Our view on the financial market turmoil has been covered in the last two Oliver’s Insights – except to add that central banks are now sounding more dovish. This started with the ECB which is now expected to ease at its March meeting and is also evident from the Fed which last night was less positive on the growth outlook and indicated it was monitoring recent economic and financial developments. The probability of a March Fed hike is now just 20% and rather than four Fed rate hikes this year I see only one or none. The Reserve Bank of NZ has also turned more dovish and I expect the RBA to do the same.

The one big surprise in the ongoing turmoil in financial markets is the role played by oil. Past experience tells us surging oil prices are bad and plunging oil prices are good. But that has not been the experience lately. It seems there is a positive correlation been oil prices and share markets (“shares down on global growth worries as oil plunges” with occasional “shares up as oil rallies as growth fears ease”). So what’s going on?

Why the oil price plunge?

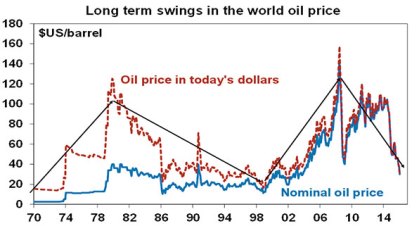

The oil price has collapsed because the global supply of oil has surged relative to demand. Last decade saw the price of oil go from $US10/barrel in 1998 to $US145 in 2008. After a brief plunge during the GFC it average around $US100 into 2014.

Black lines show long term bull & bear phases. Source: Bloomberg, AMP Capital

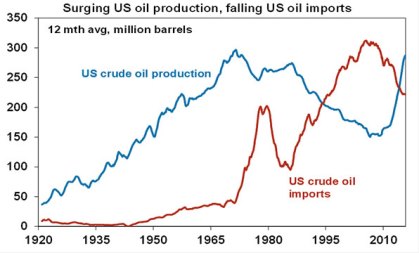

This sharp rise in the oil price last decade encouraged fuel efficiencies (use of ethanol, electric cars, etc) and more importantly encouraged the development of new sources of oil (offshore, US shale oil, etc) that were previously uneconomic.

Source: Bloomberg, AMP Capital

This is similar to what occurred in response to sharp rises in oil prices in the 1970s. But other factors are playing a role too:

-

Slowing emerging world growth. Chinese economic growth has slowed to around 7% compared to 10% or so last decade and more of this is now being accounted for by services and consumption so it’s less energy intensive.

-

Middle East politics – Iran coming back on stream this year and OPEC no longer functioning as a cartel but rather driven by Saudi Arabia’s desires to put pressure on Iran and assure its long term oil market share (by squeezing alternative suppliers and slowing the switch to alternative/more efficient energy sources).

-

Technological innovation has enabled some producers to maintain production despite the sharp fall in oil prices.

-

A rise in the $US, which has weighed on most commodities as they are priced in US dollars. However, the oil price has also plunged in euros, Yen and the $A.

Last year the world produced a near record 96.3 million barrels of oil a day, which was 1.8m more than was used. More broadly oil is just part of the commodity complex with all major industrial commodities seeing sharp price falls over the last few years.

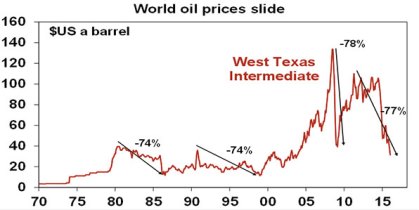

Are we near the bottom for the oil price?

How much further the oil price falls is really anyone’s guess. Oddly enough having fallen 77% from its 2011 high the plunge is similar to past falls after which supply started to be cut back (see the next chart). I suspect we have now reached or are close to the point where, baring a global recession, it will start to become self-limiting but the oil price could still push down to $US20/barrel which in today’s prices marked the lows in 1986 and 1998.

Source: Bloomberg, AMP Capital

At current levels, even oil futures prices are likely below the level necessary – thought to be around $US50/barrel – to justify new shale oil drilling in the US. And prices at these levels are seeing consumer demand in the US shift back to more gas guzzling vehicles. So I suspect we are near the bottom. By the same token the ease with which shale oil production can be brought back on stream and rapid technological innovation in alternatives suggests a cap is likely to be in place on oil prices during the next secular upswing (maybe around $US60).

Why has the oil prices plunge been a big negative?

There are several reasons why the negatives may have predominated this time around. First, Middle East oil producers consume more of their oil revenues now than in the past and so a collapse in the latter may have forced a cutback in their spending compared to oil price plunges of the 1980s & 1990s.

Second, consumers in developed countries are more cautious than in the past & so respond less to lower energy costs.

Third, the plunge in oil prices at the same time the US dollar has increased has added to the stress in many emerging countries, causing funding problems in such countries and raising fears of a default event in the emerging world.

Finally, much recent corporate borrowing in the US and growth in investment has come from energy companies developing shale oil. They are now under pressure leading to worries of a default event and causing a fall back in investment.

But will the negative impact continue to predominate?

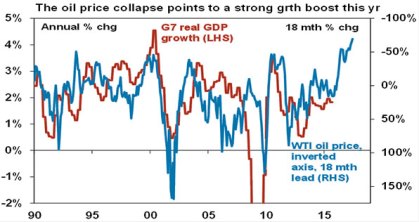

Many of these worries will persist but at some point the positive impact flowing from reduced business and consumer costs will become evident. The historical relationship indicates that the positive impact of lower oil prices and developed country growth takes a while to flow through, with the next chart suggesting the bulk of it is likely to show up this year.

Source: Deutsche Bank, Thomson Reuters, AMP Capital

Lower oil and energy prices also mean a usually one-off hit to inflation as the oil price level falls. This largely impacts headline inflation and is generally thought to be temporary. But the longer it persists the greater the chance that it will flow through to underlying inflation and inflation expectations. This is something that central banks are now grappling with as it makes it harder for them to get inflation back to their target levels, which in turn will mean low interest rates for longer.

What are the implications for Australia?

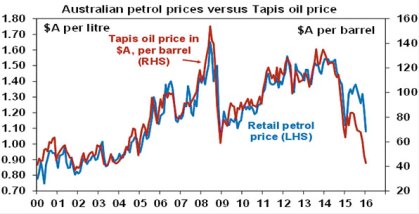

While Australia is a net oil importer, it is a net energy exporter which means that to the extent that lower oil prices flow through to oil and gas prices it means a loss of national income and tax revenue. For Australian households though lower oil prices mean big savings. The plunge in the global oil price adjusted for moves in the Australian dollar indicates average petrol prices should be around $0.90/litre (see next chart). While prices haven’t dropped this far – apparently due to high refinery margins based on Singapore petroleum prices – the price at the bowser is still well down on 2014 levels.

Source: Bloomberg, AMP Capital

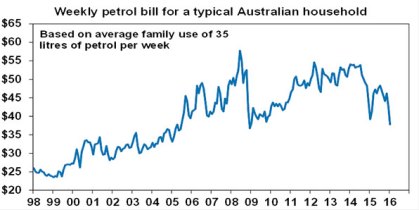

Current levels for the average petrol price of around $1.10/litre represent a saving for the average family petrol budget of around $14 a week compared to two years ago, which is a saving of $750 a year. Some of this saving will likely be spent.

Source: AMP Capital

What happened to “peak oil”?

Last decade there was much talk of an imminent “peak” in global oil production based on the work of Dr M. King Hubbert and that when it occurs it will cause all sorts of calamities ranging from economic chaos to “war, starvation, economic recession and possibly even the extinction of homo sapiens”. The film “A Crude Awakening” helped popularise such fears. Such claims have in fact been common since the 1970s, but they have been wide of the mark with global oil production continuing to trend higher. With the real oil price once again plumbing the lows of the 1980s and 1990s it’s clear that such claims remain way off. While the world’s oil supply is limited, “peak oil” claims ignore basic economics which, via higher prices combined with new technologies, will make alternatives viable long before we run out of oil.

Implications for investors

As long as the oil price remains in steep decline the negative impact on producers is likely to predominate the positive impact on consumers at least as far as share markets are concerned. However at some point in the year ahead, it’s likely the boost to consumers and to economic growth in developed countries and in energy importing countries in Asia will predominate. In the meantime weak oil prices mean that deflationary risks remain and interest rates will remain low for longer.

AMP Capital Markets 28th January 2016

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.