Contrary to what would normally be suggested by the worst recession since the 1930’s, high unemployment, the worst riots since 1968 and the poor handling of the coronavirus pandemic Donald Trump performed very well in the US presidential election resulting in a close outcome. However, while counting is still continuing in some key states, major US TV networks and Associated Press have called the result in Biden’s favour and he has claimed victory as it looks highly likely he will secure at least the 270 electoral college votes required to win and possibly 306. In the popular vote President Trump received at least 70.8 million votes but Joe Biden received 75.2 million votes (and still counting), more than 4 million above Trump.

With likely run-offs for both Senate seats in Georgia in January there is a possibility the Democrats ultimately achieve a “clean sweep” having retained control of the House and gaining control of the Senate if they win both seats in Georgia given that this would give them 50 Senate seats plus one vote from the Vice President Harris in the event of ties. However, the likelihood of the Democrats winning both Senate seats in Georgia is low given Georgia is traditionally Republican and the Republican vote in both Senate races was above the Democrat vote.

So, the most likely outcome is a divided government with Biden as President, the Democrats retaining control of the House and Republicans retaining control of the Senate. So, no “blue wave.”

A victory by President Trump based on final counting (which now looks very unlikely) or recounts and challenges (which is possible but unlikely given the margins that Biden is ahead in key states) would mean more of the same. US tax rates would stay low, but the trade war would ramp up again – which would be bad for non-US shares including Australian shares relative to US shares and be positive for the US dollar including against the $A and the Renminbi. This note looks at the key implications of a Biden victory.

Biden’s key policies

Taxation: Biden plans to raise the corporate tax rate to 28% (reversing half of Trump’s cut to 21%), return the top marginal tax rate to 39.6% (from 37%) and tax capital gains and dividends as ordinary income.

Infrastructure: Biden plans to spend $1.3trn over 10 years.

Climate policy: Biden aims for the US to reach net zero emissions by 2050 by raising the cost of fossil fuels & boosting the development of alternatives (possibly with a carbon tax). He would take the US back into the Paris Climate Agreement.

Regulation: Biden is likely to end the era of deregulation.

Healthcare: Biden wants to strengthen Obamacare and limit drug prices.

Trade and foreign policy: Biden would likely de-escalate tensions with Europe and strengthen the alliance, work with international organisations like the World Trade Organisation, work to re-establish the nuclear deal with Iran and adopt a more diplomatic approach to dealing with trade and other issues with China (working with Europe and Asian allies in the process).

Fiscal stimulus: Biden would support another round of fiscal stimulus of around $US3 trillion or so.

But what can we expect given divided govt?

-

Biden’s proposed tax hikes are extremely unlikely to pass into law given blockage from the Senate.

-

Some form of fiscal stimulus is likely to be agreed, with Senate Majority Leader McConnell saying after the election that, “I think we need do it.”, It could come before the end of the year while Trump is still president but is likely to be smaller at say $US1.5 trillion rather than say $3 trillion had the Democrats won the Senate as well.

-

Joe Biden and Mitch McConnell already have a strong working relationship so may be able to get something done on infrastructure spending and other Democrat spending priorities around health care and education. There may be some incentive for Senate Republicans to cut a deal with Democrats if they can make Trump’s corporate tax cuts (most of which expire in 2025) permanent.

-

The Senate is likely to limit what Biden can do on climate policy where spending & tax measures are required, but a lot can still be achieved by regulation of the energy sector and the US will likely re-enter the Paris Climate Agreement.

-

Biden is likely to re-engage and strengthen relationships with traditional US allies and international bodies like the WHO and WTO. The US is also likely to re-enter the Trans-Pacific Partnership (now CPTPP) and the Iran Nuclear Deal.

-

Trade wars are likely to be toned down with the US relying on a more diplomatic approach working with US allies to resolving trade differences with China, using the prospect of cutting Trump’s tariffs as leverage. This doesn’t mean that Biden will be “soft on China” just that a different approach will be used to address US grievances.

-

A Biden presidency is likely to take a more expert based approach to controlling coronavirus ahead of the full deployment of vaccines. This could involve a more coordinated approach and partial lockdowns in the short term, eventually leading to a more confident reopening.

-

Biden will seek to heal divisions and unify the US that were inflamed by President Trump. This may be helped by having Kamala Harris as VP who may very well be the Democrat nominee for President 2024. He will also support the rule of law and reinforce US institutions that have served it well.

Key risks under a Biden presidency

-

Expect more episodes of budget gridlock – including over the debt ceiling that needs to be increased by July next year. As we saw in the Obama years, this can lead to periods of market volatility, but we also saw that Republicans back down quickly once they realise it was working against them. Agreeing more short-term stimulus may cause some short-term share market uncertainty.

-

While the Republican Senate will serve to head off left ward drift under a Biden presidency – by limiting what he can do in areas like tax, climate policies etc – this may alienate many of Biden’s more left-wing supporters reinforcing cynicism. Then again, staying in the political middle is probably the best way to see a Democrat re-elected in 2024.

-

The contentious nature of the election fuelled in large part by Trump’s claims of voter fraud may see divisions remain intense in the US, particularly with Trump sniping on the sidelines. This could lead to unrest in the short term.

-

President Trump could also throw curve balls between now and inauguration day on 20th January – possibly in terms of refusing to leave office (although I suspect key Republicans will progressively desert him) & also potentially in terms of tensions with China, Iran and North Korea.

Economic impact of a Biden presidency

Our base case remains that while it will be bumpy and uneven, the US economy will continue to recover from the coronavirus hit, helped along by more fiscal stimulus & ultra-easy monetary policy. This will be accelerated if highly effective vaccines are deployed to a wide proportion of the population through next year. The negatives from the tax hikes are likely gone due to the Senate and the impact of more regulation under a Biden presidency should be offset by a ramping down of the trade war compared to what would have happened under Trump.

The main near-term risk is that Biden announces another lockdown to slow coronavirus resulting in another hit to growth. But while this is a short term negative it should ultimately result in a more confident reopening like we are seeing in Australia.

Market implications of a Biden Presidency

Share markets have so far responded favourably to news of Biden being ahead in presidential election counting. However, with Republicans likely retaining control of the Senate this is on the grounds that Biden’s promised tax hikes likely won’t happen, but with some sort of fiscal stimulus still likely. Beyond election challenges we are now into a period of the year where shares normally perform well seasonally, and US shares have typically gone up initially in the aftermath of close elections.

Ultimately, looking beyond the initial knee jerk reaction, the combination of averted tax hikes but some more US stimulus and a toning down of the trade war may be slightly more positive for non-US shares and Australian shares relative to US shares and slightly negative for the US dollar including against the Chinese Renminbi and Australian dollar.

The move towards a more diplomatic approach to resolving issues with China could be particularly positive for Australia to the extent that it would also help encourage Australia and China to resolve tensions that have been ramping up recently. This in turn would help avert a further threat to our exports to China and support Australian exporters and the Australian dollar. Trump’s “Phase One” trade deal with China may also have been working against Australia to the extent that reported Chinese restrictions on imports from Australia may have been partly motivated to free up scope for China to import more from the US to meet the terms of its deal with Trump.

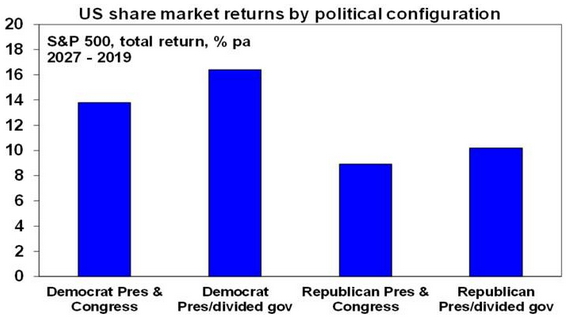

For those worried about “left wing” Democrats, it’s worth noting that US shares have done best under Democrat presidents with an average return of 14.6% pa since 1927 compared to an average return under Republican presidents of 9.8% pa. However, the best average result has actually occurred when there has been a Democrat president and Republican control of the House, the Senate or both. This has seen an average return of 16.4% pa. By contrast the return has only averaged 8.9% pa when the Republicans controlled the presidency and Congress.

Source: Bloomberg, AMP Capital

How would a Democrat Senate change things?

In the unlikely event that the Democrats get control of the Senate via Georgia it would clear the way for significantly more US expansionary fiscal policy and action on climate change but it would likely also mean higher corporate tax in the US and more regulation. Global shares would likely benefit more than US shares and the US dollar would likely fall more. Historically this has been the second-best outcome for share markets. It would probably be the best outcome for Australian shares and the $A as Australia would benefit from more US stimulus, our companies would be relatively more attractive with a higher tax rate in the US and we would likely see less tensions with China.

Implications for Australia

The main positive implications from a Biden Presidency for Australia are likely to be: ultimately a stronger US economy which will benefit the Australian economy; a stronger more consistent relationship with the US; a toning down of the trade war with China in favour of a more diplomatic and engaged approach to resolving trade issues which will be less negative for Australia; and US re-entry into the TPP. More aggressive action on climate change in US may also force Australia and Australian companies (that engage with the US) down a more aggressive response to climate change too. Beyond short term uncertainties around US civil tensions in the aftermath of the election and when US fiscal stimulus will come, overall, we see it as benefitting Australian shares and the Australian dollar.

Source: AMP Capital 9th November 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.

This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.