Earlier this year the big fear was that inflation was going to surge led by the US and that this was going to drive aggressive interest rate hikes by the US Federal Reserve and much higher bond yields, which in turn would pressure other asset classes. Such fears saw a significant correction in global share markets with US shares falling 10%, global shares falling 9% and Australian shares falling 6%. Since then, inflation fears seem to have taken a back seat. While in most major countries 10-year bond yields are well up from their 2016 multi decade lows, US bond yields have struggled to stay above 3%, German bond yields are around 0.3%, Japanese bond yields are around 0.09% and Australian bond yields are around 2.58%, with most well below their highs seen earlier this year. So, what happened? Should we still worry about inflation?

What happened?

A whole bunch of things have helped bond yields remain low and kept investors focused elsewhere:

-

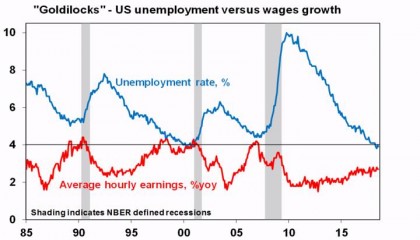

First, although US inflation has moved up it remains relatively benign with the core private final consumption deflator around 2% year on year which is the Fed’s inflation target. It seems every US jobs report has seen the same “Goldilocks” (not too hot/not too cold) combination of strong jobs growth and falling (now sub-4%) unemployment but low wages growth of around 2.7-2.8% year on year implying low inflation pressures. See the next chart.

Source: Bloomberg, AMP Capital

-

While the Fed has continued its drip feed of rate hikes consistent with strong economic conditions, the lack of any inflation break-out has meant that they have been able to remain gradual, with one hike every three months and monetary policy remains very easy.

-

Strong US earnings growth has helped distract share market investors. June quarter earnings results have seen 84% of companies surprise on the upside regarding earnings and 71% beat revenue expectations, both of which are above normal levels. Reflecting this, June quarter earnings growth has come in around 27% on a year ago, up from expectations for 20% earnings growth in early July.

Source: Bloomberg, AMP Capital

-

The trade war threat has tended to dominate, leading to fears of a hit to global (and US) growth and safe haven demand for assets like bonds (which has helped keep their yields down).

-

Worries about Italy’s new populist government blowing out its budget deficit and already high level of public debt, or worse still threatening to leave the Euro resulting in bond holders taking a hit on their investment in Italian bonds, have boosted demand for German bonds depressing their yields and helped extend expectations of easier for longer European Central Bank monetary policy.

-

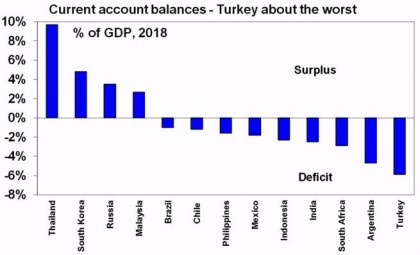

Other geopolitical events like the crisis in Turkey have kept investors on edge for deflationary shocks. The latest worries about contagion from Turkey as its currency plunged anew are likely overdone. Yes, there will be some impact on Eurozone banks that are exposed to Turkish debt (which will keep the ECB cautious), but it’s unlikely to be economically significant. More fundamentally, Turkey is not indicative of the bulk of emerging countries. Its currency has crashed 40% or so this year because of current account and budget deficit blowouts, surging inflation, political interference in its central bank and populist economic mismanagement generally. In addition, political tensions with the US following the imprisonment of an American pastor resulting in US sanctions on Turkey including tariff hikes on steel and aluminium have made things even worse. The crisis is now being intensified by Turkish PM Erdogan’s rejection of higher interest rates and an international bailout. While Brazil, Argentina and South Africa also have particular problems, most of the rest of the emerging world is in far better shape. That said, emerging markets will remain vulnerable until the US dollar stops rising (as a rising $US boosts US dollar denominated debt servicing costs for emerging countries that have high foreign debt), the global trade threat ends and uncertainty regarding Chinese growth fades. And upwards pressure on the US dollar is likely to continue as the Fed is unlikely to stop its process of gradual rate hikes anytime soon.

Source: IMF, AMP Capital

- Finally, while growth in the US has accelerated this year, in other major countries it looks to have slowed. So, while there was talk of the Bank of Japan, the European Central Bank and even the Reserve Bank of Australia following the US into tightening this has been pushed out further. Similarly, some signs of a softening in growth in China and the tariff threat have seen the PBOC (China’s central bank) move towards monetary easing.

Implications – another extension to the cycle?

These considerations have combined to help fade the inflation/Fed tightening fears of earlier this year with the result that bond yields have been contained and most share markets have been able to recover from their February inflation-scare lows. In some ways it’s more of the same because the whole post global financial crisis (GFC) experience has been one of two or three steps forward towards stronger global growth followed by one or two steps back (with eg the Eurozone debt crisis, the 2015 growth scare and various deflation fears along the way). What we have seen this year is effectively a continuation of that.

By delaying or slowing monetary tightening this has all helped extend the economic and investment cycle. The implications have been:

-

A continuation of low returns from cash and low bank deposit rates.

-

Yield-sensitive share market listed investments like real estate investment trusts have been able to rebound.

-

Unlisted assets like infrastructure and commercial property have continued to benefit from a search for yield by investors.

With global monetary conditions remaining easy and US recession warning indicators still not flashing red (although the yield curve is worth keeping an eye on) our assessment remains that the investment cycle has more upside and that a US recession remains a way off yet. However, the main risks around this relate to the threat of a global trade war should the tariff threat from the US continue to escalate.

But should we still worry about inflation?

However, while the investment cycle has been extended it would be wrong for investors to dismiss the inflation threat – particularly in relation to the US:

-

First, while it has taken a long time to get there resulting in numerous deflation scares along the way, spare capacity in the US economy has been mostly used up.

-

Second, numerous indicators point to a very tight labour market in the US – with more vacancies than there are unemployed, very high hiring and quits rates, companies nominating finding suitable labour as a bigger problem than weak demand – suggesting that sooner or later wages growth will start to pick up more significantly.

-

Third, inflation is well known to be a lagging indicator and it often appears as a problem after the pace of economic growth has peaked.

-

Finally, from a longer-term perspective there is a risk that the lessons of the break out in inflation from the late 1960s into the 1970s are being forgotten and that populist politicians will seek to weaken the institution of an independent central bank targeting low inflation. President Trump’s tweets critical of the Fed raising interest rates are concerning in this regard.

As a result, we remain of the view that (absent a full-blown global trade war) the drip feed of Fed rates hikes will continue well into next year, that the 35 year bull market in bonds that began in the early 1980s is over and that the risks to US and by implication global bond yields into next year are still on the upside. This suggests investors need to be a little more wary of yield-sensitive globally-exposed investments that don’t offer inflation protection (like inflation-linked bonds do and the potential for rising rents do in the case of commercial property and infrastructure) than was the case a few years ago when there was still plenty of spare capacity in the US. Ongoing Fed rate hikes also point to ongoing upwards pressure on the US dollar which in turn suggests that investors should remain cautious in relation to emerging market shares.

The upside risks for bond yields is less in Australia given much higher unemployment and underemployment and that the RBA is likely to remain well behind the US in raising interest rates. With the Fed hiking and the RBA holding, this is all consistent with ongoing downwards pressure on the Australian dollar which we still see falling to around $US0.70, having recently broken below $US0.73.

Source: AMP Capital 14 August 2018

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.