Introduction

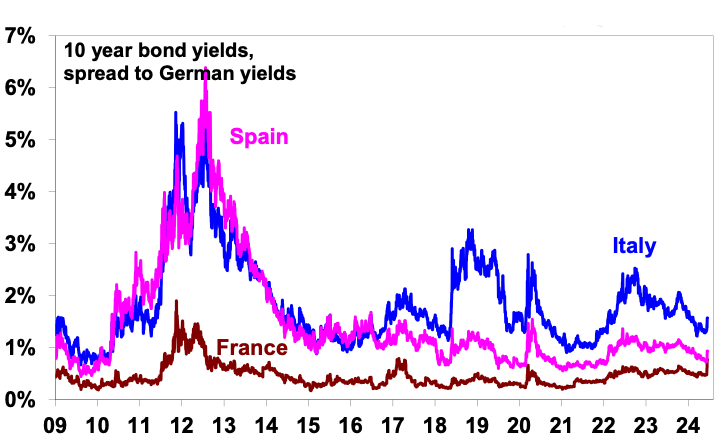

Since the European Union parliamentary election results were released just over a week ago, seeing a rise in support for far-right parties and French President Macron’s surprise decision to call parliamentary elections, Eurozone shares have had a fall of 4.2%, French shares fell 6.2% and the gap between the French and German 10 year bond yields has increased by 29 basis points indicating that investors are demanding an increased premium to hold French debt. In fact, the gap between French and German 10 year bond yields is back to levels last seen around the 2017 French presidential election. There has also been some flow on to Italian and Spanish bond yields, the Euro and global and Australian shares, although strength in tech shares continued to support US shares.

French, Italian and Spanish bond yield spreads up

Source: Bloomberg, AMP

So why all the fuss? Put simply investors are fearful that far-right success could lead to more populist policies, greater economic uncertainty and a fear that a far-right win in the French election could ultimately threaten a breakup of the Eurozone which, if it occurs, would plunge the world’s third biggest economic region (i.e. the 20 countries in the Eurozone) into financial chaos & possible recession, which would weigh on global growth.

Of course, the fears of a breakup of the Eurozone was a recurring soap opera through the last decade with recurring crises in Greece, Spain and Italy and worries around French elections which saw the far right Marine Le Pen in run-off elections against the centrist Macron all leading to fears that any one of them could leave the Euro (with a Grexit, Itexit, Frexit, etc) triggering a contagion of countries seeking to leave. Investment markets threatened to make this self-fulfilling by pushing up relative bond yields in countries perceived to be vulnerable on the grounds that if they leave, the Euro bond holders will be paid back in a devalued Drachma, Lira, Francs etc. The crisis peaked in 2012 after various measures to strengthen European integration and the ECB’s commitment to “do whatever it takes to preserve the Euro” which was backed by various policy tools that could be triggered at times of instability in bond markets. But ever since then there has been various flareups, such as around Greek, Italian, Spanish and French elections. The British decision to leave the EU also briefly added to such fears although less so as Britain was not in the Euro.

That such fears keep arising reflects the fundamental flaw in the Euro. Having a monetary union without common budgetary policies is problematic and differences in competitiveness, work ethics and savings are immense across Europe. But how serious is the current threat and what are the implications of the rise of the far-right in Europe?

The EU elections – less dramatic than portrayed

The current concerns started with the EU parliamentary election that saw a rise in support for far-right parties that support less immigration, less rationalist economic policies and tend to be more nationalist. However, their success was less than feared. Right-wing parties certainly saw a rise in support but their proportion of seats in the new parliament only rose from 19.6% to 22%. See the next table. The rise in support for populist parties in this case on the right does point to a bias towards more protectionist policies, a crackdown on immigration and slower progress towards climate action. But this shouldn’t be exaggerated. Firstly, the centrist parties remain dominant with 63% of EU parliament seats which suggests little substantive change in EU policies or support for the Euro.

Seats in the European Parliament

|

|

Outgoing parliament |

New parliament |

|

Left |

5 |

5 |

|

Greens |

10 |

7 |

|

Social democrats |

20 |

19 |

|

Renew (Liberals) |

14 |

11 |

|

EPP (Conservatives) |

25 |

26 |

|

Unaffiliated (others) |

6 |

9 |

|

Unaffiliated (right-wing) |

3 |

3 |

|

ECR (right-wing) |

10 |

11 |

|

ID (right-wing) |

7 |

8 |

|

Centrist parties incl Greens |

69 |

63 |

|

Right-wing parties |

20 |

22 |

May not add to 100% due to rounding. Source: Deutsche Bank, AMP

Secondly, EU elections are often seen as opportunities for a protest vote – given issues around the cost of living and immigration. This is arguably magnified as the elections are not compulsory with 51% turnout which is below most national elections, which means the voters are often more motivated and lean more extremist than the wider population – and so won’t necessarily translate to elections at the national level.

Finally, it should be noted that unlike the fascists of the 1930s, European far-right parties – such as National Rally in France, the Party for Freedom in the Netherlands, the Brothers of Italy and Fidesz in Hungary – are similar on immigration and nativism but have very different views on things like the Euro, NATO, Ukraine, and economic policies.

French parliamentary elections – a far bigger risk

Of course, things are a little different in France with the success of Le Pen’s National Rally which received more than double the 15% or so share of votes that President Macron’s Renaissance Party received in the EU election, prompting Macron to call parliamentary elections. This would see Macron remain President (until 2027 when his term expires, and he can’t run again) but could see him lose control of the government and domestic policies compared to the current centrist alliance he relies on to govern. This election is three years ahead of when its due and is an attempt by Macron to force the French people to choose between the far right and more centrist forces now or alternatively if National Rally is able to form a government, then hope that their extreme policies will work against them and see the electorate swing back to the centre by 2027.

The first round of the election is on 30 June with run-off elections on 7 July. The first round often sees more than 10 candidates in each electorate with only those receiving support from more than 12.5% of registered voters moving to the second round where the winner is the one who gets the most votes (which does not necessarily mean a majority). In theory this can make it easier for extremist parties to win but centrist parties often coordinate to drop those with the least chance in the second round. The EU election suggests that the far-right National Rally has a chance to form government in its own right or with an alliance with other right-wing parties. But French polls are not decisive, and another broad centrist alliance could be the outcome. But it’s a close call.

A far-right National Rally led government could go two ways:

-

It might go hard to implement its policies to cut tax on energy, exit the EU electricity market, unwind Macron’s pension & other reforms and be less compliant with EU fiscal rules. This could set up conflict with the European Commission, result in an adverse market reaction and eventually set France on a path to exit the Euro. This would be bad for markets but could play into Macron’s strategy with the turmoil leading to National Rally’s rejection in the 2027 elections.

-

Or it might follow a similar path to Italy’s PM Meloni from the Brothers of Italy and come down hard on social issues like immigration but adopt market-friendly EU compliant economic policies with the hope that it wins the presidency in 2027.

Of course, markets have no way of knowing the election outcome and which way it will go so the uncertainty is weighing. With France at the centre, along with Germany, of the EU and the Euro, anything that threatens its commitment is a big concern. However, there are reasons for optimism that a return to a full-blown Eurozone crisis will be averted and the Euro will yet again survive without a series of exits.

-

First, the commitment to the European Union and the Euro is very strong. While the Euro is flawed economically, it’s part of a grand political vision that’s led to a long period of peace across Europe and rapid growth in prosperity that neighbouring countries envy. As a result, most European politicians don’t want to give up on what has been a successful political journey towards a more united Europe. Particularly at a time of increasing geopolitical threats from Russia and a less certain commitment from the US. So European leaders will likely continue to find a way to make the economics work.

-

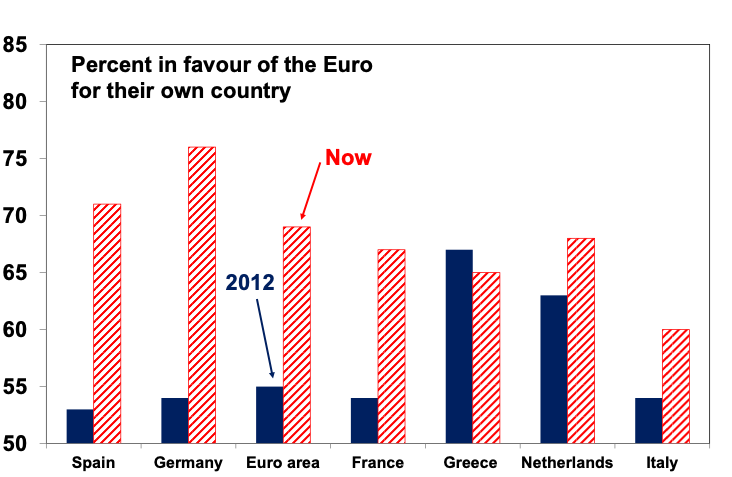

Second, consistent with this, public support for the Euro is high with 67% of the French and 69% of people in the Eurozone agreeing that the Euro is a good thing for their country. In contrast to the British, Europeans are far more likely to see themselves as European in addition to citizens of their own country.

Public support for the Euro is generally high

Source: Eurobarometer, AMP

-

Thirdly, knowing this most, far-right parties including Le Pen’s National Rally have dropped leaving the Euro from their policies as it’s not popular and prevents them from achieving broad support.

-

Fourthly, surging bond yields will likely influence any National Rally government to modify its less market friendly economic policies.

-

Finally, the ECB retains its tools to stabilise national bond markets if there is a threat to the application of its monetary policy across Europe.

While investment markets are nervous and a far-right win in the French elections could see that nervousness rise further before it falls, a return to the crisis days of last decade and a serious threat to the Euro is unlikely. In this regard, it’s noteworthy that bond spreads to Germany, including in France, are well below 2012 extremes, as evident in the first chart.

More bigger government and deglobalisation

However, at a broader level, the modest success of the far-right parties in the EU elections is consistent with a backlash seen against free market economic policies that has been building since the GFC. The political pendulum is continuing to shift towards more protectionism, industrial policies, tougher immigration and bigger government and slower progress towards net zero carbon emissions. This has been seen in the last month in the US and EU’s moves to impose higher taxes on some imports from China (notably on electric vehicles) and in the Future Made in Australia policies. While the economic impact of each move on their own is minor (e.g. the 17-38% tariffs on Chinese EVs in the EU will only have a minor impact on European inflation as they are just 0.4% of all EU imports), taken together they will mean slightly slower growth in living standards and slightly more inflation prone economies over time.

Implications for investors

The uncertainty around the French election adds to geopolitical uncertainty and reinforces our view that share market returns over the remainder of this year will be constrained and volatile and that bonds will rally. The ongoing rise in support for populist policies is likely to also constrain medium term returns. That said, the far-right is still far from dominant, and we continue to see reasonable returns from shares this year as central banks move to cut interest rates, at varying paces.

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

Source: AMP Capital June 2024

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.