The AMP Capital Wholesale Australian Property Fund recently bought Stage 1 of the Connect Corporate Centre in Mascot, Sydney, a sleek, brand-new building close to the Sydney CBD valued at $43.6 million.

What made the building so attractive? For a start, it has a list of blue-chip tenants that will deliver reliable income, but also excellent growth prospects in a transforming area.

It’s characteristics like that that underpin successful commercial property investments. But while there is growing excitement around commercial property’s potential to generate reliable income, particularly for those moving into retirement, few investors understand the real drivers of good commercial property investment.

There are five features that help investors distinguish good commercial property investment or funds from the bad.

High-quality tenants

High-quality tenants

Quality tenants are the major building block of commercial property. You want access to high-quality tenants with deep pockets and fixed leases – whether government departments, Australian businesses or international companies.

The Connect Corporate Centre in Mascot has a list of high-quality tenants, including the Commonwealth Government, Kone Elevators, global real estate services firm Jones Lang Lasalle, former Qantas credit union Qudos, and international medical device maker, Boston Scientific.

The Fund’s portfolio more broadly consists of household names such as Coles, Woolworths, Leo Burnett, ConocoPhillips and Dulux.

High occupancy rates and a long rent roll

In addition to quality tenants, investors should look for properties and funds that have a high number of tenants. But, importantly, you should look for a high occupancy rate that has been demonstrated right through the cycle. A high occupancy rate allows the property or fund to maintain consistent cash flow streams.

Past performance is not a reliable indicator of future performance.

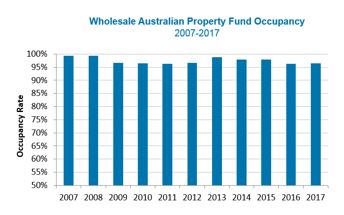

We have a good track record of renewing tenants and our occupancy rate has been more than 95 per cent for more than 10 years.

Maintaining high occupancy requires excellent management: making sure tenants are well taken care of and that we’re doing all we can to service them.

The right level of debt

Debt often plays a big part in real estate. Debt juices up capital returns – it multiplies both gains and losses. But debt can make income less secure. The right level of debt depends on your investment objectives.

If you are looking for a defensive, income-generating investment, then you’re likely to prefer an investment with lower levels of debt underpinning more predictable returns.

Because we focus on a solid income profile with a little bit of capital growth, our fund’s policy is to use debt very conservatively. Our gearing levels are typically 0 to 15 per cent.

Location, location

Just as with residential property, location matters. History shows that assets in major cities tend to benefit from a larger pool of tenants and industries, creating higher rental demand, strong underlying land values and more stable rental returns.

The property should also be in an area with potential. We believe the Connect Corporate Centre’s location in Mascot provides significant upside to rents. The South Sydney market has been transformed over the past decade and Mascot is establishing itself as an attractive new commercial precinct.

Rents in Mascot at $360sqm to $400sqm are cheap relative to the CBD, which have risen from $600sqm to $1000sqm, but also relative to the likes of Chatswood, Parramatta and Macquarie Park. However, Mascot rents probably won’t stay cheap forever. As the area continues to change and densify, our view is that the market will catch up over time, providing solid capital growth.

Another recent acquisition, the Brickworks Centre, a 15,183 square metre single -level lifestyle centre at Southport on the Gold Coast, has 50 tenants across fresh food markets, eateries, furniture, homewares and boutique retailing.

Another recent acquisition, the Brickworks Centre, a 15,183 square metre single -level lifestyle centre at Southport on the Gold Coast, has 50 tenants across fresh food markets, eateries, furniture, homewares and boutique retailing.

The Brickworks Centre is located in Southport, a hotspot for population growth on the Gold Coast. Southport has been classified as a priority development area which has led to a surge in development applications including several mooted large-scale apartment projects. The Centre also benefits from the recently constructed light rail, built for the Commonwealth Games.

Scale and diversification

The final factor is diversification. Diversification is crucial to producing quality, stable returns from commercial property. Ideally, you don’t want to be exposed to one property with one tenant. If the tenant leaves and you have difficulty re-leasing, your income could dry up.

Few commercial properties are priced under $1 million, and it can be difficult to get the scale required to achieve a diversified exposure unless you invest in a fund. A fund provides diversification across national property markets, property sectors, buildings and tenants.

The Wholesale Australian Property Fund, as an example, has exposure to NSW, Queensland, Victoria, South Australia and the ACT. We are also diversified across retail, office and industrial sectors, which bring different benefits to a portfolio. Industrial, for example, typically generates more yield. (Broadly, we aim for one-third in retail, a third in office, and another third in industrials.)

We have a mix of 300 tenants in our 22 properties across many sectors such as retail, government, financial and business services and manufacturing and transport.

Ideally, you don’t want to be overly exposed to one tenant. Our largest tenant, generates less than 5 per cent of the portfolio’s revenue and if we acquire further properties in the fund that percentage will fall.

Locking in solid returns

There is no doubt that commercial property can deliver solid, stable income streams. But to deliver that stable income stream, investors need to focus on the right properties and right funds.

Our team is extremely selective and for every property we buy, we typically consider and reject another 20.

If investors can focus on properties and funds that have good quality assets and tenants, then they will lay the platform for solid returns over the medium to long term.

For more information on the Wholesale Australian Property, listen to our recent webinar.

It’s important to be aware that there are risks associated with investing in the Wholesale Australian Property Fund. Before investing, please read the Product Disclosure State which can be found by visiting our website.

Source: AMP Capital 12 October 2017

Author: Christopher Davitt, Portfolio Manager

Important note: Investors should consider the Product Disclosure Statement (“PDS”) available from AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (“AMP Capital”) for the Wholesale Australian Property Fund (“Fund”) before making any decision regarding the Fund. The PDS contains important information about investing in the Fund and it is important investors read the PDS before making a decision about whether to acquire, continue to hold or dispose of units in the Fund. National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (“NMFM”) is the responsible entity of the Fund and the issuer of units in the Fund. Neither AMP Capital, NMFM nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance.

While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Investors and their advisers should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.