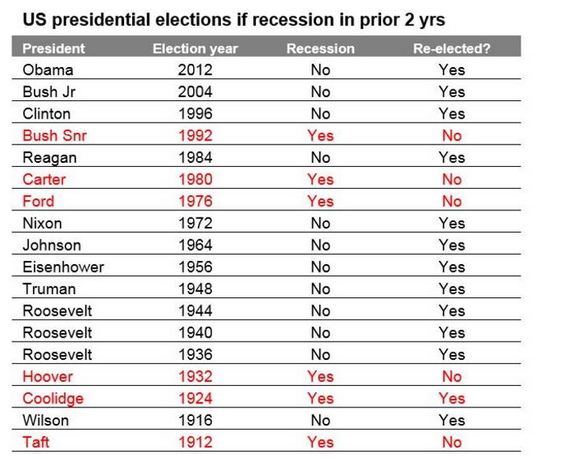

Investor focus on the US election waned earlier this year after socialist Bernie Sanders dropped out of the Democratic primary race in favour of moderate Joe Biden. At the same time coronavirus became the main focus for markets. However, markets may soon start to pay more attention as the election is rapidly approaching, while Joe Biden is a moderate, he is proposing higher taxes and more regulation and President Trump is not having a good run. Trump’s re-election chances have fallen with a majority of surveyed Americans disapproving of his handling of the pandemic and recent civil unrest at a time when the US has plunged into its deepest recession since the 1930s. The historical record indicates incumbent presidents tend to lose when there is a recession in the two years before the election and unemployment has gone up.

Source: Strategas

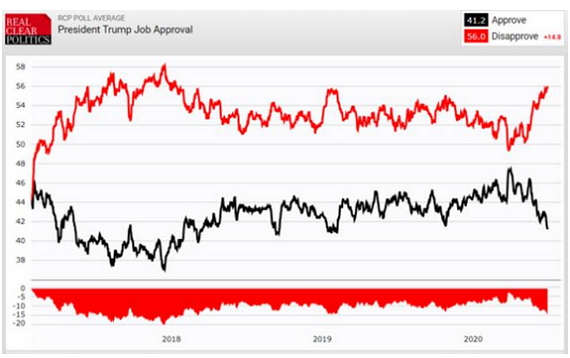

Normally at this point past presidents seeking re-election have started to see an upswing in approval, but this is not evident yet for Trump. Rather, consistent with the above, according to Real Clear Politics’ average of polls Trump’s approval rating has fallen to 41.2% over the last two months, his disapproval rating is edging above its 2019 high, opinion polls have Biden leading Trump by around 9 points and Biden is ahead in all 6 “battleground states”, the ‘Predict It’ betting market, which had Trump ahead of Biden up until late May, now has Biden with a 23 point lead and also now has Democrats winning the presidency, the House and the Senate. The Democrats already have control of the House and are likely to retain that, but they need three seats to then along with the Vice President, gain a majority of the Senate. A clean sweep for the Democrats would remove the Senate as a blockage to higher taxes.

Source: Real Clear Politics

However, it would be wrong to write Trump off. Polls and betting markets were not so reliable in the 2016 election, there are still four months to go to the election & ongoing civil unrest could see him garner support as a “law and order president” as Nixon did in 1968. And Trump rates more highly on the economy than Biden and this may get a boost if the economy continues to reopen and recover. A rebound in the economy is Trump’s best hope which partly explains why he cheered on reopening from the end of April. However, the rebound in US coronavirus cases in many states in the last few weeks puts all this at risk.

Key Biden policy directions versus Trump

Taxation: Biden plans to raise the corporate tax rate to 28% (reversing half of Trump’s cut to 21%), return the top marginal tax rate to 39.6% (from 37%) and tax capital gains and dividends as ordinary income.

Infrastructure: Biden plans to spend $1.3trn over 10 years.

Climate policy: Biden aims for the US to reach net zero emissions by 2050 by raising the cost of fossil fuels & boosting the development of alternatives (possibly with a carbon tax).

Regulation: Biden is likely to end the era of deregulation.

Healthcare: Biden wants to strengthen Obamacare and limit drug prices.

Trade and foreign policy: Biden would likely de-escalate tensions with Europe and strengthen the alliance, work with international organisations like the World Trade Organisation, work to re-establish the nuclear deal with Iran and adopt a more diplomatic approach to dealing with trade & other issues with China (working with Europe and Asian allies in the process). By contrast a re-elected Trump is likely to double down on his trade war with China and possibly elsewhere including Europe.

Budget deficit: For the near term, the budget deficit is likely to remain high whoever wins, but historically they have fallen under Democrats after rising under Republicans. That said, if the economy proves slow to recover Joe Biden may be more likely to respond with large public sector spending programs aided by ongoing Fed quantitative easing in order to deal with ongoing high levels of spare capacity and unemployment.

Economic impact

On their own higher corporate and top marginal tax rates, increased regulation and an increased cost of carbon which will weigh on energy companies when they are already struggling are negative for the growth outlook. For example, the rise in the corporate tax rate would knock around 6% off earnings per share for S&P 500 companies. In particular, they may reverse some of the supply side boost provided by Trump. However, as with all things economic its never as simple as that.

-

First, the negative impact of tax hikes and increased regulation in the short term could be more than offset by increased infrastructure spending (particularly if some of the revenue comes from those with high saving rates).

-

Second once in office Biden may dampen down his planned tax hikes, particularly if the economy is still weak as is likely.

-

Third, raising taxes on top earners while a negative for incentive may help reduce inequality which has been a key driver of the populist backlash of recent years and has arguably been made worse by Trump.

-

Fourth, Biden’s trade and foreign policy focussed more on strengthening ties with Europe and a diplomatic approach to dealing with China may substantially reduce a source of angst and uncertainty under Trump (which is likely to intensify if he is re-elected).

-

Finally, more stable and predictable policy making reliant on expert advice under Biden may provide a more certain environment for business and so result in increased business investment despite a rise in the corporate tax rate. Don’t forget that the uncertainty caused by Trump’s trade wars offset the boost to investment from his tax cuts.

So, on balance I see no reason to expect a weaker economic and share market outlook under a Biden presidency.

Likely market reaction

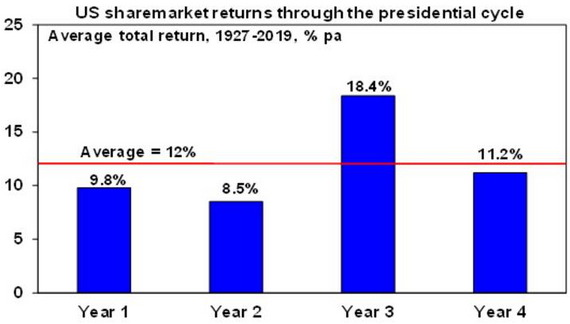

Firstly, despite the heightened policy uncertainty the election year is normally an okay year for US shares.

Source: Bloomberg, AMP Capital

Since 1927, the election year, or year 4 in the presidential cycle, has had an average total return of 11.2% pa, which is only just below the average return for all years. Of course, this year is complicated by the coronavirus hit to growth and so may well be weak regardless of the election.

Second, the run up to the election could see increased share market volatility if Trump’s prospects look bleak for two reasons: investors may start to fret about the prospects of increased taxes and regulation under a Biden presidency, particularly if it looks like Democrats will win control of the Senate; and Trump may reason that he will have nothing to lose by seriously ramping up tensions with China (and maybe Europe) in a way that threatens the economic outlook, but with the prospect of shoring up his base and rallying Americans around the flag. However, while there may be short term jitters ahead of the election, for the reasons noted in the last section, there is no reason to expect a weaker economy and hence share market under a Biden presidency. Investors may ultimately welcome more reasoned and predictable policy making.

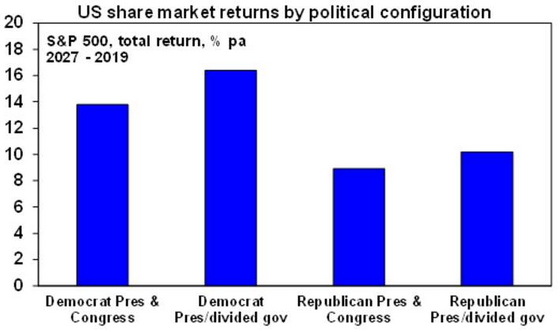

Third, historically US shares have done best under Democrat presidents with an average return of 14.6% pa since 1927 compared to an average return under Republican presidents of 9.8% pa. This has been evident in recent years with good average annual returns under President’s Obama (14.8% pa) and Clinton (19.1% pa) versus terrible returns under President G W Bush (-0.6% pa) but strong returns under President Trump’s first three years (16.3% pa).

However, the best average result has actually occurred when there has been a Democrat president and Republican control of the House, the Senate or both. This has seen an average return of 16.4% pa. By contrast the return has only averaged 8.9% pa when the Republicans controlled the presidency and Congress.

Source: Bloomberg, AMP Capital

Concluding comment

The run up to the US election has the potential to drive increased share market volatility if it looks increasingly likely that Biden will win and raise taxes and regulation and the risk is probably greater if President Trump decides he has nothing to lose and so ramps up tensions with China and maybe Europe. This would weigh on global and Australian shares and the Australian dollar given Australia’s exposure to China. However, this is likely to be short lived as there is no reason to expect a weaker economy and hence share market under a Biden presidency and he is likely to take a less disruptive approach to trade and foreign policy issues.

Source: AMP Capital 30 June 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.