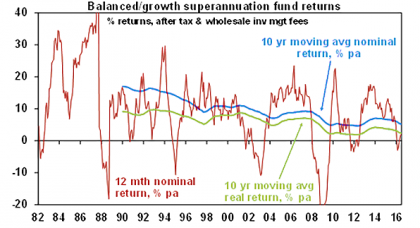

While the high inflation of the 1970s and early 1980s was bad for investment returns at the time, it left a legacy of very high investment yields which helped set the scene for high investment returns through the 1980s and 1990s. Back in the early 1980s the RBA’s “cash rate” was averaging around 14%, 3 year bank term deposit rates were around 12%, 10 year bond yields were around 13.5%, commercial and residential property yields were running around 8-9% and dividend yields on shares were around 6.5% in Australia and 5% globally. Such yields meant investments were already providing very high cash income. So for assets like property or shares only modest capital growth was necessary to give good returns. As a result, back then the medium term (5-10 year) return potential from investing was solid. In fact most assets had spectacular returns in the 1980s and 1990s. Australian superannuation funds saw returns average 14.1% pa in nominal terms and 9.4% pa in real terms between 1982 and 1999 (after taxes and fees).

Source: Mercer Investment Consulting, Morningstar, AMP Capital

But since the early 1980s the starting point in terms of investment yields has been moving progressively lower, resulting in slowing 10 year average nominal and real returns for superannuation funds as seen the chart above. Today the RBA cash rate is just 1.5%, 3 year bank term deposit rates are just 2.6-3%, 10 year bond yields are just 1.9%, gross residential property yields are around 3% and while dividend yields are still around 6% for Australian shares (with franking credits) they are around 2.5% for global shares. This note looks at the medium term return potential from major assets and the implications for investors.

Potential return drivers

In getting a handle on potential medium term returns from an asset class the key is its starting point valuation. For example, if current yields – say bond yields and dividend yields – are lower than “normal” then this will likely constrain returns relative to the past. Investment returns have two components; capital growth, and yield (or income). The yield is the most secure component and generally speaking, when you start your investment the higher it is the better. So our approach to assessing medium term return potential is to start with current yields for each asset class and apply simple and consistent assumptions regarding capital growth. We prefer to avoid a reliance on forecasting and to keep the analysis as simple as possible. Complicated adjustments just lead to compounding forecasting errors.

-

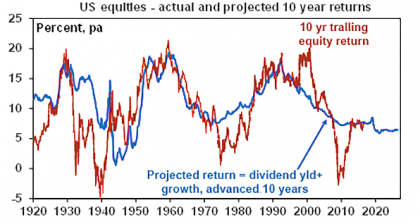

For equities, a simple model of current dividend yields plus trend nominal GDP growth (as a proxy for earnings and capital growth) does a good job of predicting medium term returns. This approach allows for current valuations (via the yield) but avoids getting too complicated. The next chart shows this approach applied to US equities, where it can be seen to broadly track big secular swings in returns.

Source: Thomson Reuters, Global Financial Data, AMP Capital

-

For property, we use current rental yields and likely trend inflation as a proxy for rental and capital growth.

-

For unlisted infrastructure, we use current average yields and capital growth just ahead of inflation.

-

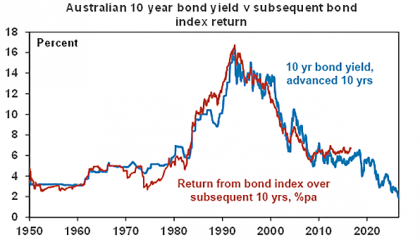

For bonds, the best predictor of future medium term returns is the current bond yield. If a 10 year bond is held to maturity its initial yield will be its return over 10 years. The close relationship between 10 year bond yields and subsequent returns from bonds is clear in the next chart.

Source: Global Financial Data, Bloomberg, AMP Capital

Projections for medium term returns

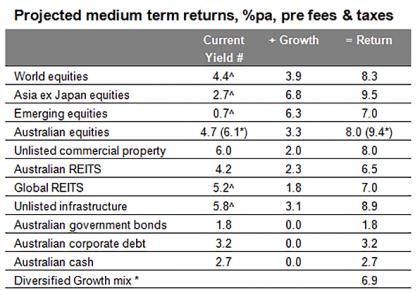

Return projections using this approach are shown in the next table. The second column shows each asset’s current income yield, the third shows their 5-10 year growth potential, and the final column their total return potential. Note that:

-

We assume central banks average around or just below their inflation targets, eg 2.5% in Australia & 2% in the US.

-

For Australia we have adopted a relatively conservative growth assumption below nominal GDP growth potential reflecting the headwind from weak commodity prices & the impact of this on resource sector profits & sales growth.

-

We allow for forward points in the return projections for global assets based around current market pricing – which adds 1.8% to the return from world equities.

-

The Australian cash rate is assumed to average 2.75% over the medium term. Cash is one asset where the current yield is of no value in assessing the asset’s medium term return potential because the maturity is so short. So we assume a medium term average. Normally for cash this would be around a country’s potential nominal growth rate, but we have adjusted for higher than normal bank lending rates relative to the cash rate and higher household debt to income ratios which have pulled down the neutral cash rate.

Combining the return projections for each asset indicates that the implied return for a diversified growth mix of assets has now fallen to 6.9% pa and is shown in the final row.

# Current dividend yield for shares, distribution/net rental yields for property and duration matched bond yield for bonds. ^ Includes forward points. * With franking credits added in. Source: AMP Capital

Megatrends influencing the growth outlook

Several themes are allowed for in our projections: slower growth in household debt; the backlash against economic rationalist policies of globalisation, deregulation and small government; rising geopolitical tensions; aging and slowing populations; low commodity prices; technological innovation & automation; the Asian ascendancy & China’s growing middle class; rising environmental awareness; & the energy revolution. Most of these are constraining nominal growth and hence investor returns. However, technological innovation is positive for profits and some of these point to inflation bottoming. (See “Megatrends…”, Oliver’s Insights, July 2016.)

Key things to note

Several things are worth noting from these projections.

-

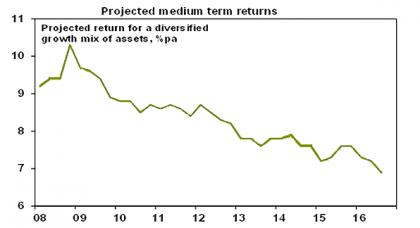

The medium term return potential using this approach continues to soften largely reflecting the rally in most assets of the last few years which has pushed investment yields lower. Projected returns using this approach for a diversified growth mix of assets has fallen from 10.3% pa at the low point of the GFC in March 2009 to 6.9% now.

Source: AMP Capital

-

The starting point for returns today is far less favourable than when the last secular bull market in shares and bonds started in 1982, due to much lower yields.

-

Government bonds offer low return potential thanks to ultra low bond yields.

-

Unlisted commercial property and infrastructure continue to come out well, reflecting their relatively high yields.

-

Australian shares stack up well on the basis of yield, but it’s still hard to beat Asian shares for growth potential.

-

The downside risks to our medium term return projections are referred to endlessly by financial commentators: namely that the world is plunged into another recession or that investment yields are pushed up to more normal levels causing large capital losses. The upside risks are (always) less obvious but could occur if global growth improves but inflation remains low which could see a continuing search for yield further pushing up capital values.

Implications for investors

There are several implications for investors:

-

First, have reasonable return expectations. The combination of low investment yields & constrained GDP growth indicate it’s not reasonable to expect sustained double digit returns. In fact, the decline in the rolling 10 year moving average of superannuation fund returns (first chart) indicates we have been in a lower return world for many years.

-

Second, allow that this partly reflects very low inflation. Real returns haven’t fallen as much and are still reasonable.

-

Third, using a dynamic approach to asset allocation makes sense as a way to enhance returns when the return potential from investment markets is constrained. This is likely to be enhanced by continued bouts of volatility.

-

Finally, focus on assets providing decent sustainable income as they provide confidence regarding future returns, eg; commercial property and infrastructure.

Source: AMP Capital

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.