Introduction

Since the global growth panic in January/February share markets and commodity prices have seen a decent rebound. and the stress in credit markets has receded. This has been helped by a combination of Fed assurances that it will not be reckless and ignore global risks in determining US interest rates, somewhat better economic data in the US and China, more monetary easing in Europe and a rebalancing in the global oil market that has allowed oil prices to stabilise which has helped reduce the risk of default by energy producers. However, the big question is whether it is sustainable or just a bounce. This note looks at the main issues.

Seasonal strife

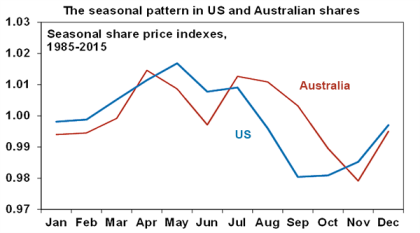

But let’s first take a look at seasonal patterns. It’s well known that the best time for shares is from November to May and that the worst time is from May to November. This can be seen in the next chart, which shows the seasonal pattern in share markets since 1985 (after removing the underlying rising trend).

Source: Bloomberg, AMP Capital

Most major share market falls have occurred in the May to October period: the 1929 crash; the 1987 crash; the post Lehman Brothers collapse; the various iterations of the Eurozone crisis; and last year’s share market falls around the September quarter. Hence the old saying “Sell in May and go away, come back on St Leger’s Day” still resonates.

The seasonal pattern appears to reflect some combination of tax loss selling by US mutual funds around the end of their tax year that sees them sell losing stocks around September in order to reduce their clients’ capital gains bill, followed by having to buy shares back in November, the investment of year-end bonuses, New Year optimism and the absence of capital raising over the Christmas/New Year period all serving to drive shares higher from around October/November, which then peters out around May giving way to weakness that’s accentuated by tax loss selling in the September quarter, etc. Of course this may not be the whole story because the seasonal pattern may date back to agricultural crop cycles which saw merchants withdraw their money from financial assets at the end of summer to pay for the summer crop and then having to reinvest into year end.

Reasons for short term caution

Apart from the risk of seasonal weakness in the months ahead, there are several risks in the short term.

-

The month or so ahead sees “event risks” with the June 14-15 Fed meeting “live” for consideration of another interest rate hike, the Brexit vote on June 23 with a “leave” vote likely to be taken badly for the UK and posing the more significant risk that it might trigger renewed debate about a break-up of the Eurozone, another Spanish election on June 26 where a left wing victory could be taken badly, and the Australian election on July 2 where the left/right divide seems more extreme than at any election since the 1970s.

-

Uncertainty around how much the Fed will ultimately hike will likely cause ongoing angst in terms of its impact on the US economy and globally if a rising $US dollar puts renewed pressure on commodity prices, emerging countries and the Chinese Renminbi.

-

Nervousness may rise in the run up to the US Presidential election in November if Trump continues to rise in the polls.

-

The global growth environment remains fragile and China remains a source of uncertainty.

-

The US share market while arguably the most at risk on some value measures had the smallest fall from its high last year to its low in February (-14% compared to 20% plus falls in other major share markets) so may have more work to do.

Seven reasons for optimism

However, against this there are reasons for optimism particularly beyond near term risks. First, some of the above mentioned risks may not be as threatening as they look:

-

Whether the Fed hikes in June or July, Fed Chair Janet Yellen and other key decision makers have repeatedly stressed that it takes account of global risks and that it is likely to be “gradual” in raising rates. In other words it won’t be reckless – the last thing the Fed wants is to prematurely snuff out US growth that it has spent so long to nurture.

-

Even if the UK vote is to “leave”, the response in Eurozone countries (of which the UK is not a member) may be more integration just as every other Eurozone crisis has driven.

-

Recent polls suggest non-centrist left wing parties won’t win enough support in the Spanish election to reverse the economic reforms the Spanish Government implemented.

-

The above mentioned risks are arguably well known and should be allowed for at least to some degree. After all most share markets are down on year ago levels. Remember the old saying “shares climb a wall of worry” which is certainly what they have done since February.

-

And it could be worse – the recent agreement between Greece and its creditors on its aid deal means that another Grexit scare is unlikely this summer.

Second, valuations for most share markets are not onerous. While price to earnings multiples for some markets are a bit above long term averages, valuation measures that allow for low interest rates and bond yields show shares to be cheap.

Source: Thomson Reuters, AMP Capital

Third, while the US share market may be vulnerable on some measures other share markets are not. Specifically if US shares are compared to a 10 year moving average of earnings (which is often referred to as a Shiller or cyclically adjusted PE) then they are a bit expensive and of course monetary conditions in the US are gradually tightening. However, the so-called Shiller PE is actually cheap for most markets globally including Eurozone, Chinese and Australian shares (see the next chart).

Source: Global Financial Data, AMP Capital

Fourth, global monetary conditions are very easy and likely to remain so, with further easing in Europe, Japan, Australia and probably China likely to ensure that liquidity conditions for shares and growth assets remain favourable.

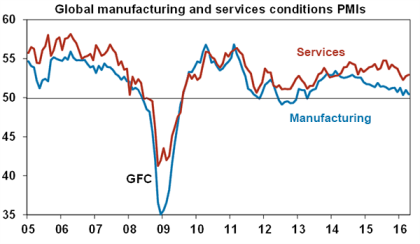

Fifth, there are no signs of a US, Australian or global recession. US economic growth appears to have picked up after a seasonal soft spot early this year, Chinese economic growth appears to have stabilised, global business conditions surveys or PMIs have slowed but are not pointing to anything approaching recession (see the next chart). Australia is continuing to grow with consumer spending, housing construction, a resurgence in services like tourism and higher education exports and booming resource export volumes (the third phase of the mining boom) keeping the economy going.

Source: Bloomberg, AMP Capital

This is very important. Ignoring the most recent fall, since 1900 there have been 17 bear markets in Australian shares (defined as a 20% plus falls). Of these 11 saw shares higher a year after the initial 20% decline with an average gain of 14%. Of course the remaining 6 pushed further into bear territory with average falls over the next 12 months, after having declined by 20%, of an additional 22.5%. Stockbroker Credit Suisse, albeit focussing only on the period from the 1970s, called these Gummy bears and Grizzly bears respectively.

Source: ASX, Global Financial Data, Bloomberg, AMP Capital

The big difference between them is whether there is recession (in Australia or the US) or not. Grizzly bears tend to be associated with recessions but Gummy bears tend not to be.

Sixth, if recession is avoided as appears likely, the profit outlook should start to improve. There are some pointers to this: US earnings are likely to have bottomed as the negative impact of the fall in oil prices and the rise in the $US has abated; and Australian earnings momentum will start to improve in the next financial year as the impact of last year’s plunge in commodity prices – which drove resource profits down 60% – falls out.

Finally, there still seems to be a lot of pessimism around. According to the American Association of Individual Investors bullish sentiment amongst US retail investors is 18%, less than half the long term average. The proportion of Australians interviewed by the Westpac/Melbourne Institute consumer survey who nominated shares as the wisest place for savings is just 7.6%, also half the long term average. This is positive from a contrarian perspective. As Warren Buffett advised, “Be fearful when others are greedy. Be greedy when others are fearful”.

Concluding comment

After a strong 12 to 14% rebound in share markets from the February lows we could be in for a rough patch over the months ahead. However, many of the current threats are well known and with most share markets offering reasonable value, global monetary conditions remaining easy, and no sign of the much feared recession, the trend in shares is likely to remain up.

Source: AMP Capital

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.