Ever since the mining boom ended several years ago it seems a sense of gloom has pervaded debate regarding Australia. There is constant talk of recession whether we don’t do something (like control the budget) or even if we do nothing (with reports titled “Australian Recession 2016 – Why it’s unavoidable and the quickest way to protect your wealth”). This sense of gloom makes me wonder whether it could be harming us – by dulling innovation, investment and a “can do” spirit. This note looks at seven reasons for optimism on Australia.

There is always something to worry about

To be sure Australia does have its problems. Unemployment at 5.7% and labour underutilisation at over 14% are too high. Housing is too expensive, the Sydney and Melbourne property markets are too hot, we are likely to see an oversupply of apartments and household debt levels are very high. The biggest boom in our history has ended, hitting investment and national income. Given this the $A is arguably still too high. Profits of listed companies fell around 7% over the last financial year. Wage growth and inflation are arguably too low for comfort. And we seem to be in perpetual political grid lock with a difficult Senate and no political ability to control the budget and undertake hard economic reforms.

But these worries are well known and have been done to death. Of course there is always something to worry about, but the endless whinging we hear in Australia leaves the impression we are in a constant state of crisis & distracts from the good news.

Seven reasons for optimism on Australia

There are in fact several reasons for optimism on Australia.

-

First, economic growth is pretty good with the economy expanding 3.1% over the year to the March quarter and looking similar for the June quarter. This is in line with Australia’s long term average. It’s also way above most other advanced countries. Latest annual GDP growth rates are 1.2% in the US, 1.6% in the Eurozone and 0.6% in Japan. Of course I could add that the economy hasn’t had a recession in over 25 years, but that one gets a bit overdone and owes a little bit to luck with statistics!

-

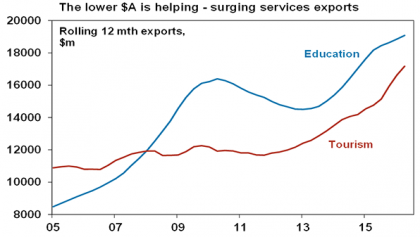

Second, the economy has rebalanced. The slump in mining investment and national income due to the collapse in our export prices has been offset by a surge in housing construction, solid consumer spending, a pick-up in services exports and a surge in resource export volumes.

Source: ABS, AMP Capital

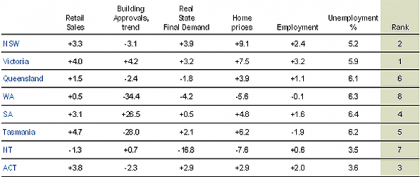

As a result of all this, post mining boom weakness in WA & NT is being offset by strength in NSW and Victoria as the much talked about two speed economy has just reversed.

State of the states, annual % change to latest

Source: ABS, CoreLogic, AMP Capital

The bottom line is that the recession many said was inevitable as a result of the mining bust hasn’t happened.

-

Third, the worst of the slump in commodity prices and mining investment looks to be behind us. After sharp falls from their highs around the turn of the decade global prices for iron ore, metals and energy have stabilised as greater balance has started to return to commodity markets and the $US has stopped surging higher. While a new commodity price boom is a long way away the stabilisation should help our terms of trade and national income.

-

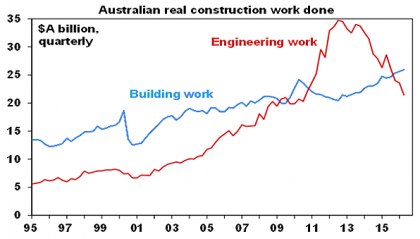

Furthermore, after falling for three years from a peak of 7% of GDP, mining investment intentions indicate that mining investment will have fallen back to around its long term norm of around 1-2% of GDP by mid next year. Reflecting the slump in mining investment, engineering construction has now fallen back to near its long term trend indicating that the wind down in the mining investment boom is almost complete and that it will be less of a drag on growth next year. This is important because the slump in mining investment has been knocking 0.5 to 1 percentage points of annual GDP growth over the last three years.

Source: ABS, AMP Capital

-

Fourth, public infrastructure investment is ramping up strongly. This is partly driven by former Federal Treasurer Joe Hockey’s Asset Recycling Initiative that is seeing new state infrastructure spending particularly in NSW and the ACT financed from the privatisation of existing public assets. The upshot of a fading growth drag from mining investment and rising public capital spending is that it will offset the inevitable slowing in housing construction that we will see next year.

-

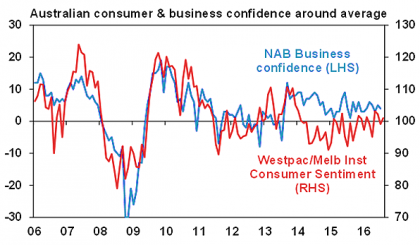

Fifth, despite all the gloom consumer and business confidence are actually around their long term averages. Would be nice to be higher but it ain’t bad.

Source: National Australia Bank, Westpac/MI, AMP Capital

-

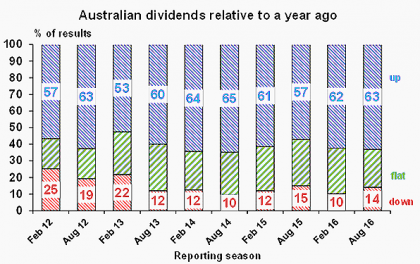

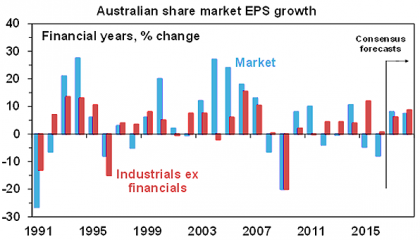

Sixth, share market profits have likely bottomed. 2015-16 was not great for listed company profits with earnings per share down around 8% driven by a 47% slump in resources profits and a 4% fall in bank profits. But it is notable that 62% of companies have seen their profits rise on a year ago and the typical or median company has seen profit growth of around 4%. 54% have seen their share price outperform the market the day results were released which suggests results haven’t been worse than expected. While aggregate dividends fell 10% mainly due to a cut in resources company dividends (which were never sustainable anyway), 86% of companies actually increased or maintained their dividends indicating that the median company is doing okay.

Source: AMP Capital

Overall profits are on track to return to growth in 2016-17 as the slump in resources profits reverses (thanks to higher commodity prices, cost and supply controls) and non-resource stocks see growth. 2016-17 earnings growth is expected to be around 8%.

Source: UBS, AMP Capital

-

Finally, there are lots of social reasons to be optimistic about Australia. For example, we are living longer, healthier lives – in fact we rank 4th in the world in terms of life expectancy (at 82.8 years). Our cities regularly rank amongst the world’s most liveable cities – with Sydney and Melbourne at 10 and 15 respectively according to one survey. Unlike many developed countries our population is still growing solidly and we seem to do a better job at integrating immigrants than many countries. We are not wracked by the problems of a sharp rise in inequality seen in the US and UK. Despite the usual post-Olympic whinging we outperformed all the other top 10 2016 Olympic medal winning countries with 1.2 medals per million people (with the UK being the closest at 1 and the US at just 0.4).

Implications for investors

While the RBA may still need to cut rates again to help push inflation back up and keep the $A down, there is good reason for optimism regarding the overall Australian growth outlook making our call for one more rate cut a close one. Either way it’s unlikely that Australia will need zero interest rates or quantitative easing. But the key for investors is that there is reason for optimism regarding the outlook for Australian assets (Sydney and Melbourne residential property aside). Shares are due a short term correction with the next few months seeing various global event risks, but the broad trend is likely to remain up.

Source: AMP Capital

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.