While there are a handful of actively managed equity income funds in the market, many are not optimally designed to meet the needs of a retiree. This article explores the role of equity income (through dividends) for those in or nearing retirement.

Where to invest for income?

A question many investors face is where to invest for sources of income in a low yield environment. With the cash rate at 2.0% since May 2015, many investors are looking for income opportunities outside of term deposits. Sources of income are available across the traditional risk spectrum through equities and listed property in the form of dividends, to bonds and hybrids in the form of coupon payments. Equity income can provide investors with regular and reliable income that grows over time.

2 reasons why increasing dividend yield is important

Dividend yield is a way to measure the cash flow received for each dollar invested in an equity position – in other words, the income return from dividends. For a retiree, it can be argued that the best way to increase income from equities is to increase dividend yield, rather than drawing down on capital.

There are two key reasons for this:

-

Franked dividends are more tax effective for a retiree than capital gains;

-

The dividend yield on equities is far more predictable and reliable than capital returns.

As such, equity products designed for retirees should be focused on increasing dividend yield. While the prices of equities fluctuate in capital value in the short-term, the success of equity income investing is about focusing on the income stream that a high-quality dividend-paying company can provide. Short-term market fluctuations are not an issue if retirees receive adequate income for life’s everyday expenses.

We are lucky to live in Australia which, on the whole, offers higher dividends than global counterparts. In addition, Australian equity investors benefit from imputation credits, a type of credit that allows Australian corporates to pass on tax paid at the company level to shareholders, which effectively can be used to reduce income tax paid on dividends and can ultimately gross-up the dividend yield of the Australian Stock Exchange (ASX).

Optimising retirement outcomes

Investors who require a minimum stream of income from their investment portfolio can secure this by investing in equities paying relatively high, stable dividend yields. Between 1961 and 2014 the All Ordinaries Index delivered an average dividend yield of 4.7% and capital growth of 6.4% p.a.

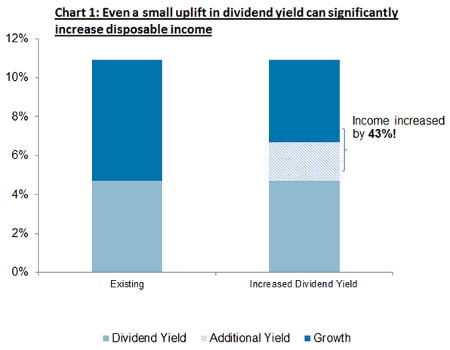

For a typical retiree this represents too much growth and not enough income. Increasing dividend yield above this level can significantly increase retirement income, while still providing enough growth to maintain or grow the real value of the income stream over time. The example in chart 1 highlights the fact that a relatively small 2.0% p.a. increase in dividend yield would increase disposable income for a retiree by 43.0% while still maintaining growth well above inflation.

Source: AMP Capital, for illustrative purposes only

Equity funds need to become more goals-oriented

The majority of equity funds are still designed to maximise returns with little or no focus given to income generation. In this way equity product design must move away from the traditional risk/return focus to a more goals-based approach, with the needs of the retiree at the centre. Equity product design must evolve to better meet the needs of retirees. For more information on this approach, go visit the Goals-based investing page.

Final thoughts

For many investors, particularly those in or approaching retirement a strong dividend yield is important because of the immediate need to have a steady and reliable income to deal with the essentials in life such as the need to pay for food, housing, transport and regular bills. To address this goal, an adviser might recommend a strategy based on income-focused security strategies that aim to deliver a sustainable level of income to keep up with the cost of living. The powerful link between regular, sustainable income and living expenses represents a source of great confidence and helps an investor stick to their strategy.

|

About the Author Michael Price joined AMP Capital in January 2012 to assume responsibility for the AMP Capital Sustainable Share Fund, and to develop an income-focussed Australian equity strategy. Michael joined from ING Investment Management where he held a range of roles over 17 years. |

|

About the Author Thomas Young joined the Fundamental Equities team in December 2010. Supporting AMP Capital’s Equity Income Generator, he is responsible for research in the healthcare, telecommunications and diversified financial sectors as well as portfolio operations and analytics. Thomas is a chartered financial accountant and holds a Bachelor of Commerce with First Class Honours from the University of Melbourne. |