Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Introduction

A few years ago, I put together a list of key common-sense points that may be useful in terms of borrowing to finance a home along with broader personal finance and investment decisions we make. Given the surge in interest rates lately, I thought it was worth an update so here they are. Many Australians may know these, but unfortunately financial literacy is still not taught in schools and so many don’t. Otherwise, Australians would have far less trouble with their finances. I have deliberately kept it simple and in many cases this draws on personal experience. I won’t tell you to have a budget though because that’s like telling you to suck eggs!

1. Shop around

We often shop around to get the best deal when it comes to consumer items but the same should always apply to services we get. It’s a highly competitive world out there and service companies want to get and keep your business. So when getting a new service – whether it be for a power contract, phone plan, insurance or mortgage, or who to manage your super etc it makes sense to look around to find the best deal. And when it comes time to renew a service – say your home and contents insurance – and you find that the annual charge has risen sharply, it makes sense to call your provider to ask what gives. I have often done this to then be offered a better deal on the grounds that I am a long-term loyal customer.

2. Don’t take on too much debt

Debt is great, up to a point. It helps you have today what you would otherwise have to wait until tomorrow for. It enables you to spread the costs associated with long term assets like a home over the years you get the benefit of it, and it enables you to enhance your underlying investment returns. But as with everything you can have too much of a good thing – and that includes debt. Someone wise once said “it’s not what you own that will send you bust but what you owe.” So always make sure that you don’t take on so much debt that it may force you to sell all your investments just at the time you should be adding to them or worse still potentially send you bust. Or to sell your house when it has fallen in value. A rough guide may be that when debt servicing costs exceed 30% of your income then maybe you have too much debt – but it depends on the level of your income and expenses. A higher income person could manage a higher debt servicing to income ratio simply because living expenses take up less of their income.

3. Allow that interest rates go up and down

Of course, we have been given a rather rude reminder that interest rates can go up over the last year. But when things are going one way for a long time as interest rates did when they fell from 2011 to 2020, it’s easy to forget that the cycle could turn. So, when you take on debt the key is to make sure you can afford higher interest payments at some point. Fortunately, under guidance from the bank regulator, APRA, lenders these days have to allow that you can service your debt when interest rates are an extra 3% above the proposed borrowing rate. Of course, after 12 rate hikes in quick succession which has taken interest rates back to levels last seen in 2012 the odds are we are now getting close to the peak in interest rates so some relief may be on the way next year.

4. Contact your bank if struggling with a mortgage

After the biggest surge in interest rates since the late 1980s, it’s understandable many may be worried about servicing their mortgage. A survey by AMP Bank found that nearly 70% of those with a mortgage are worried about meeting repayments if rates continue to rise with 31% worried right now, but that most of those with small safety buffers had not sought help from their lender. However, homeowners struggling with a mortgage should not be shy in seeking assistance either to get a lower interest rate or maybe to switch to a different mortgage repayment arrangement. The home mortgage market is highly competitive and it’s not in banks’ interest to see people default on their loans.

5. Seek advice regarding fixed versus variable rates

Australians have long struggled regarding how best to use fixed rates – often locking in at the top of the rate cycle & then staying variable at the bottom. Thankfully this recent cycle was different with a record 40% of mortgages locking in record low fixed rates around 2% in 2020-21. But still many didn’t. Sure, the fixers were only protected for two or three years but still they would have done better than those who stayed variable. As a general principle locking in low fixed rates makes sense when the rate cycle has gone down but staying variable when rates have gone up. Of course, it’s still hard to time it – eg, locking in fixed rates around 4% in 2016 after five years of rate falls would have been premature and there is always a case to maintain some flexibility by keeping a portion of the loan variable to allow for windfalls (like say an inheritance or a big bonus) that enable you to pay down your loan faster. The key is to seek advice.

6. Allow for rainy days

Because the future is uncertain it always makes sense to have a financial buffer to cover us if things unexpectedly go badly. The rainy day could come as a result of higher interest rates, job loss or an unexpected expense. This basically means not taking all the debt offered to you, trying to stay ahead of your payments and making sure that when you draw down your loan you can withstand at least a 3% rise in interest rates.

7. Credit cards are great, but they deserve respect

I love my credit cards. They provide free credit for up to around 6 weeks and they attract points that really mount up. So, it makes sense to put as much of my expenses as I can on them. But they charge usurious interest rates of around 20% if I get a cash advance or don’t pay the full balance by the due date. So never get a cash advance unless it’s an emergency and always pay by the due date. Sure the 20% rate sounds like a rip-off but don’t forget that credit card debt is not secured by your house and at least the high rate provides that extra incentive to pay by the due date.

8. Use your mortgage for longer term debt

Credit cards are not for long term debt, but your mortgage is. And partly because it’s secured by your house, mortgage rates are low compared to other borrowing rates. So, if you have any debt that may take longer than the due date on your credit card to pay off then it should be included as part of your mortgage if you have one.

9. Start saving and investing early

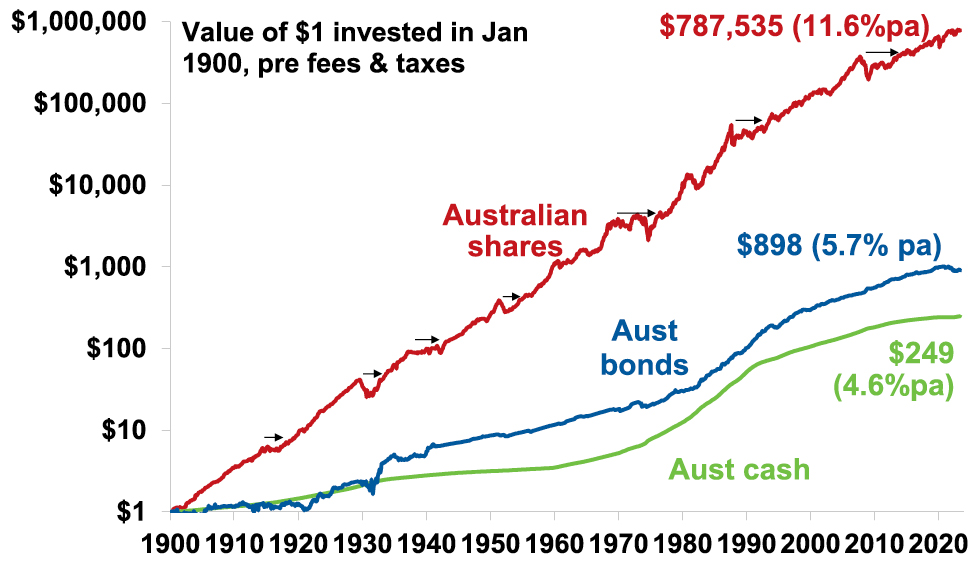

If you want to build your wealth to get a deposit for a house or save for retirement the best way to do that is to take advantage of compound interest – where returns build on returns. Obviously, this works best with assets that provide high returns on average over long periods. But to make the most of it you have to start as early as possible. Which is why those piggy banks that banks periodically hand out to children have such merit in getting us into the habit of saving early. This gives me another opportunity to show my favourite chart on investing which tracks the value of $1 invested in Australian shares, bonds and cash since 1900 with dividends and interest reinvested along the way. Cash is safe but has low returns and that $1 will have only grown to $249. Shares are volatile (and so have rough periods highlighted by arrows) but if you can look through that they will grow your wealth and that $1 will have grown to $787,535.

Shares versus bonds & cash over very long term – Australia

Source: ASX, Bloomberg, RBA, AMP

10. Plan for asset prices to go through rough patches

It’s well known that the share market goes through rough patches. The volatility seen in the share market is the price we pay for higher returns than most other asset classes over the long term. And while property prices will always be smoother than share prices because it’s not traded daily and so not as subject to very short-term sentiment swings, history tells us that home prices do go down as well as up. Japanese property prices fell for almost two decades after the 1980s bubble years, US and some European countries’ property values fell sharply in the GFC and the Australian residential property market has seen several episodes of falls over recent years. So, the key is to allow that asset prices don’t always go up – even when the population and the economy are growing.

11. See big financial events in their long-term context

Hearing that $70bn was wiped off the share market in a day or two sounds scary – but it tells you little about how much the market actually fell and you have only lost something if you sell out after the fall. Scarier was the roughly 35% fall in share markets in February-March 2020 due to the pandemic and scarier still the GFC that saw 50% falls. But such events happen every so often – the 1987 crash saw a 50% fall in a few months and Australian shares fell 59% over 1973-74. And after each the market has gone back up and resumed its long-term rising trend. The trick is to allow for periodic sharp falls in your investments and when they happen remind yourself that we have seen it all before and the market will most likely find a base and resume its long-term rising trend.

12. Know your risk tolerance

When embarking on your investing journey, it’s worth thinking about how you might respond if you found out that market movements had just wiped 20% off your investments. If your response is likely to be: “I don’t like it, but this sometimes happens in markets and history tells me that if I stick to my strategy, I will see a recovery in time” then no problem. But if your response might be: “I can’t sleep at night because of this, get me out of here” then maybe you should rethink your strategy as you will just end up selling at market bottoms and buying at tops. So, try and match your investment strategy to your risk tolerance.

13. Make the most of the Mum and Dad bank

The Australian housing boom that started in the mid-1990s has left housing very unaffordable for many. This has contributed to a big wealth transfer from Millennials to Baby Boomers and Gen Xers. For Millennials and Gen Z, if you can it makes sense to make the most of the “Mum and Dad bank”. There are two ways to do this. First stay at home with Mum and Dad as long as you can and use the cheap rent to get a foothold in the property market via a property investment and then use the benefits of being able to deduct interest costs from your income to reduce your tax bill to pay down your debt as quickly as you can so that you may be able to ultimately buy something you really want. Second consider leaning on your parents for help with a deposit. Just don’t tell my kids this!

14. Be wary of what you hear at parties

Back in 2021, Bitcoin was all the rage. But jumping in when it was near $US68,000 a coin at the point when everyone was talking about it back then would not have been wise – it’s now around $US30,000 but had a fall to below $US16,000 on the way and its yet to prove its use value, beyond something to speculate in. Often when the crowd is dead set on some investment it’s best to stay away, particularly if you don’t understand it.

15. There is no free lunch

When it comes to borrowing and investing there is no free lunch – if something looks too good to be true (whether it’s ultra-low fees or interest rates or investment products claiming ultra-high returns and low risk) then it probably is and it’s best to stay away.

Concluding comment

I have focussed here mainly on personal finance and investing at a very high level, as opposed to drilling into things like diversification and taking a long-term view to your investments. An earlier note entitled “Nine keys to successful investing” focussed in more detail on investing.

Source: AMP Capital July 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.