At the start of last year, with global and Australian shares down around 20% from their April/May 2015 highs, the big worry was that the global economy was going back into recession and that there will be another Global Financial Crisis (GFC). Now, with share markets having had a strong run higher, it seems to have been replaced by worries that a crash is around the corner and this will give us the global recession and new GFC that we missed last year!

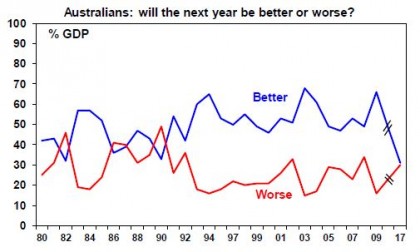

Australians seem particularly vulnerable to worries these days. On the weekend I read that Australians are suffering from an “epidemic of anxiety” and that out of a survey of 24 nations Australians ranked in the upper half in terms of worries about a health epidemic (9th highest), a terrorist attack (8th highest) and a nuclear attack (5th highest) – way above South Korea in terms of the latter despite Kim Jong-un’s new found nuclear capability just across the border! And a Roy Morgan survey has found that only 31% of surveyed Australians expect next year to be a better year than 2017, which is the lowest on record and only just above the 30% who expect next year to be worse. See the next chart.

No survey results for 1996, 2010-2016, Source: Roy Morgan, AMP Capital

In fact, it’s the lowest net balance of “better” less “worse” expectations for the year ahead since Australia was in the midst of the last recession in 1990. Whatever happened to the “she’ll be right” approach? Surely it’s not that bad!

At a broader global level, there seems to be a never ending worry list which since the GFC has rolled on through worries about a new collapse in the US (on the back of too much debt, hyperinflation on the back of money printing, deflation after the hyperinflation failed to materialise, a slump when monetary stimulus ends, or whatever), to worries the Eurozone will blow (or vote) itself apart, to worries that China will collapse as a result of too much debt and/or a property crash, interspersed by worries about the emerging world, Ebola, Ukraine, deflation, North Korea and various elections including the advent of President Trump along the way. And of course, the worries about Australia collapsing keep rolling on with the focus switching from a commodity crash to a housing crash.

Despite this ongoing worry list, investment returns have generally been good. Most assets have had good returns over the last year and the last five years, and balanced growth superannuation funds after fees and taxes returned an average 8.2% over the year to September and 9.3% per annum over the last five years.

So why the persistent gloom?

Some might argue that post the GFC, the world is now a more negative place and so gloominess is understandable today. But given the events of the last century – ranging from flu pandemics, the Great Depression, several major wars and revolutions, numerous recessions and financial panics – it’s doubtful that this is the case.

More fundamentally, it’s well known that humans are naturally attracted to bad news stories. The evolution of the human brain through the Pleistocene age where the trick was to dodge woolly mammoths and sabre toothed tigers means that much more space in our brains is devoted to threat than reward. This means that we are constantly on the lookout for risks and so more disposed to check out bad news stories as opposed to good news. In the investment world, an outcome of this is known as “loss aversion” in that a financial loss is felt far more keenly than a same-sized gain. As a result, doomsters are far more likely to be seen as deep thinkers than optimists and “bad news sells”.

But there is nothing new here. What has changed is the flow of information from a trickle to an avalanche. This is the case everywhere and the investment world is not immune. As the well-known US stock picker Peter Lynch observed “stock market news has gone from hard to find (in the 1970s and early 1980s), then easy to find (in the late 1980s), then hard to get away from”. This can be great in a way, but it can also just add to confusion.

But more significantly, the information age has led to not just greater access to information but also an explosion of media begging for attention. And in the scramble to get me and you to tune in, bad news and gloom beats good news and balance. I just have to swipe right (no, not Tinder!) on my smart phone to see an updated list of links to bad news stories and celebrity gossip (but rarely anything positive!).

Arguably, the political environment has added to this in some countries with politicians becoming more polarised to the left and the right and more willing to scare the electorate into supporting them.

Despite the improvement in the global economy over the last year, Google the words “the coming financial crisis” and you’ll still get 49.3 million search results including such gems as:

-

“The next financial crisis is coming ‘with a vengeance’.”

-

“The next financial crisis is coming, I just don’t know when.”

-

“Financial crisis coming by end 2018: Prepare urgently.”

-

“Trump can’t stop the next financial crisis.”

-

“It’s a scary time with a global crisis on the way.”

-

“Major crisis coming, bigger than 2008 financial crisis.”

And on and on.

Of course, people have always been making such predictions of imminent disaster – my favourite was Ravi Batra’s The Great Depression of 1990, which didn’t happen so it morphed into The Crash of the Millennium, which saw an inflationary depression that didn’t happen either. It’s just that it’s now a lot easier and cheaper to access it and be scared by it.

So with all the talk of another global financial crisis and some sort of collapse in Australia, it’s not that surprising that people are apprehensive and Australians are less positive about the future.

But the world is actually looking good

While all countries have their challenges, the global economy is in its best shape in years:

-

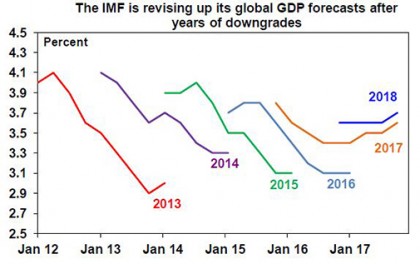

After years of downgrading its global growth forecasts, the IMF has been revising them up this year.

Source: IMF, AMP Capital

-

Global profits are up around 15% over the last year.

-

Unemployment has been falling virtually everywhere (except Japan where it’s just 2.8%!).

And while Australia could be doing a lot better and is not without its issues (notably around record low wages growth, high underemployment, expensive housing and high household debt), the economy has managed to keep growing despite the mining investment boom going bust and should benefit from stronger global growth and the end of the drag from falling mining investment. All of which should be able to keep it growing, albeit we don’t see strong enough growth or inflation for the RBA to start raising rates for a while yet.

The case for optimism as an investor

Dr Don Stammer – a doyen of Australian economists and investing – has said there are six things we owe our children or grandchildren: a sense of humour; a reasonable education; an early understanding of the magic of compounding; an awareness the cycle lives on; some help when they buy their first house or apartment; and a feeling of optimism. I completely agree. I have written lots on the importance of compounding and the cycle but I think a degree of optimism is essential if you wish to succeed as an investor.

Benjamin Graham once said: “To be an investor you must be a believer in a better tomorrow.” If you don’t believe the bank will look after your term deposits, that most borrowers will pay back their debts, that most companies will see rising profits over time, that properties will earn rents etc then there is no point investing. This is flippant but true – to be a successful investor you need a favourable view of the future.

Of course this does not mean blind optimism where you get sucked in with the crowd when it becomes euphoric or into every new whiz bang investment obsession that comes along (with bitcoin the latest in a long list of manias that goes back to Dutch tulip bulbs and includes the dot com stocks of the late 1990s). If an investment looks and feels too good to be true and the crowd is piling in, then it probably is… particularly if the main reason you are buying in is because of huge recent gains and their extrapolation off into to the future. So the key is cautious optimism, not blind optimism.

But when it comes to conventional investments like shares, since 1900 shares in the US have had positive returns around seven years out of ten and in Australia it’s around eight years out of ten. So getting too hung up in permanent pessimism on the next financial crisis and when it will come and what will on the basis of history inevitably drive the market down in the two or three years out of ten may mean missing out on the years it rises.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.