Housing matters a lot in Australia. Having a house on a quarter acre block is part of the “Aussie dream”. Housing is a popular investment destination. And the housing cycle is a key component of the economic cycle and closely connected to interest rate movements. But in the last 15 years or so it has taken on a darker side as a surge in house prices that started in the late 1990s has led to poor affordability and gone hand in hand with surging household debt. Reflecting this, predictions of an imminent property crash bringing down the Australian economy have been repeated ad nauseam since 2003. This note looks at the risks of a property crash, particularly given the rising supply of units, implications from the property cycle for economic growth and how investors should view it.

High house prices and high debt

The big picture view on Australian residential property is well known. First, Australian housing is expensive. According to the 2016 Demographia Housing Affordability Survey the median multiple of house prices in cities over 1 million people to household income is 6.4 times in Australia versus 3.7 in the US and 4.6 in the UK. In Sydney it’s 12.2 times and in Melbourne it’s 9.7 times. The ratios of house price to incomes & rents are at the high end of OECD countries and have been since 2003.

Second, the surge in home prices has gone hand in hand with a surge in household debt, which has taken Australia’s household debt to income ratio from the low end of OECD countries 25 years ago to now around the top. This can be seen in the next chart which shows the deviation in the house price to income ratio against its long term average for Australia against the ratio of household debt to income. The shift to overvaluation and high debt mostly occurred over the 1995-2005 period.

Source: OECD, RBA, AMP Capital

How did it come to this?

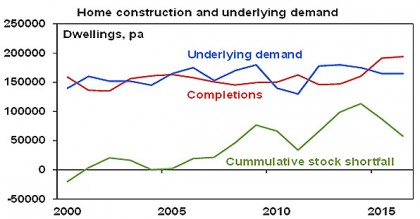

While it’s common to look for scapegoats to blame for high home prices and debt the basic driver looks to be a combination of the shift from high to low interest rates over the last 20-30 years which has boosted borrowing and buying power and the inadequacy of a supply response (thanks to tight development controls, restrictive land release and lagging infrastructure) to suppress the resultant rise in the ratio of prices to incomes. The following chart shows a cumulative shortfall of over 100,000 dwellings relative to underlying demand had built up by 2014.

Source: ABS, AMP Capital

A home price crash remains unlikely…

The surge in prices and debt has led many to conclude a crash is imminent. But we have heard that lots of times over the last 10-15 years. Several considerations suggest a crash is unlikely.

First, we have not seen a generalised oversupply and at the current rate we won’t go into oversupply until around 2017-18.

Second, despite talk of mortgage stress the reality is that debt interest payments relative to income are around 2004 levels.

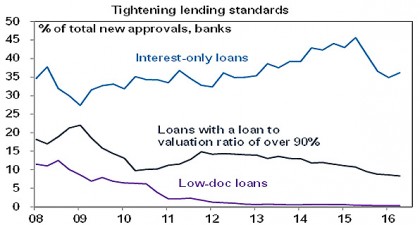

Third, Australia has still not seen anything like the deterioration in lending standards seen in other countries prior to the GFC. In fact in recent years there has been a decline in low-doc loans and a reduction in loans with high loan to valuation ratios.

Source: APRA, AMP Capital

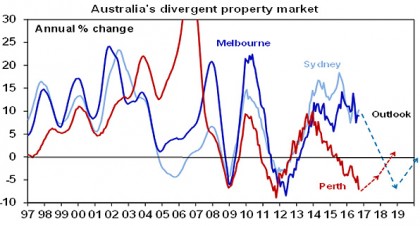

Finally, it is dangerous to generalise. While property prices have surged 60% and 40% over the last four years in Sydney and Melbourne, they have fallen in Perth to 2007 levels and have seen only moderate growth in the other capital cities.

…but the risks on the unit supply front are a concern

To see a property crash – say a 20% plus average price fall – we probably need to see one or more of the following:

-

A recession – much higher unemployment could clearly cause debt servicing problems. This looks unlikely though.

-

A surge in interest rates – but rate hikes are unlikely until 2018 and the RBA knows households are more sensitive to higher rates so it’s very unlikely rates will reach past highs.

-

Property oversupply – as noted above this would require the current construction boom to continue for several years.

However, the risks on the supply front are clearly rising in relation to apartments where approvals to build more apartments are running at more than double normal levels.

Source: ABS, AMP Capital

Due to the rising supply of units, vacancy rates are trending up & rents are stalling, making property investment less attractive.

Outlook

Nationwide price falls are unlikely until the RBA starts to raise interest rates again and this is unlikely before 2018 at which point we are likely to see a 5% or so pullback in property prices as was seen in the 2009 & 2011 down cycles. Anything worse would likely require much higher interest rates or recession both of which are unlikely. However, it’s dangerous to generalise:

-

Sydney and Melbourne having seen the biggest gains are more at risk and so could fall 5-10% around 2018.

Source: CoreLogic, AMP Capital

-

Price growth is likely to remain negative in Perth and Darwin as the mining boom continues to unwind but this should start to abate next year.

-

The other capitals are likely to see continued moderate growth and a less severe down cycle in or around 2018.

-

But units are at much greater risk given surging supply and this could see unit prices in parts of Sydney and Melbourne fall by 15-20% as investor interest fades as rents fall.

The property cycle and the economy

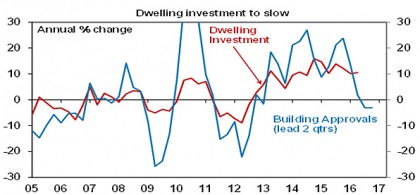

Slowing momentum in building approvals points to a slowdown in the dwelling construction cycle ahead. While this might be delayed into 2017 as the huge pipeline of work yet to be done is worked through, slowing dwelling investment combined with a slowing wealth affect from rising home prices mean that contribution to growth from the housing sector is likely to slow. However, as this is likely to coincide with a fading in the detraction from growth due to falling mining investment and commodity prices it’s unlikely to drive a slowing in the economy.

Source: ABS, AMP Capital

However, a likely decline in rents (as the supply of units hits) will constraint inflation helping keep interest rates low for longer.

Implications for investors

There are several implications for investors:

-

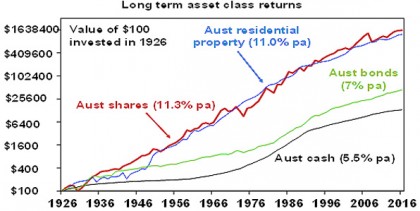

Firstly, over the very long term residential property adjusted for costs has provided a similar return to Australian shares. Its low correlation with shares, lower volatility but lower liquidity makes it a good portfolio diversifier with shares. So there is clearly a role for property in investors’ portfolios.

Source: ABS, REIA, Global Financial Data, AMP Capital

-

Secondly, there remains a case to be cautious regarding housing as an investment destination for now. It is expensive on all metrics and offers very low income (rental) yields compared to other growth assets. This means a housing investor is more dependent on capital growth.

-

Thirdly, these comments relate to housing in aggregate and right now it’s dangerous to generalise. Apartments in parts of Sydney & Melbourne are probably least attractive but for those who want to look around there are pockets of value.

-

Finally, investors need to allow for the fact that they likely already have a high exposure to Australian housing. As a share of household wealth its nearly 60%. Once allowance is made for exposure via Australian shares it’s even higher.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.