Introduction

Through the secular bull market in shares that went from 1982 through to 2000 (or up to 2007 in Australia) most asset classes did well and so getting the asset mix right – ie the relative exposure to each of the major asset classes like shares, bonds and cash – was seen as less important and many thought that actively managing it was too hard. This all changed with the GFC and its aftermath of messy markets providing a reminder of just how important asset allocation is. As a result the importance of asset allocation, and specifically active approaches to managing the asset mix over time, has made a comeback. See “The critical role of asset allocation”, Oliver’s Insights, March 2014 for a broader discussion around asset allocation.

However, in saying that actively managing asset allocation is important it also needs to be recognised that this can be very difficult for many investors and so rather than mess it up, the common view has been that for many it’s better to just adopt a long term strategy and stick to it. This note looks at this issue and in particular why investors need a rigorous approach to asset allocation if they are going to consider moving their asset mix around in relation to short term cyclical swings in markets. Let’s first go back to investing basics.

Investing 101

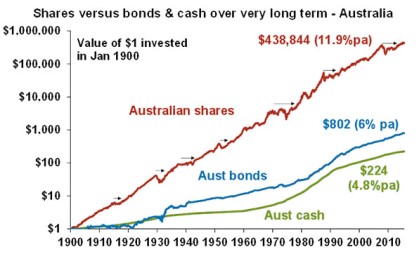

Investors should always be aware of two fundamentals: the power of compound interest and that there is always a cycle. The power of compound interest, which is basically the compounding of investment returns in one year on top of those earned in previous years, is demonstrated in the next chart which shows the value of $1 invested in 1900 in Australian cash, bonds and shares over time assuming that interest and dividends are reinvested along the way.

Source: Global Financial Data, AMP Capital

Whilst shares are more volatile than cash and bonds and can see significant periods of poor returns (shown with arrows in the chart), the compounding effect of their higher returns over time results in a much higher wealth accumulation from them. The average return since 1900 from Australian shares at 11.9% pa is only double that of Australian bonds at 6% pa but over the whole period $1 invested in shares would have compounded to $438,844 today versus only $802 if that $1 had been invested in bonds. Over all rolling 40 year periods and virtually all 20 year periods shares trump bonds and cash. This is basically the argument for a long term approach to investing.

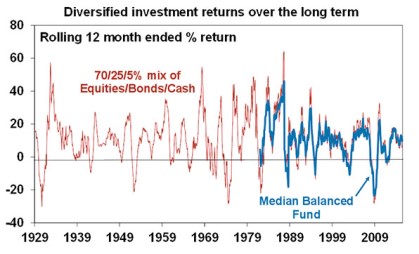

The problem is that there is always a cycle. Cycles encompass both secular malaises like those seen in the 1930s, 1970s and last decade for global shares that can last a decade or so before giving way to better times, and normal business cycles that result in three to five year cyclical swings in share markets. The impact of this can be seen in the following chart that shows returns from a diversified mix of assets back to the 1920s.

Traditional diversified investment portfolios that underpin many superannuation funds aim to reduce the volatility associated with shares and other growth assets by having some exposure to cash and bonds. But despite this the historical record indicates that traditional diversified portfolios (cash, bonds, property, equities, etc) have negative returns every six years or so. The next chart shows returns for balanced growth super funds since 1982. Since balanced super funds only came into existence thirty years ago, the chart also shows a simulated balanced fund going back to the late 1920s. This is constructed on the basis of 70 per cent in Australian equities, 25 per cent in Australian bonds and five per cent in cash. The chart excludes exposure to global assets and property as we do not have a long term monthly return series for these. In any case, going by the last 86 years it’s doubtful that it would change the pattern of returns dramatically.

Source: Global Financial Data, Mercer Investment Consulting, Morningstar, AMP Capital

It’s clear from the chart that, while the losses around 2008 through the GFC were extreme they were comparable to experiences in the 1930s and 1970s, and more broadly it’s clear that negative returns every few years are a normal cyclical phenomenon. Negative returns occurred in 1929-31 (Great Depression), 1938-39, 1941-42 (World War II), 1949, 1952, 1956, 1960-61, 1964-65, 1970-71, 1972-74 (oil crisis, stagflation, Watergate, etc), 1981-82, 1987-88 (share market crash), 1990, 1994 (bond crash) and 2001-03 (tech wreck, terrorist attacks), 2008 (GFC) and 2011 (Eurozone crisis). Equity market falls were a key factor in most of these episodes as were recessions.

But while cycles are normal, the problem with them is that they can throw investors out of a well thought out investment strategy that aims to take advantage of compounding long term returns and can cause problems for investors when they are in or close to retirement. Cycles also create opportunities for investors to enhance returns. So for these reasons cyclical variations in asset class returns ideally need to be managed.

A constrained and volatile return world

The case for adopting some sort of process to manage asset allocation is also highlighted by the likelihood that the return potential from major asset classes is now much lower than was the case say 30 years ago. This simply reflects the fall in cash rates, term deposit rates, bond yields and property yields and higher price to earnings multiples on shares. See “Where will returns come from?” Oliver’s Insights, May 2015. At the same time the return potential between asset classes is likely to be wide and volatility is likely to be relatively high reflecting high public debt levels, extreme monetary policy settings and a greater reliance now on the more volatile emerging world for global growth. So in this environment getting the asset mix right will be far more important than it was prior to the GFC.

You know AA ain’t easy

However, in highlighting the importance of actively managing the asset mix over time it’s worth recognising that it’s not easy. The temptation for many investors is simply to move in response to recent developments. So if returns have been bad for a while then a typical response is to reduce exposure to growth assets and vice versa when returns have been good. This approach is well grounded in findings from behavioural finance which shows that investors tend to down play uncertainty and project the current state of the world into the future and that this is reinforced by the “safety in numbers” aspect of crowd psychology. The problem though is that after a period of share market weakness this will just lock in the loss and will invariably result in lower long term returns.

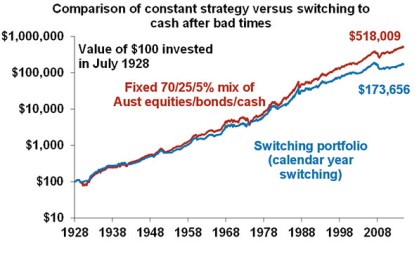

The following chart shows the cumulative return of two portfolios since July 1928.

-

A fixed balanced mix of 70 per cent Australian equities, 25 per cent bonds and five per cent cash as per the last chart;

-

a portfolio which starts off with the above but moves 100 per cent into cash after any negative calendar year and doesn’t move back until after the balanced portfolio has a calendar year of positive returns (assuming an investor will require a year of positive returns to get confident again). We have assumed a two-month lag. This is called the “switching portfolio”.

Source: Global Financial Data, AMP Capital

The switching strategy does produce better short term results when there are two consecutive calendar years of negative returns from the fixed balanced mix as in the early 1930s and mid-1970s. However, over the long run it produces an average return of 9% pa versus 10.3% pa for the balanced fund. On a $100 investment in 1928 the switching portfolio would have grown to $173,656 now compared to $518,009 for the constant balanced mix. (It doesn’t look so dramatic in the chart as I have used a log scale because otherwise it would just show two exponential curves.) Over the same period $100 invested in cash would have grown to $11,280 and $100 invested in bonds would have grown to $34,830. Out of interest while the constant balanced mix portfolio is now well above its pre GFC high, the switching portfolio is yet to fully recover.

The conclusions are clear. Over the long term, cash and government bonds will generate much lower returns than a diversified mix of assets and switching to cash after a bad patch is not the best strategy for maximising wealth over time. But many do. This leaves investors with two choices:

-

Adopt a long term strategy and effectively rely on the power of compound interest to deliver over time and look through short term cyclical swings. This is okay for true long term investors but maybe not for those with a shorter term focus.

-

Use a rigorous approach to dynamically vary the asset mix (ie what is increasingly referred to as dynamic asset allocation or DAA) in anticipation of cyclical swings.

The key underpinnings of a rigorous DAA approach

While investment cycles do not repeat precisely they do rhyme. Each cycle has common elements – eg, downswings in equities are usually preceded by shares becoming overvalued, over loved with investors piling into them and with tight monetary conditions threatening weaker economic conditions or a recession. These rhyming elements can be captured and combined to provide warning of swings in the cycle and hence are a solid foundation for a dynamic asset allocation process. This is our approach.

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.