Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

In 1981 on a holiday with my parents to Hawaii we got into a discussion with some Americans about their new President, Ronald Reagan, and they said he had to deliver some tough economic medicine after years of policy mismanagement. At the time I dismissed them, but as the years went by I concluded that they had a point. The 1970s were an economic mess as inflation was allowed to get out of control. In fact, things were so bad that there was a wave of nostalgia for the 1950s and early 60s when things seemed a lot better – starting with American Graffiti, Happy Days, Laverne and Shirley and the rise of retro radio stations playing hits from the 50s and 60s. With inflation surging lately, what lessons can be drawn from the 1970s and its aftermath in terms of today’s problems. This is important because if we don’t learn the lessons of the past, we are bound to repeat them. This is particularly pertinent now as I often hear the comment “why are we so worried about a bit of inflation?” and “why is the RBA inflicting so much pain?”

What went wrong in the 1970s?

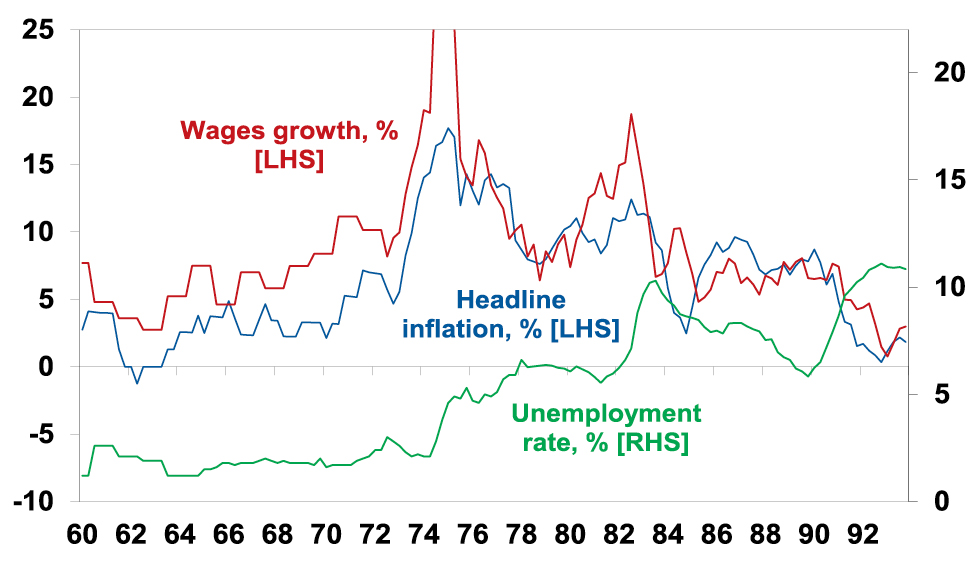

But first it’s worth a brief recap. From around the mid-1960s inflation started rising. First in the US and then in Australia. It was driven by a combination of tight labour markets, more militant workers demanding higher wages, a big expansion in the size of government, disruption from the Vietnam War, easy monetary policies, social unrest and years of industry protection reducing competition and pushing up prices. It really blew out after the OPEC oil embargo of 1973 and the second oil shock after the Iranian revolution of 1979. The surge in inflation came in waves, reaching double digit levels. It also combined with frequent recessions as policy makers tightened monetary policy in response to high inflation but were too quick to ease when growth slumped only to see inflation take off again driving more tightening and another economic downturn. The end result was a decade of high inflation, high unemployment and slow economic growth from which it took a long time to recover. For investors it was bad as high inflation meant high interest rates, high economic volatility & uncertainty and reduced earnings quality all of which demanded higher risk premiums to invest (& low PEs). The 1970s were one of the few decades to see poor real returns from both shares and bonds.

Aust inflation, wages grth & unemployment, 1960 – early 90s

Source: ABS, AMP

So what broke it?

The malaise ultimately ended after voters turned to economically rationalist political leaders – like Thatcher, Reagan and Hawke and Keating in Australia. The policy response involved:

-

tight monetary policy which drove severe recessions, ultimately culminating in inflation targeting;

-

supply side reforms like deregulation, privatisation & competition laws to make it easier for the economy to meet demand;

-

this was aided by globalisation and then in the late 1990s the tech boom – which boosted the supply of low-cost goods and services;

-

in Australia, the prices and incomes Accord between Government, unions and business helped break the wage price spiral at the time.

This all broke the back of inflation with some in the 2000s calling it dead.

Key lessons

There are several lessons from the malaise of the 1970s and its aftermath and early 1990s recession in Australia for the inflation problem of today:

1. What won’t work. First, the experience of the 1970s and 1980s provides a clear list of things that won’t work to solve the problem:

-

Higher wage growth to keep up with inflation – this just perpetuates high inflation making it harder to get back down.

-

Price controls – these were tried, eg, in the early 1970s in the US. But they restrict supply and when removed inflation was worse than ever.

-

Replacing the RBA Governor – doing this mid-way through the problem would risk shaking confidence in the RBA’s anti-inflation commitment at the worst time likely resulting in even higher interest rates. The US saw something similar in the 1970s when it replaced William Martin at the Fed with Arthur Burns which just perpetuated high inflation.

-

·Raise the RBA’s inflation target – this would also reduce confidence in its ability to get inflation down and mean higher interest rates.

-

Shift responsibility for inflation control back to government – this sounds fine in theory as governments have more levers to pull (eg it could impose a 1% temporary income tax surcharge to cool demand which would spread the load more fairly beyond those with a mortgage). But unfortunately, politicians have shown an inability to inflict the pain necessary to slow inflation. So, it doesn’t work in practice. It was the way things were done in Australia in the 1970s and its failure led to the widespread adoption of central bank independence focussed on meeting an inflation target.

2. Containing inflation expectations is key. Once inflation takes hold it gets harder to squeeze out. This relates to “inflation expectations”. Once inflation has been high for a while consumers and businesses expect it to stay high and so behave in ways – via wage demands, price setting and acceptance of price rises – that perpetuate it. A wage price spiral is a classic example of this where prices surge, workers demand wage rises to compensate which boosts costs & drives a new round of sharp price rises. This is an example of the “fallacy of composition” – while it is rational for an individual to demand a wage rise to match inflation if all workers do so it just leads to a further surge in prices.

3. Whether its supply or demand, central banks have to respond. While the initial impetus to a surge in inflation may be constrained supply if it occurs when demand is strong or goes on for too long, central banks still have to respond to cool demand and signal they are serious about containing inflation. Central banks failure to do this after the 1973 OPEC oil shock contributed to inflation getting entrenched in the 70s.

4. Avoid stop go monetary policy. There is a danger in easing monetary policy too early in a downturn if inflation expectations have not been tamed. This occurred in the 1970s with inflation slowing and central banks easing as growth slowed but inflation soon rising even higher. This underpins talk central banks will keep rates “higher for longer”.

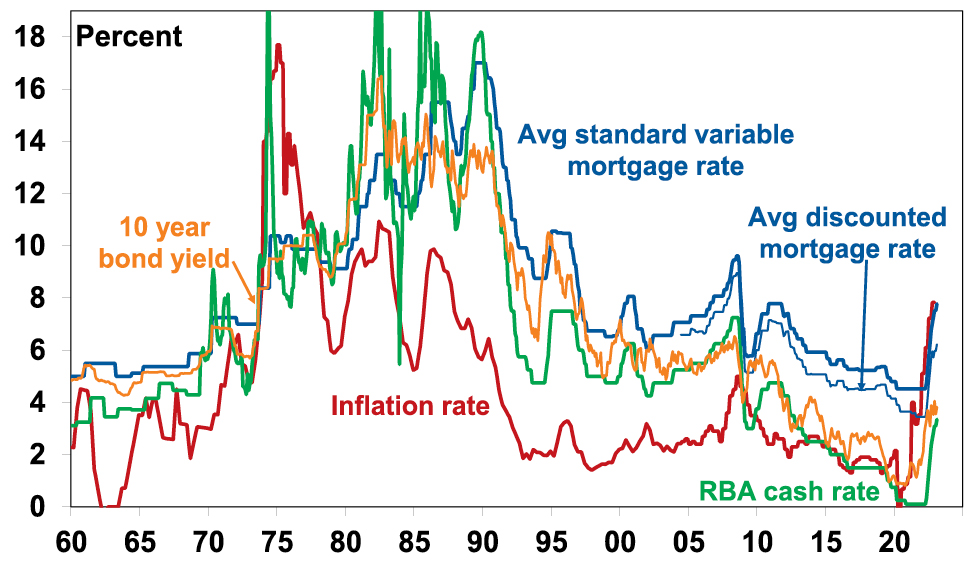

5. Entrenched high inflation will mean entrenched high interest rates. This is because investors will start to demand compensation for the fall in the real value of their savings by demanding higher rates. So interest rates rose through the 1970s into the 1980s. And this of course weighs on the valuation of shares and property. 10-year bond yields of around 3.5% to 4% are fine if investors expect inflation will fall to say 2-3% but if they believe inflation will stay high at 6-8% then they are too low.

Sustained high inflation = high interest rates

Source: ABS, AMP

6. Entrenched high inflation is bad for the economy. Because it distorts economic decisions it can cut economic growth as in the 1970s, add to economic uncertainty which hampers investment & boost inequality.

7. Once entrenched high inflation risks requiring a deep recession to remove it. This was seen in the deep recessions of the early 1980s and early 1990s in Australia which saw double digit unemployment. This was because by the late 1970s inflation expectations in the US as measured by the University of Michigan consumer survey were running around 10% following years of very high inflation making it harder to get inflation down. Australia was likely similar.

8. Governments should focus on the supply side. The practical inability of governments to adjust fiscal policy much to control inflation means the best it can do in the short term is not add to the problem and this means reducing budget deficits and limiting new spending. Longer term there is a lot that government can do to help control inflation and its all about supply side reform to make the economy work more smoothly, ie deregulate, cut back government and competition reforms. Unfortunately, the political appetite for such reforms is low.

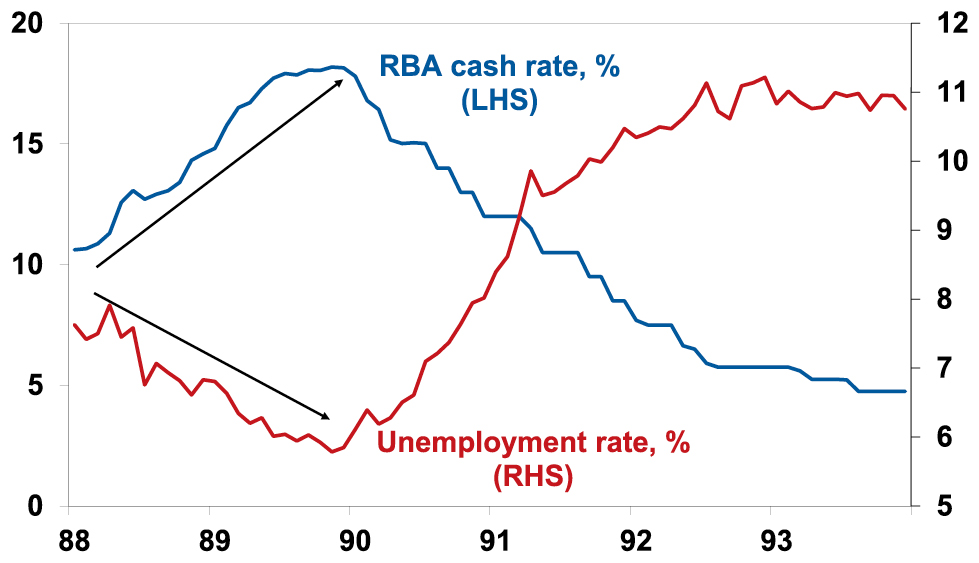

9. Monetary policy operates with a lag. The early 1990s recession showed monetary policy works with a lag. This seems contradictory to the fourth point above but highlights the risk of overtightening. The lags arise as it takes time for rate hikes to be passed on to borrowers, that to slow spending and then for slower demand to lead to less employment and the flow on of this back to households and for all of this to cool inflation. This can take 12 months or more. So just looking at inflation and jobs data can be misleading as they are lagging indicators. In the late 1980s the RBA kept hiking and unemployment kept falling. But by early 1990 it was clear it had gone too far.

RBA rate hikes & unemployment in the late 1980s/early 1990s

Source: ABS, RBA, AMP

So what does it all mean for today?

The good news is that this is not 1980 and more like the early 1970s: inflation expectations are low; there is no evidence of a wage price spiral, notably in Australia; supply bottlenecks, freight costs and surging money supply which led inflation are now reversing; and high household debt ratios compared to the 1970s should make monetary policy more potent. But the lessons from the 1970s explain why central banks are so fearful of letting inflation get out of control and also the difficult balancing act facing them. As RBA Governor Lowe said they “are managing two risks…not doing enough [resulting in high inflation persisting & proving costly later] [and] that we move too fast, or too far” and trigger recession. Balancing these two risks is seen as resulting in a narrow path to low inflation and the economy continuing to grow. But what is too much or too little tightening is a judgement call. The RBA’s view has become more hawkish after the December quarter CPI and is signalling at least two more rate hikes and money markets and the consensus of economists have moved to reflect this with consensus rate expectations rising above 4%. Our view is that the RBA risks doing too much given the high vulnerability of a significant minority of indebted Australian households and that the impact of past rate hikes is just being masked by normal lags accentuated by revenge spending associated with reopening. Signs of slowing consumer spending and jobs growth along with there still being no evidence of a wages breakout in Australia are consistent with this. As such, it risks a re-run of the late 1980s/early 1990s experience where Australia was inadvertently knocked into a deep recession as the lagged impact of rate hikes took time to show up. So, while we believe rates are close to the top, the RBA’s tough guidance means that the risks are skewed to the upside. Further evidence of a slowing consumer and jobs data are necessary to cause the RBA to rethink so upcoming retail sales and jobs data are critical in this.

So what does it all mean for today?

The good news is that this is not 1980 and more like the early 1970s: inflation expectations are low; there is no evidence of a wage price spiral, notably in Australia; supply bottlenecks, freight costs and surging money supply which led inflation are now reversing; and high household debt ratios compared to the 1970s should make monetary policy more potent. But the lessons from the 1970s explain why central banks are so fearful of letting inflation get out of control and also the difficult balancing act facing them. As RBA Governor Lowe said they “are managing two risks…not doing enough [resulting in high inflation persisting & proving costly later] [and] that we move too fast, or too far” and trigger recession. Balancing these two risks is seen as resulting in a narrow path to low inflation and the economy continuing to grow. But what is too much or too little tightening is a judgement call. The RBA’s view has become more hawkish after the December quarter CPI and is signalling at least two more rate hikes and money markets and the consensus of economists have moved to reflect this with consensus rate expectations rising above 4%. Our view is that the RBA risks doing too much given the high vulnerability of a significant minority of indebted Australian households and that the impact of past rate hikes is just being masked by normal lags accentuated by revenge spending associated with reopening. Signs of slowing consumer spending and jobs growth along with there still being no evidence of a wages breakout in Australia are consistent with this. As such, it risks a re-run of the late 1980s/early 1990s experience where Australia was inadvertently knocked into a deep recession as the lagged impact of rate hikes took time to show up. So, while we believe rates are close to the top, the RBA’s tough guidance means that the risks are skewed to the upside. Further evidence of a slowing consumer and jobs data are necessary to cause the RBA to rethink so upcoming retail sales and jobs data are critical in this.

Source: AMP Capital February 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.