years-old.

There are two vital pieces of information to take from this.

-

A higher exposure to growth assets can significantly increase the expected level of income.

-

The chance of the capital lasting until age 90 is very similar across all risk profiles, ranging from 49%probability with cash to 47% probability if using a high growth option.

Therefore, it could be argued that it makes more sense to take a higher risk approach in retirement, given the higher income this will generate, as the probability of capital lasting throughout retirement is broadly the same, regardless of risk profile.

Impact of investment option on expected retirement income

Source: Towers Watson paper, The Path to Retirement Success

Past performance is not a reliable indicator of future performance

But there is an important question to ask: how many retirees would consider an investment strategy that only had around a 50% chance of success? Retirees don’t have the capacity to recover losses, as they are unable to return to work in order to generate an income if they run out of capital. Therefore, it’s unlikely that many retirees would want to take these odds.

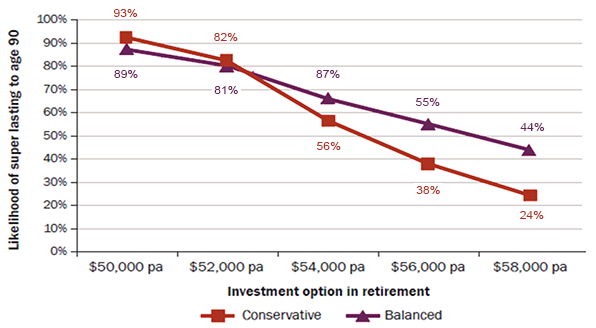

To increase the likelihood of savings lasting until age 90, one option for retirees is to review their spending strategies. The next chart shows how, if retirees are willing to adopt lower spending strategies, there is a high likelihood of success for both the conservative and the balanced options. But if the couple is spending at a higher rate then the investment option chosen has a much greater impact on the chance of super lasting until age 90.

Impact of spending strategy and investment option on likelihood of super lasting to age 90

Source: Towers Watson paper, The Path to Retirement Success

Past performance is not a reliable indicator of future performance

The spending level in retirement is critically important, especially when combined with different investment strategies. Getting the combination right can make the difference between a comfortable and a miserable retirement.

Based on the Towers Watson paper The Path to Retirement Success, November 2014.

About the author

This article has been based on the Towers Watson paper, The Path to Retirement Success, written by Andrew Boal, Managing Director, Towers Watson Australia.

24 February 2016