Introduction

This year has seen a growing concern that central banks are out of ammo when it comes to reinvigorating global growth and preventing deflation. And the Reserve Bank of Australia’s latest rate cut has some fearing that it’s going down the same “failed path” as other major central banks. But is it really that bad? Have central banks really failed? Are they really out of ammo?

Why did the RBA ease again?

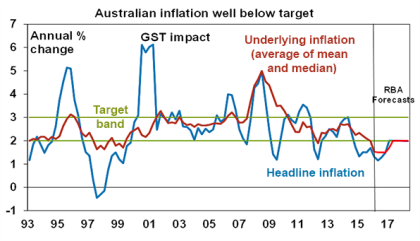

The latest RBA rate cut, which took the official cash rate to a record low of 1.75%, surprised many because recent economic data in Australia has been OK. But the reason for the cut is simple. Inflation has fallen well below the RBA’s 2-3% target, the weakness in prices was broad based and inflation is expected by the RBA to remain below target or at the low end of the target for some time.

Source: ABS, RBA, AMP Capital

Naturally, the RBA worried that if it didn’t provide more stimulus to the economy low inflation could become entrenched and could give way to deflation. With the $A pushing up towards $US0.80 prior to the cut and the Fed continuing to delay rate hikes, the RBA was no doubt also concerned that if it didn’t ease the $A would push even higher, putting more downwards pressure on inflation.

Why not just lower the inflation target?

Since the last RBA cut, some have said that the RBA should just lower its inflation target because it cannot fight falling global commodity prices and what’s wrong with very low inflation anyway. This reminds me of a similar argument back in 2007-08, when inflation had pushed above 4%, that the RBA should not worry but just raise its inflation target as it cannot fight rising global commodity prices. Such arguments are nonsense.

First, the whole point of having an inflation target is to anchor inflation expectations. If the target is just raised or lowered each time it looks like being seriously breached then those expectations – which workers use to form wage demands and companies use in setting wages and prices – will simply move up or down depending on which way the target is changed. And so inflationary or deflationary shocks from things like commodity prices will turn into permanent shifts up or down in inflation. Second, there are problems with allowing too-low inflation. Most central bank inflation targets are set at 2% or so because statistical measures of inflation tend to overstate actual inflation by 1-2% because statisticians have trouble actually adjusting for quality improvements and so some measured price rises really reflect quality improvements. In other words, 1.5% inflation could mean we are actually in deflation. And there are problems with deflation – see below.

How far will the RBA cut rates?

To the extent that the minutes from the RBA’s May meeting indicate the RBA had considered “waiting for more information”, it may choose to sit tight at its June meeting. However, given the downside risks to inflation, particularly with wages growth falling to a record low 2.1%, constrained growth and the still high $A more rate cuts are likely. We are allowing for two more rate cuts this year, taking the cash rate to 1.25% by year end.

What’s wrong with falling prices (deflation) anyway?

Deflation refers to persistent and generalised price falls. It occurred in the 1800s, 1930s and the last 20 years in Japan. Most people would see falling prices as good because they can buy more with their income. However, deflation can be good or bad depending on the circumstances. In the period 1870-1895 in the US, deflation occurred against a background of strong economic growth, reflecting rapid productivity growth and technological innovation. This can be called “good deflation”. However, falling prices are not good if they are associated with falling wages, rising unemployment, falling asset prices and rising real debt burdens. For example, in the 1930s and more recently in Japan. This is “bad deflation”.

In the current environment of high debt levels, sustained deflation could cause big problems. Falling wages and prices would make it harder to service debts. Lower nominal growth will mean less growth in tax revenues making high public debt levels harder to pay off. And when prices fall people put off decisions to spend and invest, which could threaten economic growth. This could risk a debt deflation spiral of falling asset prices and falling incomes leading to rising debt burdens, increasing defaults, spurring more falls in asset prices, etc. There are good reasons why central banks want to avoid that.

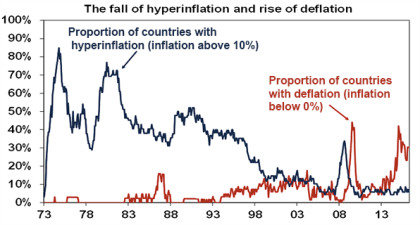

As can be seen in the next chart, there are still more countries experiencing deflation than hyperinflation.

Source: Thomson Reuters, AMP Capital

What has been driving deflation?

Several factors have driven the plunge in global inflation and some countries dipping into deflation: commodity prices have been in a downtrend since 2011 as their supply surged; and the sub-par global recovery since 2009 means the world has plenty of spare capacity. Global economic activity is around 2.5% below potential. Excess capacity means companies lack pricing power and workers lack bargaining power.

But are rate cuts actually working?

Some worry that rate cuts have just made things worse by cutting into the spending power of retirees and forcing those nearing retirement to save more. However, there are several points to note in relation to this. First, the level of household deposits in banks in Australia at around $0.9 trillion is swamped by the level of household debt at $2.2 trillion. So the household sector is a huge net beneficiary of lower interest rates. Second, the responsiveness to changes in spending power for a family with a mortgage is far greater than for retirees. Third, the proof is in the pudding. The fall in interest rates has helped the economy rebalance as mining investment has collapsed: first via a pick-up in housing construction and more recently via growth in consumer spending of close to 3% per annum (pa). While those close to retirement may be saving more because of lower investment returns, the household saving rate overall has drifted down from 11% to around 8% since the first RBA rate cut in late 2011. And of course RBA rate cuts have helped push the $A lower. So overall, rate cuts do work.

Have non-traditional monetary policies failed?

This is a relevant question with many saying that zero interest rates and quantitative easing in developed countries have not worked. But actually in the US they have as growth there has been averaging around potential at 2% pa, unemployment has fallen from 10% to below 6%, wages look to be picking up and underlying inflation is close to the Fed’s 2% inflation target. Sure, the Eurozone and particularly Japan are less clear but this may be because they waited too long before acting by which time low inflation or deflation had become entrenched. The lesson from this is that central banks need to act quickly and not that non-traditional monetary policy doesn’t work.

Are central banks out of ammo?

This is a common concern. However, central banks are a long way from being unable to do anything: the Fed can reverse last year’s interest rate hike and launch another round of quantitative easing if needed; and both the ECB and Bank of Japan could expand their quantitative easing programs further both in terms of size and the type of assets. More negative interest rates are an option but central banks are wary of this after the adverse impact of Japan’s experience regarding negative rates.

The ultimate option is for central banks to provide direct financing of government spending or tax cuts using printed money. This is often referred to as “helicopter money”. Unlike quantitative easing, which requires banks to lend their newfound cash to borrowers who want to borrow, it would yield an almost guaranteed response as the recipients of government spending/tax cuts will spend at least some of it. It won’t add to government debt either. As the examples of Zimbabwe and the Weimar Republic demonstrate, such an approach would make no sense if supply is constrained relative to demand and inflation is already high and rising. But that is not the case now and deflation remains the main threat, not inflation.

Of course none of these are an issue for the RBA as it still has plenty of scope to cut interest rates if needed.

Ideally, central banks should be getting more help from governments in terms of fiscal stimulus and supply side reforms but there are all sorts of constraints around this.

Implications for investors?

There are a number of implications for investors. First, while the worst may be over in terms of commodity price falls so the threat from deflation may be receding globally, the risk remains thanks to spare capacity and low wages growth, so low interest rates will remain in place for some time. While the Fed may continue down its path of gradual rate hikes, elsewhere rates are likely to stay low and, in Australia, fall further. Australian term deposit rates at around 2% are at their lowest since the early 1950s. So don’t expect great returns from them.

Second, given the absence of significant monetary tightening, a 1994-style bond crash remains as distant as ever. The most likely outcome is just low returns from government bonds.

Third, the low interest rate environment means the chase for yield is likely to continue supporting commercial property, infrastructure and shares offering sustainable high dividends.

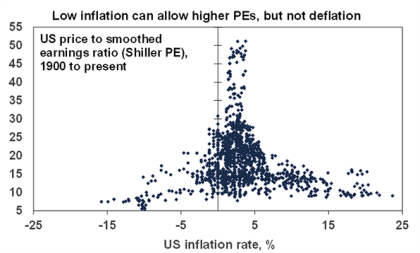

Finally, as can be seen in the next chart, low inflation is generally good for shares as it allows shares to trade on higher price to earnings multiples. But it would be preferable not to see low inflation slip into deflation as this could be bad for shares given it tends to go with poor growth and profits and as a result shares trade on lower PEs. The same would apply to assets like commercial property and infrastructure.

Source: Global Financial Data, Bloomberg, AMP Capital

So, combined with the social damage that a bout of debt deflation could cause, I would much prefer to see central banks continue to do all they can to avoid deflation.

Source: AMP Capital

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.