Introduction

Recently I was asked where we are in the cycle of investor emotion between the extremes of “euphoria” and “depression”. This is a good question, as knowing where the investment crowd is at and being wary of it is essential to successful investing. The late 1980s Japanese bubble, the Asian miracle of the mid-1990s, US tech stocks in the late 1990s, US housing and dodgy credit in the mid 2000s and arguably the commodity boom early this decade all had one thing in common: investors had jumped on a bandwagon, resulting in assets that became overvalued, over loved and ripe for a crash. But how do crowds get into such a muddle and what are they telling us now?

Investor psychology and the madness of crowds

The trouble with crowds from an investment perspective has its source in investor psychology. Individuals suffer from various lapses of logic. In particular, they:

-

Tend to down-play uncertainty & project the current state of the world into the future – eg, resulting in a tendency to assume recent investment returns will continue;

-

Give more weight to recent spectacular or personal experiences in assessing probabilities. This results in an emotional involvement with an investment – if it’s been winning an investor is likely to expect it to keep doing so;

-

Tend to focus on occurrences that draw attention to themselves, such as stocks or asset classes that have risen sharply or fallen sharply in value;

-

Tend to regard events as obvious in hindsight – by fostering the illusion that the world is more predictable than it really is this tends to promote overconfidence;

-

Tend to be overly conservative in adjusting expectations to new information – explaining why bubbles and crashes normally unfold over long periods; and

-

Tend to ignore information conflicting with past decisions.

Naturally the result is magnified if many investors make the same lapses of logic at the same time, as part of a crowd. This can easily arise when several things are present:

-

A means where behaviour can be contagious – mass communication with the proliferation of electronic media are a perfect example of this as more than ever investors get their information from the same sources. And the influence of this is growing;

-

Pressure for conformity – interaction with friends, performance comparisons, the fear of missing out, etc;

-

A precipitating event or displacement which motivates a general investment belief – the IT revolution of the late 1990s or the rapid industrialisation of China which led to talk of new eras are examples of positive displacements upon which were built general believes that shares will only go up.

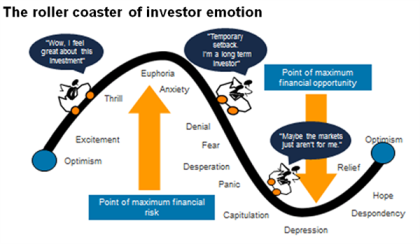

The combination of lapses of logic by individuals in making investment decisions being magnified by crowd psychology go a long way to explaining why speculative surges in asset prices develop (usually after some good news) and how they feed on themselves (as individuals project recent price gains into the future, exercise “wishful thinking” & get positive feedback via the media, their friends, etc). Of course the whole process goes into reverse once buying is exhausted, often triggered by contrary news to that which drove the rise initially. Investor psychology through a market cycle looks like what Russell Investments called the roller coaster of investor emotion.

Source: Russell Investments, AMP Capital

In a bull market ‘optimism’ gives way to ‘excitement’, then ‘thrill’ and eventually ‘euphoria’ as the actions of investors push the asset class – be it shares or whatever – ever higher. It is at this point that investors are most bullish. Unfortunately it’s usually at this point that the market has become overvalued and with the crowd fully on board everyone who wants to buy has, so it only takes a bit of bad news to tip the market down.

When a bear market begins investors initially see it as a short term setback. But as ‘anxiety’ gives way to ‘fear’ investors eventually ‘capitulate’ and become ‘despondent’, selling their investments. However, the point of maximum crowd pessimism, when the crowd has sold and the asset class is cheap and unloved is the time when it provides its best opportunity. It then only takes a bit of good news to push the market higher.

So the behaviour of the crowd gives a great guide to investment market opportunities. Tops are usually associated with some form of crowd euphoria and market bottoms are associated with mass depression and despondency. So being a contrarian and doing the opposite to the crowd at extremes makes sense.

As always there are qualifications. Ideally, one needs to look at what investors are thinking (sentiment) and what they are actually doing (positioning). Secondly, negative crowd sentiment at market bottoms can tend to be associated fairly quickly with market bottoms reflecting the steep declines associated with panics as a market falls. But during bull markets positive sentiment or even euphoria can tend to persist for a while as it takes investors longer to build exposures to assets than to sell them.

So where are we in the emotion roller coaster?

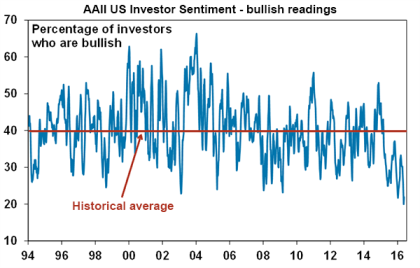

For shares crowd sentiment ranges from very cautious to neutral. According to the American Association of Individual Investors bullish sentiment amongst retail investors has been averaging around 20% over the last few weeks, which is about as low as it ever gets and half its long term average.

Source: Bloomberg, AMP Capital

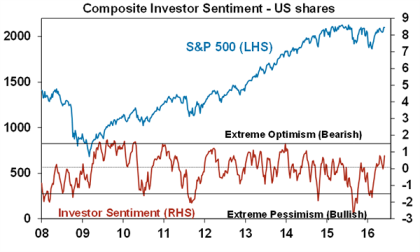

A broader composite measure of US investor sentiment that includes surveys of investment newsletter writers, the ratio of puts (options to sell shares) to calls (options to buy) amongst retail investors is more positive but a long way from euphoria.

Source: Bloomberg, Sentimentrader, Investors Intelligence, AMP Capital

Finally, in terms of positioning, US share market mutual funds and exchange traded funds have been seeing outflows.

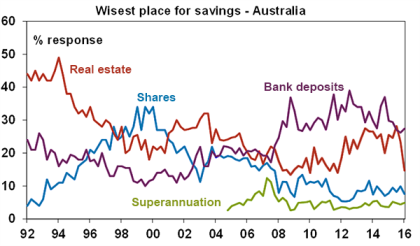

In Australia, the proportion of those surveyed by the Westpac / Melbourne Institute consumer survey nominating shares as the wisest place for savings is just 7.6%, half its long term average. See the next chart.

Source: Westpac/Melbourne Institute, AMP Capital

Overall this suggests that crowd sentiment towards shares is a long way from the sort of euphoria that normally characterises major market tops. In fact it sometimes feels as if we are stuck between ‘hope’ and ‘relief’ in the roller coaster. What about other asset classes?

Australians’ interest in residential property appears to have taken a hit recently as indicated in the last chart. Sentiment towards property seems a lot more cautious than was the case around 2013-15. However, an increasing supply of units, restrictions on bank lending to housing and the fact that Sydney and Melbourne have already seen huge price gains cautions against treating this too positively.

From the above chart, in Australia the most popular asset class continues to be bank deposits with 27% of those surveyed seeing them as the wisest place for savings. With term deposit rates now pushing 2% this may prove to be another example where the crowd gets its wrong – in this case in terms of their relative returns.

Implications for investors

There are several implications for investors. The first thing to do is recognise that investment markets are not only driven by fundamentals, but also by the often-irrational and erratic behaviour of an unstable crowd of other investors. The key here is to be aware of past market booms and busts, so that when they arise in the future you understand them and do not overreact (piling into unstable bubbles near the top or selling everything during busts and locking in a loss at the bottom).

Second, try and recognise your own emotional capabilities. In other words, be aware of how you are influenced by lapses in your own logic and crowd influences like those mentioned above. For example, you could ask yourself: “am I highly affected by recent developments (positive or negative)? Am I too confident in my expectations? Can I bear a paper loss?”

Thirdly, to guard against this choose an investment strategy which can withstand inevitable crises whilst remaining consistent with your financial objectives and risk tolerance. Then stick to this broad strategy even when surging share prices tempt you into a more aggressive approach, or when plunging values suck you into a highly defensive approach.

Fourthly, if you are tempted to trade, do so on a contrarian basis. Buy when the crowd is bearish, sell when it is bullish. Extremes of bullishness often signal market tops, and extremes of bearishness often signal market bottoms. Successful investing requires going against the crowd at extremes. Various investor sentiment and positioning surveys provide a guide.

Finally, investor sentiment right now towards shares still seems to be relatively cautious – nothing like the ‘euphoria’ seen at major market tops.

Source: AMP Capital

About the Author

Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist at AMP Capital is responsible for AMP Capital’s diversified investment funds. He also provides economic forecasts and analysis of key variables and issues affecting, or likely to affect, all asset markets.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.